Unearthing Iran's Oil Wealth: A Comprehensive Look At Its Hydrocarbon Might

Iran, a nation steeped in history and rich in natural resources, stands as a pivotal player in the global energy landscape. When we delve into the question of "how much oil in Iran," we uncover a story of immense geological wealth, complex geopolitical dynamics, and a profound impact on both the national economy and international markets. This article aims to provide a comprehensive, data-driven exploration of Iran's oil reserves, production capabilities, consumption patterns, and its crucial role in the world's energy supply, offering insights that go beyond surface-level understanding.

Understanding the intricacies of Iran's oil industry is not merely an academic exercise; it's essential for comprehending global energy security, market stability, and the geopolitical currents that shape our world. From the vastness of its underground reservoirs to the daily ebb and flow of its production and exports, Iran's hydrocarbon sector is a subject of continuous interest and strategic importance. Let's embark on a journey to quantify and qualify the sheer scale of Iran's oil might.

Table of Contents

- Unveiling Iran's Oil Riches: A Global Perspective

- The Vastness Beneath: Iran's Proven Oil Reserves

- Mapping the Hydrocarbon Landscape: Fields and Reservoirs

- Iran's Oil Production: A Deep Dive into the Numbers

- Fueling the Nation: Iran's Domestic Oil Consumption

- Navigating the Global Market: Iran's Oil Exports

- The Economic Lifeline: How Oil Shapes Iran

- The Future of Iran's Oil Industry: Challenges and Prospects

Unveiling Iran's Oil Riches: A Global Perspective

Iran's position as a major oil producer and exporter is not just a matter of historical fact but a contemporary reality that continues to shape global energy dynamics. The nation possesses an extraordinary endowment of hydrocarbon resources, making it a key player in the Organization of the Petroleum Exporting Countries (OPEC) and a significant determinant of global oil prices and supply stability. The sheer volume of "how much oil in Iran" is staggering, placing it among the world's elite in terms of proven reserves. This wealth underpins its economic structure, influences its foreign policy, and provides a critical revenue stream for national development. Understanding the scale of this resource is the first step in appreciating Iran's enduring influence on the world stage.The Vastness Beneath: Iran's Proven Oil Reserves

When discussing "how much oil in Iran," the conversation inevitably begins with its proven reserves. According to the Iran Energy Balance Sheet, Iran holds some of the world’s largest deposits of proved oil. Specifically, with approximately 157 billion barrels of proven crude oil, Iran commands a substantial share of global hydrocarbon wealth. This figure represents about a quarter (24 percent) of the Middle East’s proven oil reserves and a significant 12 percent of the world’s total proven oil. These numbers underscore Iran's strategic importance as a long-term supplier to the global energy market. The concept of "proven reserves" refers to the estimated quantities of crude oil that geological and engineering data demonstrate with reasonable certainty to be recoverable in future years from known reservoirs under existing economic and operating conditions. Iran's vast proven reserves are a testament to its rich geology, with numerous large fields contributing to this impressive total. This substantial endowment ensures that Iran will remain a formidable force in the oil industry for decades to come, provided it can navigate the complexities of international trade and investment. The ability to access and exploit these reserves is crucial for the nation's economic prosperity and its capacity to meet both domestic and international energy demands.Mapping the Hydrocarbon Landscape: Fields and Reservoirs

