Navigating Iran's Income Tax: A Comprehensive Guide For 2024

The intricate world of taxation often appears daunting, and understanding the nuances of income tax in Iran is no exception. For individuals and businesses operating within the Islamic Republic, a clear grasp of the tax system is not merely beneficial but essential for compliance and effective financial planning. Iran's taxation system is a complex and constantly evolving one, making it challenging for individuals and businesses to navigate effectively. This comprehensive guide aims to demystify the core aspects of income tax in Iran, providing a detailed overview that emphasizes the importance of understanding regulations for both residents and expatriates.

This insightful article delves into the intricacies of taxation in Iran, shedding light on its significance in the nation's economic framework. From historical evolution to current reforms, we will explore the various types of taxes, filing requirements, and strategic considerations that can shape your financial landscape. Our goal is to provide a reliable resource that enhances your understanding and empowers you to make informed decisions regarding your tax obligations in Iran.

Table of Contents

- Understanding the Iranian Tax Landscape

- Key Types of Income Tax in Iran

- Personal Income Tax Rates and Thresholds (2024)

- Specific Tax Scenarios and Exemptions

- Navigating Filing Requirements and Payment Deadlines

- Strategic Tax Planning and Loss Carry-Forward

- The Role of the Iranian National Tax Administration and Ongoing Reforms

- Future Trends and Challenges in Iran's Tax System

Understanding the Iranian Tax Landscape

The Iranian tax system, much like any other, has undergone significant historical evolution, adapting to economic shifts, geopolitical factors, and internal policy changes. Its significance extends beyond mere revenue generation; it plays a crucial role in wealth redistribution, economic stability, and the funding of public services. To truly grasp the current state of income tax in Iran, one must appreciate this dynamic background. The system is designed to capture various forms of income, ensuring that contributions are made across different economic activities. While the core principles remain consistent, the specific rates, thresholds, and regulations are subject to periodic adjustments, making continuous awareness vital for compliance. Exploring the comprehensive overview of the Iranian tax system, including its historical evolution, types of taxes, filing requirements for individuals and businesses, the role of the Iranian National Tax Administration, and ongoing reforms addressing challenges like tax evasion, reveals a system striving for greater efficiency and fairness.

Key Types of Income Tax in Iran

The Iranian tax code categorizes income tax into several distinct groups, each with its own set of rules and considerations. Understanding these categories is fundamental to identifying your specific tax obligations. There are six groups of income tax in Iran, as follows:

- Income tax on the revenue of real estates

- Income tax on agricultural activities (currently exempted from tax payment)

- Income tax on salaries

- Income tax on occupational activities (business income)

- Income tax on legal entities (corporate tax)

- Miscellaneous income tax (e.g., capital gains, interest income not covered elsewhere)

Each of these categories addresses a specific source of income, and the rules applied can vary significantly. For instance, while agricultural income is currently exempt, real estate income is very much within the tax net. To download the updated direct tax code of Iran, interested parties should consult official government or tax administration websites, as this document provides the most authoritative and detailed information.

Income Tax on Real Estate Revenue

One of the prominent categories of income tax in Iran is that derived from real estate. Rental income is subject to real estate income tax in Iran. This is a critical point for property owners and investors. The calculation of this tax is based on a specific methodology designed to reflect the net earnings from rental properties. The net income, which is 75% of the gross rent, is then subject to the same rates as in the personal income tax tables. This means that a significant portion of the rental income is considered taxable, highlighting the importance of accurate record-keeping and understanding the applicable rates. This approach ensures that while a deduction is provided for expenses, a substantial part of the rental revenue contributes to the national tax base.

- How Many Nuclear Weapons Does Iran Have

- 670 Kirn Radio Iran Live

- What Languages Are Spoken In Iran

- Latest News Of Iran

- Is Iran Middle East

Income Tax on Agricultural Activities

In contrast to real estate, income tax on agricultural activities is currently exempted from tax payment in Iran. This exemption is a strategic policy decision, likely aimed at supporting the agricultural sector, promoting food security, and encouraging rural development. While this provides a significant relief for farmers and agricultural businesses, it is crucial to remember that tax laws can change. Therefore, staying informed about any potential future amendments to this exemption is always advisable for those involved in the agricultural sector.

