Decoding Iran's GDP: A Deep Dive Into Economic Resilience And Challenges

Iran's GDP, a crucial indicator of its economic health, reveals a complex narrative of growth, challenges, and resilience amidst a unique geopolitical landscape. Understanding the intricacies of this nation's economic performance requires a closer look at official data, historical trends, and the multifaceted factors that shape its trajectory.

This comprehensive analysis aims to shed light on the current state of Iran's economy, drawing upon reliable sources such as the World Bank, the International Monetary Fund (IMF), and Worldometer. By exploring key figures, sectoral contributions, and the significant impact of geopolitical developments, we can gain a clearer picture of where Iran stands in the global economic arena and what its future might hold.

Table of Contents

- Understanding Iran's Gross Domestic Product (GDP) Fundamentals

- Iran's GDP in Current US Dollars: Recent Trends and Figures

- A Historical Perspective: Iran's GDP Trajectory (1980-2024)

- Beyond Nominal: Iran's GDP in PPP Terms and Per Capita

- Pillars of the Iranian Economy: Sectoral Contributions to GDP

- Navigating Economic Headwinds: Challenges Facing Iran's GDP

- The Interplay of Geopolitics and Iran's Economic Future

- Iran's GDP Growth Rate: Projections and Realities

Understanding Iran's Gross Domestic Product (GDP) Fundamentals

To truly grasp the economic standing of any nation, including Iran, it's essential to begin with a clear understanding of what Gross Domestic Product (GDP) represents. At its core, GDP at purchaser's prices is defined as the sum of gross value added by all resident producers in the economy, plus any product taxes, and minus any subsidies not included in the value of the products. In simpler terms, it's the total monetary value of all finished goods and services produced within a country's borders in a specific time period. This fundamental metric serves as a crucial barometer for a nation's economic health, indicating the size and growth rate of its economy.

- Iran Leopard

- Saudi And Iran

- Amirkabir University Of Technology Iran

- Mazandaran Province Iran

- What Will Happen If Iran Attacks Israel

For Iran's GDP, a variety of reputable sources provide invaluable data. The World Bank is a primary provider, offering comprehensive data on Iran's GDP in current US dollars, alongside estimates in nominal and PPP (Purchasing Power Parity) terms since 1960. Worldometer also compiles nominal and real GDP data for Iran from 1993 to 2023, drawing from World Bank and United Nations sources. Furthermore, the International Monetary Fund (IMF) contributes with its nominal gross domestic product figures for Iran, published in its International Financial Statistics (IFS) release. These diverse yet complementary datasets allow for a robust and multi-dimensional analysis of Iran's economic performance, providing a trustworthy foundation for understanding its economic narrative.

Iran's GDP in Current US Dollars: Recent Trends and Figures

Delving into the most recent figures for Iran's GDP in current US dollars provides a snapshot of its contemporary economic scale. According to official data from the World Bank, the gross domestic product (GDP) in Iran was worth $404.63 billion US dollars in 2023. This figure positions Iran as a significant, albeit complex, player on the global economic stage. When considering its proportion relative to the world economy, Iran's GDP value represents 0.38 percent, indicating its specific weight within the broader international financial system.

Looking ahead, estimates for 2024 present slightly varying but consistently substantial figures. Worldometer reports Iran's GDP for 2024 at $401.357 billion US dollars. This figure, which also translates to €370,921 million, places Iran at number 41 in the ranking of GDP among the 196 countries published by Worldometer. The International Monetary Fund (IMF), in its October 2024 World Economic Outlook report, provides a slightly higher estimate, projecting Iran’s nominal gross domestic product (GDP) at approximately $434.24 billion US dollars as of 2024. These close but distinct estimates highlight the dynamic nature of economic forecasting, yet both underscore Iran's considerable economic size within the global context.

Iran's Global Economic Ranking

The consistent placement of Iran around the 41st position in global GDP rankings, as indicated by Worldometer, speaks to its established economic presence. While not among the top global economic powerhouses, its GDP size is noteworthy, especially considering the unique set of external pressures and internal dynamics it navigates. This ranking is a testament to the country's diverse economic base, which, despite challenges, continues to generate substantial output. The ability to maintain such a position, even amidst fluctuating oil prices and international sanctions, highlights a certain degree of resilience inherent in the Iranian economy.

A Historical Perspective: Iran's GDP Trajectory (1980-2024)

Examining the historical trajectory of Iran's GDP reveals a story of significant growth interspersed with periods of contraction, largely influenced by internal policies and external geopolitical factors. From 1980 to 2024, the gross domestic product of Iran has seen a remarkable increase, rising by approximately $305.51 billion US dollars. This long-term growth underscores the nation's developmental efforts over several decades, transforming its economic landscape.