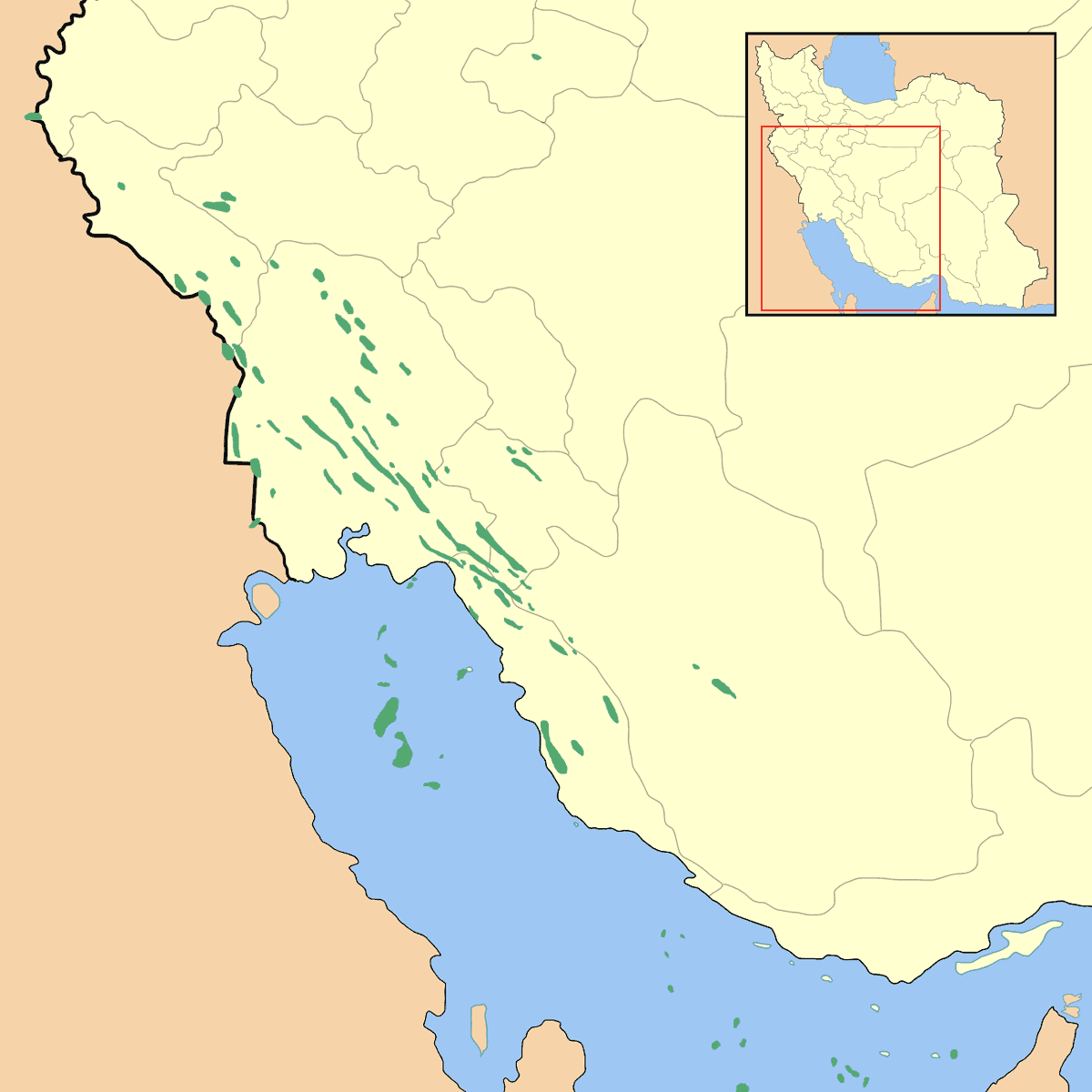

The story of "how much oil in Iran" is not just about the total volume but also about the intricate network of fields and reservoirs from which this precious resource is extracted. Since the initial discoveries, Iran has systematically explored and developed its hydrocarbon potential. Based on the latest oil and gas reports, a remarkable 145 hydrocarbon fields and 297 oil and gas reservoirs have been discovered across the country. This extensive network highlights the widespread distribution of oil and gas wealth within Iran's borders. A significant characteristic of Iran's hydrocarbon landscape is that many fields boast multiple pay zones, meaning they contain several layers of oil and gas that can be extracted, further enhancing their overall productivity and longevity. Of the discovered fields, 102 are primarily oil fields, while the remaining 43 are gas fields. This indicates a strong emphasis on oil production, though natural gas resources are also substantial. Delving deeper into the reservoir count, there are 205 oil reservoirs and 92 natural gas reservoirs, showcasing the immense complexity and richness of Iran's underground geology. These figures are crucial for understanding the potential for future exploration and development, as well as the long-term sustainability of Iran's oil output. The diversity and abundance of these fields and reservoirs are key to Iran's enduring role as a major energy producer.Iran's Oil Production: A Deep Dive into the Numbers