Personal Income Tax Rates and Thresholds (2024)

For individuals, understanding the personal income tax rates and thresholds is paramount for calculating salary after tax and overall financial planning. Iran residents' income tax tables in 2024 outline personal income tax rates and thresholds (annual) that are used to determine tax liabilities. These tables are essential for factoring in social security contributions, pension contributions, and other salary taxes in Iran. The rates are typically progressive, meaning higher income brackets are subject to higher tax rates. It is vital to choose a specific income tax year to see the Iran income tax rates and personal allowances used in the associated calculations, as these figures can be updated annually.

While specific rates are not provided in the data, the principle of progressive taxation is common globally. For instance, a hypothetical table might look like this (for illustrative purposes only, actual 2024 rates should be consulted from official sources):

| Tax Rate | Taxable Income Threshold (Annual) |

|---|---|

| X% | Up to IRR [Threshold 1] |

| Y% | IRR [Threshold 1] to IRR [Threshold 2] |

| Z% | Above IRR [Threshold 2] |

Reviewing the latest income tax rates, thresholds, and personal allowances in Iran is crucial for accurate financial planning, especially when calculating net income after all deductions and contributions. This information helps individuals budget effectively and understand their take-home pay.

Residency and its Impact on Taxation

A key factor in determining an individual's tax obligations in Iran is their residency status. Residency is usually determined by the length of stay in Iran, for example, residing for more than 183 days in a tax year. This criterion is standard in many tax jurisdictions globally. Generally, residents are taxed on their worldwide income, while non-residents might only be taxed on income sourced within Iran. Understanding your residency status is therefore a foundational step in navigating your income tax in Iran, as it dictates the scope of your tax liability.

Specific Tax Scenarios and Exemptions

Beyond the general categories, the Iranian tax system includes specific provisions for certain entities and activities, offering exemptions or unique tax treatments. These can significantly impact tax liabilities and are crucial for strategic planning.

Tax Holidays and Free Trade Zones

Iran has established Free Trade Industrial Zones (FTIZs) to attract foreign investment and stimulate economic growth. These zones offer significant incentives, including tax holidays. According to Article (13) of the law concerning the manner of administering the free trade industrial zone of the Islamic Republic of Iran, natural persons and legal entities economically active in such areas are exempt from payment of direct income tax for a period of 15 years from the date of operation as stated in their permits. This provision makes FTIZs highly attractive for businesses looking to establish a presence in Iran, offering a substantial period of relief from income tax. You may also be able to enjoy existing tax holidays beyond the FTIZs, depending on the specific industry or investment type, making it essential to research all available incentives.

Foreign Companies and Branches

The taxation of foreign companies and their branches in Iran can be particularly complex. On the strength of Note (3) to Article (107) of the Direct Taxes Act approved on February 15, 2009, the branches and agencies of foreign companies and banks in Iran, which are engaged in marketing or gathering information for their parent companies without having the right to make transactions and receive some funds from those parent companies, may have specific tax treatments. This highlights the importance of clearly defining the scope of activities for foreign entities to ensure proper tax compliance and avoid unforeseen liabilities. The nuances of whether a branch is considered a permanent establishment for tax purposes, and thus subject to Iranian corporate income tax, depend heavily on the nature of its operations.

Navigating Filing Requirements and Payment Deadlines

Adhering to filing requirements and payment deadlines is a critical aspect of tax compliance in Iran. Non-compliance can lead to penalties and legal issues. Generally, businesses and individuals are given a specific timeframe to submit their tax declarations and make payments. You will have four months after the end of your fiscal year to pay the tax and deliver the reports. This deadline is crucial for all taxpayers to remember, ensuring that all necessary documentation is prepared and submitted accurately and on time. For most Iranian businesses following the Persian calendar, this would typically mean a deadline around the end of July, assuming their fiscal year ends on March 20th/21st. However, specific circumstances or types of income might have different reporting periods, so it is always best to verify the exact deadlines applicable to your situation.