More recent data highlights specific fluctuations that demonstrate the volatility the Iranian economy has experienced. For instance, Iran's GDP for 2020 was $239.74 billion US dollars, marking a 15.48% decline from 2019. This downturn can be attributed to a confluence of factors, including the global economic slowdown exacerbated by the COVID-19 pandemic and the ongoing impact of international sanctions. However, the economy demonstrated a strong rebound in the subsequent year: Iran's GDP for 2021 surged to $359.10 billion US dollars, representing a substantial 49.79% increase from 2020. This impressive recovery indicates the economy's capacity to bounce back from setbacks, often driven by shifts in oil revenues or domestic policy adjustments.

Understanding GDP Fluctuations and Their Causes

The dramatic swings in Iran's GDP, particularly the sharp decline in 2020 and the robust recovery in 2021, are not random. They are deeply intertwined with global oil prices, the effectiveness and intensity of international sanctions, and domestic economic policies. For example, a rise in oil prices or a slight easing of sanctions can significantly boost export revenues, directly impacting the GDP. Conversely, tightened sanctions or a drop in oil demand can lead to economic contraction. The availability of historical data, such as that provided by the World Bank since 1960 for nominal terms and since 1990 for PPP terms, allows economists to graph and analyze these trends, offering insights into the underlying causes of Iran's economic performance over time.

Beyond Nominal: Iran's GDP in PPP Terms and Per Capita

While nominal GDP provides a straightforward measure of economic output in current US dollars, understanding a country's true economic strength and the purchasing power of its citizens requires looking beyond this single metric. This is where Gross Domestic Product in Purchasing Power Parity (PPP) terms becomes crucial. PPP adjusts for differences in the cost of living and the prices of goods and services between countries, offering a more accurate comparison of economic output and living standards. For Iran, GDP, PPP (current international $) was reported at $1,600,138,342,500 USD in 2023, according to the World Bank collection of development indicators. This figure is significantly higher than its nominal GDP, highlighting that while the nominal value reflects the market exchange rate, the PPP value suggests a much larger domestic purchasing power.

The difference between nominal and PPP GDP is particularly pronounced in economies like Iran's, where exchange rates can be heavily influenced by external factors such as sanctions, rather than purely market forces. The PPP measure provides a better sense of the actual volume of goods and services produced and consumed within the country. Furthermore, understanding the GDP per capita in current US dollars for Iran, as provided by the World Bank, offers insights into the average economic output per person. While the exact figure for GDP per capita varies with population changes and total GDP, it is a vital indicator for assessing the living standards and economic well-being of the average Iranian citizen over time. Analyzing these metrics together offers a more nuanced and comprehensive view of Iran's economic reality.

Pillars of the Iranian Economy: Sectoral Contributions to GDP

With a population of 82.8 million people, Iran’s economy is characterized by a diverse, albeit state-influenced, structure. Its primary pillars include the hydrocarbon, agriculture, and services sectors, complemented by a noticeable state presence in manufacturing and financial services. This multi-sectoral approach provides a degree of resilience, preventing over-reliance on a single industry, though the hydrocarbon sector remains undeniably dominant in terms of export revenues.

The services sector stands out as the biggest contributor to Iran's GDP, accounting for a significant 51 percent of the total. This highlights a modernizing aspect of the economy, where intangible services play a crucial role in wealth creation. Within the services sector, several segments are particularly important. Real estate and specialized and professional services collectively contribute 14 percent of total GDP, reflecting growth in urban development and specialized expertise. Trade, restaurants, and hotels account for another 12 percent, indicating a vibrant domestic market and a burgeoning tourism potential, despite external challenges. Public services, which encompass government administration, education, and healthcare, contribute 10 percent, underscoring the significant role of the state in providing essential services and employment.

Economic Diversification and State Influence

Despite the prominence of the services sector, Iran has long pursued policies aimed at economic diversification to reduce its heavy reliance on oil revenues. This includes investments in agriculture to achieve food security and boost rural economies, as well as efforts to strengthen the manufacturing base. The noticeable state presence across manufacturing and financial services means that government policies and directives play a substantial role in shaping these sectors. This state-led approach can facilitate large-scale infrastructure projects and strategic industries but can also introduce inefficiencies or limit private sector growth. Understanding these sectoral contributions and the degree of state involvement is crucial for any comprehensive analysis of Iran's GDP and its future economic potential.

Navigating Economic Headwinds: Challenges Facing Iran's GDP

While Iran's GDP figures indicate a substantial economy, the nation is simultaneously grappling with a series of profound economic challenges that significantly impact its stability and the daily lives of its citizens. The first three months of 2025 have already underscored that Iran’s economy remains plagued by multiple crises. A rapid depreciation of the national currency has eroded purchasing power, making imports more expensive and contributing to a general sense of economic uncertainty. This currency instability is a direct reflection of underlying economic pressures and a lack of confidence in the financial system.