Understanding "how much oil in Iran" is incomplete without a detailed look at its production capabilities and historical performance. Iran's oil production figures are closely watched by analysts worldwide, reflecting not only its operational capacity but also the impact of geopolitical factors, particularly sanctions.Current Production Snapshot

Recent data provides a snapshot of Iran's ongoing efforts to maintain and increase its oil output. According to the International Energy Agency’s (IEA) latest oil market report, released in October, Iran produced 3.14 million barrels of crude oil per day, excluding condensates. This figure highlights a robust level of activity despite external pressures. More granular data shows slight fluctuations:- Production was reported at 3,280,000 barrels per day in January 2025.

- This records a slight decrease from the previous number of 3,293,000 barrels per day for December 2024.

- Crude oil production in Iran decreased to 3,303 barrels per day (in thousands) in May from 3,328 barrels per day (in thousands) in April of 2025.

Historical Production Trends and Milestones

Iran's oil production history is marked by significant peaks and troughs, reflecting periods of intense development, political upheaval, and international sanctions.- Average production from January 2002 to January 2025 has been around 3,521,000 barrels per day.

- Looking further back, crude oil production in Iran averaged 3,442.64 barrels per day (in thousands) from 1973 until 2025.

- The nation reached an all-time high of 6,677.00 barrels per day (in thousands) in November of 1976, showcasing its immense capacity before the Islamic Revolution. This peak level of 6.6 million barrels per day (1,050,000 cubic meters per day) in 1976 remains a benchmark for Iran's potential.

- Conversely, a record low of 510.00 barrels per day (in thousands) was recorded in October of 1980, a period deeply impacted by the Iran-Iraq War.

Fueling the Nation: Iran's Domestic Oil Consumption

While much attention is given to Iran's oil production and exports, its domestic consumption patterns are equally important for a complete picture of "how much oil in Iran" is utilized. Iran is a significant consumer of oil, driven by its large population, industrial activities, and transportation needs. According to available data, Iran ranks #12 in the world for oil consumption. This accounts for about 1.86% of the world’s total consumption, which stands at approximately 97,103,871 barrels per day. On a per capita basis, based on the 2016 population of 83,812,228 people, Iran consumes about 0.9 gallons of oil per capita every day. This translates to roughly 330 gallons per capita per year, or approximately 8 barrels per capita annually. These figures indicate a substantial domestic demand for petroleum products, which must be met by the nation's own production capabilities. The balance between production and consumption is critical; any surplus can be exported to generate revenue, while a deficit would necessitate imports, impacting the national economy. Iran's significant domestic consumption underscores the importance of its vast oil reserves not just for international trade but also for ensuring national energy security and supporting its growing economy. Managing this balance efficiently is a continuous challenge for Iranian energy policymakers.Navigating the Global Market: Iran's Oil Exports

Iran's ability to export its crude oil is fundamental to its economic health, making the question of "how much oil in Iran" is exported a critical one. Despite facing significant international sanctions, Iran has consistently found ways to maintain its presence in the global oil market, demonstrating remarkable resilience.Key Export Destinations and Volumes

Iran's oil exports are a crucial source of foreign currency reserves. Recent data indicates a notable increase in export volumes:- According to Kpler trade intelligence firm’s tanker tracking data, Iran’s crude oil and gas condensate exports reached 1.812 million barrels per day (mb/d) together in October. This marked the highest level since 2019 and was about 370,000 b/d more than in September 2023.

- In 2024, Iran exported 587 million barrels of oil, representing a significant increase of 10.75 percent compared to 2023’s 530 million barrels.