Strategic Tax Planning and Loss Carry-Forward

Effective tax planning is not just about compliance; it's about optimizing your financial position within the bounds of the law. Iran’s tax law also allows you to carry forward previous years’ losses to decrease your income tax. This provision is a significant advantage for businesses, as it allows them to offset current or future profits with past losses, thereby reducing their taxable income. This comprehensive guide highlights crucial aspects of tax planning and future trends that could shape the tax landscape in Iran, emphasizing the importance of understanding regulations for both residents and expatriates. Utilizing loss carry-forward effectively requires meticulous record-keeping and a forward-looking financial strategy. It's a powerful tool for managing profitability and ensuring long-term financial health, especially for new businesses or those operating in volatile markets. Understanding and applying such provisions can lead to substantial tax savings and improved cash flow.

The Role of the Iranian National Tax Administration and Ongoing Reforms

The Iranian National Tax Administration (INTA) is the primary body responsible for administering the tax system, collecting taxes, and enforcing tax laws. Its role is pivotal in ensuring the smooth functioning of the tax system and addressing challenges like tax evasion. INTA is continuously engaged in ongoing reforms aimed at modernizing the tax system, enhancing transparency, and improving collection efficiency. These reforms often involve the digitalization of tax processes, simplification of procedures, and stricter enforcement measures. For taxpayers, staying abreast of these reforms is crucial, as they can impact filing methods, compliance requirements, and even the overall tax burden. The efforts to combat tax evasion underscore the administration's commitment to ensuring fairness and equity in the tax system, making it imperative for all entities to adhere strictly to regulations.

Future Trends and Challenges in Iran's Tax System

The taxation system in Iran is a complex and constantly evolving one, making it challenging for individuals and businesses to navigate effectively. Future trends in Iran's tax landscape are likely to be shaped by a combination of internal economic policies, international sanctions, and global tax reforms. There is a continuous drive towards greater tax transparency and digitalization, aiming to streamline processes and reduce opportunities for non-compliance. Challenges such as tax evasion remain a focus for the Iranian National Tax Administration, leading to ongoing efforts to strengthen enforcement and broaden the tax base. For businesses and individuals, this means a need for increased vigilance and proactive tax planning. Understanding potential changes in tax rates, the introduction of new taxes (e.g., potential for VAT expansion or specific industry taxes), and shifts in international tax agreements will be critical for effective financial management. Staying informed through official channels and consulting with tax professionals will be indispensable for navigating the evolving tax landscape in Iran successfully.

Conclusion

Understanding the intricacies of income tax in Iran is not merely a matter of compliance but a strategic imperative for anyone operating within its economic sphere. From the various categories of income subject to taxation, such as real estate revenue, to the progressive personal income tax rates and crucial exemptions for activities in Free Trade Zones, the Iranian tax system presents a multifaceted landscape. The ability to carry forward losses, the importance of residency, and adherence to strict filing deadlines all play a vital role in effective tax management. The ongoing reforms by the Iranian National Tax Administration underscore a dynamic environment that demands continuous awareness and proactive engagement from taxpayers.

As the tax landscape in Iran continues to evolve, staying informed and seeking expert advice will be paramount for both residents and expatriates. We hope this comprehensive guide has shed light on the essential aspects of income tax in Iran, empowering you with the knowledge to navigate its complexities confidently. We encourage you to share your thoughts or questions in the comments below, or explore other articles on our site for more insights into financial and legal matters in the region.