Furthermore, a severe lack of investment, both domestic and foreign, continues to hinder growth and modernization across various sectors. Without fresh capital, industries struggle to expand, innovate, and create new jobs. Compounding these issues is an inflation rate exceeding 35%, which drastically reduces the purchasing power of the average Iranian, making essential goods and services increasingly unaffordable. This high inflation, coupled with declining purchasing power, creates a vicious cycle that can lead to social unrest and further economic stagnation. Even the energy sector, a traditional strength, is struggling with imbalances, affecting both domestic supply and export capabilities. These internal economic ailments present formidable obstacles to sustained growth in Iran's GDP.

The Pervasive Impact of International Sanctions

Beyond internal issues, the pervasive impact of international sanctions cannot be overstated when discussing challenges to Iran's GDP. These sanctions, primarily targeting its nuclear program, have severely restricted Iran's ability to engage in widespread international trade and access global financial markets. This lack of broad economic openness with the world, a direct consequence of the sanctions, limits foreign investment, technology transfer, and the free flow of goods and services. The inability to fully participate in the global economy constrains export potential, particularly for its crucial oil and gas resources, and complicates efforts to diversify its economic base. The ongoing threat or actual imposition of sanctions creates an environment of uncertainty that deters potential investors and businesses, making long-term economic planning and growth incredibly difficult for Iran.

The Interplay of Geopolitics and Iran's Economic Future

Iran’s economic future is inextricably linked to geopolitical developments, particularly the potential easing or tightening of foreign sanctions through diplomatic negotiations. This intricate relationship means that the trajectory of Iran's GDP is often more dependent on political decisions and international relations than on purely internal economic policies. When there is a prospect of sanctions being eased, such as during periods of nuclear deal negotiations, there is an immediate surge in optimism. This can lead to a temporary increase in foreign investment interest and a boost in oil exports, directly impacting economic growth and potentially improving Iran's GDP figures. Conversely, any escalation of tensions or the imposition of new sanctions can quickly reverse these gains, leading to capital flight, currency depreciation, and a contraction of economic activity.

The global energy market also plays a crucial role, as Iran is a major oil and gas producer. Fluctuations in international oil prices, combined with the ability (or inability) to export these resources due to sanctions, significantly influence the nation's revenue streams and, consequently, its GDP. Diplomatic breakthroughs, even minor ones, can unlock new trade avenues or ease restrictions on financial transactions, providing much-needed relief to the economy. Therefore, any analysis of Iran's economic outlook must heavily factor in the complex and often unpredictable nature of international diplomacy and regional stability. The ability to navigate these geopolitical currents will be paramount in shaping the future growth and resilience of Iran's GDP.

Iran's GDP Growth Rate: Projections and Realities

The GDP growth rate is a critical indicator of economic dynamism, reflecting the pace at which a country's economy is expanding. For Iran, this metric is particularly volatile, influenced by a unique combination of internal economic reforms, global energy prices, and the ever-present shadow of international sanctions. According to recent data, the gross domestic product of Iran grew 3.5% in 2024 compared to the previous year. This positive growth rate, while modest, suggests a degree of resilience in the face of ongoing challenges and indicates that the economy is not in a state of continuous decline.

However, interpreting this growth rate requires nuance. Factors such as the volume of oil exports, which can fluctuate wildly depending on market conditions and sanction enforcement, play a massive role. Domestic policies aimed at boosting non-oil sectors, controlling inflation, and attracting investment also contribute significantly to the overall growth picture. The 3.5% growth in 2024, while a step in the right direction, must be viewed in the context of the severe economic contractions experienced in previous years, such as the 15.48% decline in 2020. Sustained, higher growth rates would be necessary to significantly improve living standards and address the deep-seated economic issues facing the nation. The dynamic nature of these projections versus the realities on the ground means that while forecasts offer a glimpse into potential futures, the actual outcomes for Iran's GDP growth are heavily dependent on a complex interplay of internal and external forces.

Conclusion

The journey through Iran's GDP data reveals a nation with a substantial economic footprint, yet one that constantly navigates a complex web of internal challenges and external pressures. From its significant nominal and PPP GDP figures, placing it as the 41st largest economy globally, to the intricate contributions of its services, hydrocarbon, and agricultural sectors, Iran's economic landscape is undeniably robust in many respects. However, the pervasive impact of currency depreciation, high inflation, a lack of investment, and especially the tightening grip of international sanctions, cast a long shadow over its potential for sustained and inclusive growth.

Understanding Iran's GDP is not merely about numbers; it's about appreciating the resilience of its economy amidst geopolitical headwinds and recognizing the profound influence of diplomatic negotiations on its future. The 3.5% growth observed in 2024, while positive, underscores the need for continued strategic reforms and a more stable international environment to unlock the nation's full economic potential. As Iran continues to evolve, its economic narrative will undoubtedly remain a subject of intense global interest and analysis.