- What Language They Speak In Iran

- Is America Going To War With Iran

- Iran Israe

- What Is The Time In Tehran Iran

- Sanctions Of Iran

Income Tax on ₹6 lakh | Tax Calculator 2025-26 | Talentd

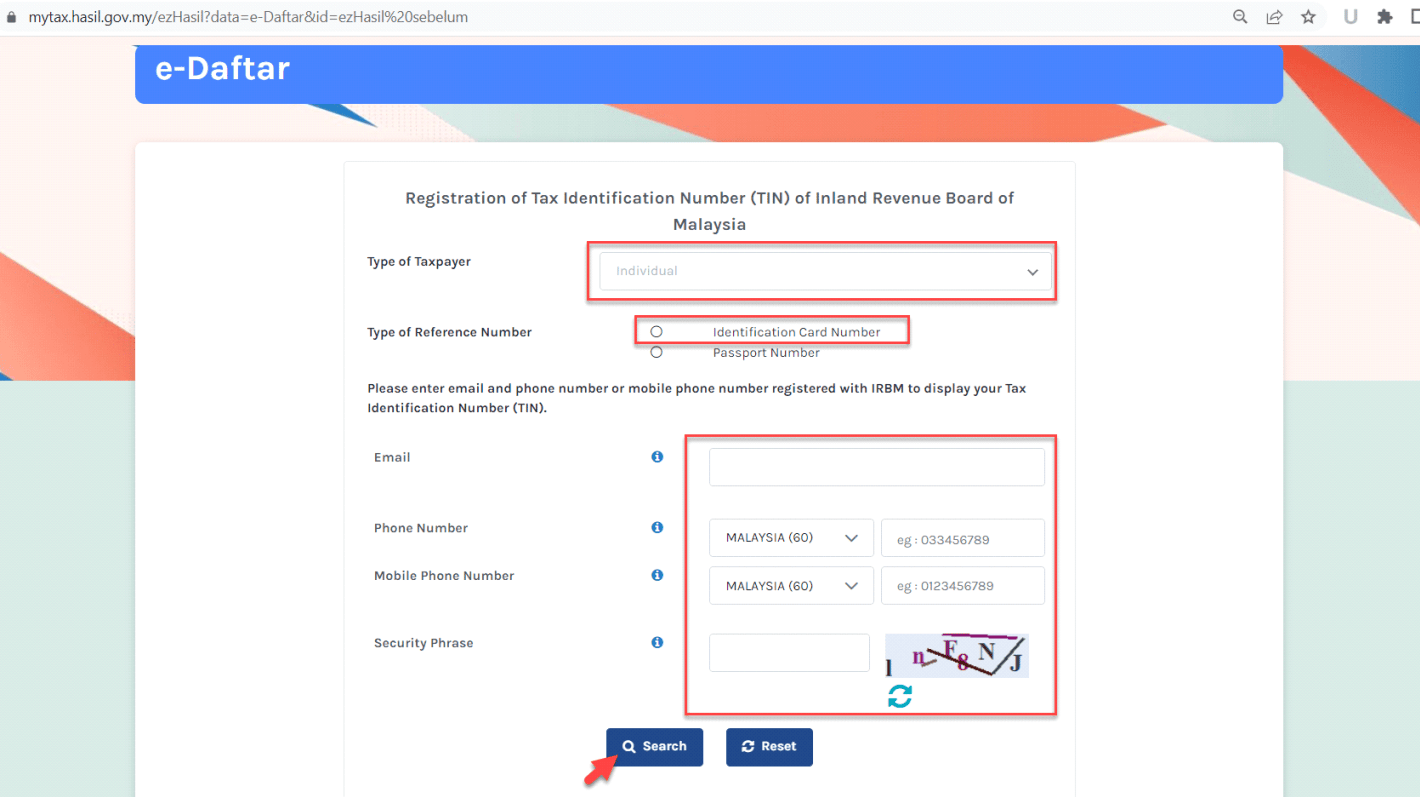

Income Tax Number Online Search in 4 steps | LHDN MyTax

CA Inter – Income Tax – Paper 3B – May 2024 & Nov 2024 – Tharun's