What are your thoughts on Iran's economic trajectory? Do you believe the recent growth is sustainable given the ongoing challenges? Share your insights in the comments below! If you found this analysis insightful, consider exploring our other articles on global economic trends and their geopolitical implications.

- Iran Assassination Trump

- Update On Israel And Iran

- Porn Video Of Iran

- Israel To Iran Distance

- Israels Attack On Iran

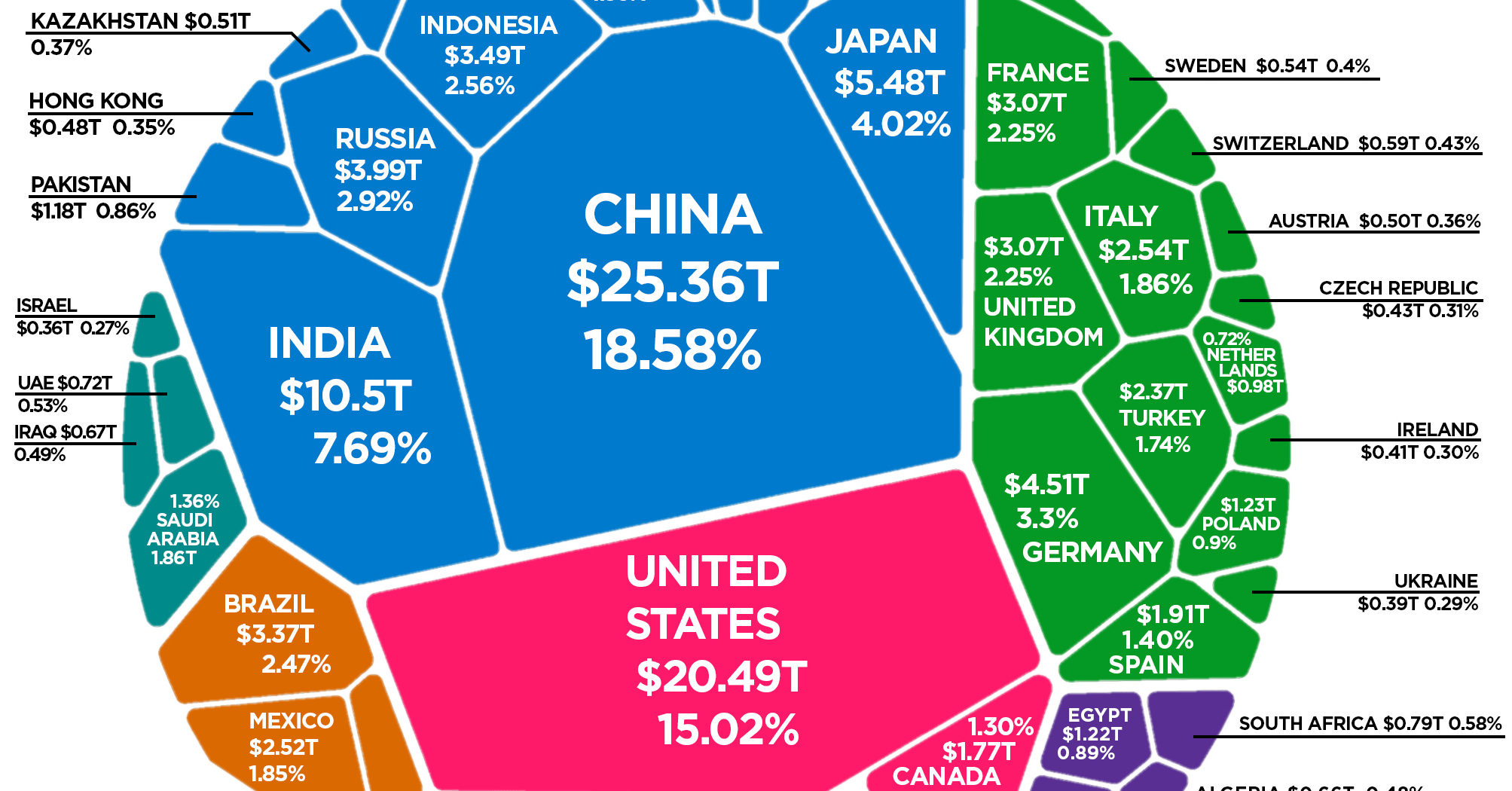

The Composition of the World Economy by GDP (PPP)

/gdp-increase-636251500-c69345ee97ba4db99375723519a2c1bd.jpg)

Real Gross Domestic Product (Real GDP) Definition

The World Economy in One Chart: GDP by Country