- During the first quarter of 2024, Iran exported 141.7 million barrels of oil, a substantial 28 percent increase over the same period last year.

The Impact of Sanctions on Iran's Oil Trade

The discussion of "how much oil in Iran" is exported cannot be separated from the pervasive influence of international sanctions. The reimposition of sanctions on Tehran’s oil exports in late 2018, a few months after President Trump withdrew from the Iran nuclear deal during his first term, severely impacted Iran's ability to sell its oil openly on the international market. These sanctions aimed to cripple Iran's economy by targeting its primary revenue source. The immediate effect of these sanctions was a significant drop in Iran's official oil exports, forcing the country to rely on covert methods, ship-to-ship transfers, and opaque financing mechanisms to continue its trade. Despite these challenges, the data on recent export increases suggests that Iran has become increasingly adept at circumventing these restrictions, finding alternative buyers and routes for its oil. Interestingly, the broader market also felt the effects of these policy shifts. During the first few months of the Trump presidency, prior to the full impact of the renewed sanctions, the price of oil and gasoline fell. This market dynamic contributed to a drop in inflation to 2.4% over a 12-month period, demonstrating how changes in Iran's oil policy and supply can have ripple effects on global energy prices and economic indicators. The ongoing cat-and-mouse game between Iran and sanctioning nations continues to be a defining feature of the global oil market, directly influencing the effective volume of "how much oil in Iran" reaches international buyers.The Economic Lifeline: How Oil Shapes Iran

The sheer volume of "how much oil in Iran" is not merely a geological statistic; it is the bedrock of the nation's economy. Oil revenues have historically funded a significant portion of Iran's government budget, infrastructure projects, social programs, and military expenditures. This reliance on oil has shaped Iran's economic development trajectory, making it highly sensitive to fluctuations in global oil prices and international sanctions. When oil prices are high and exports flow freely, Iran experiences periods of economic growth and increased national wealth. This allows for greater investment in domestic industries, job creation, and improvements in living standards. Conversely, periods of low oil prices or stringent sanctions, which restrict the sale of "how much oil in Iran" can be exported, lead to economic contraction, inflation, currency depreciation, and social unrest. The government's ability to manage its budget and provide public services becomes severely constrained. The strategic importance of oil also extends to Iran's geopolitical standing. As a major oil producer and a founding member of OPEC, Iran wields considerable influence in global energy policy discussions. Its decisions regarding production levels, pricing, and export destinations can impact the stability of the international oil market. Therefore, understanding the quantity of "how much oil in Iran" is available and being produced is crucial for anyone analyzing the country's economic resilience and its role in the broader Middle East and global affairs. The constant push and pull between maximizing oil revenues and navigating international political pressures defines Iran's economic reality.The Future of Iran's Oil Industry: Challenges and Prospects

The future of "how much oil in Iran" can be produced and exported is contingent upon a complex interplay of internal and external factors. While Iran possesses vast proven reserves and a robust infrastructure, it faces significant challenges that could impact its long-term potential. One of the primary challenges remains the international sanctions regime. Although Iran has shown remarkable ingenuity in circumventing these restrictions, their continued presence limits foreign investment, access to advanced technology, and integration into the global financial system. Modernizing aging oil fields and developing new, more complex reservoirs requires substantial capital and expertise, which are often difficult to acquire under sanctions. Without significant investment, production capacity could stagnate or even decline over time, irrespective of the vast reserves. Domestically, Iran faces the challenge of increasing its refining capacity to meet growing internal demand and add value to its crude oil. Reducing reliance on crude oil exports by processing more oil domestically into refined products like gasoline and diesel could enhance economic stability and create more jobs. Furthermore, the need for diversification away from an oil-dependent economy is a long-term goal, though achieving it remains a formidable task. Despite these hurdles, the prospects for Iran's oil industry are also considerable. Any future easing of sanctions or a comprehensive nuclear deal could unlock massive investment, leading to a significant boost in production and export capabilities. Iran has a highly skilled workforce in the energy sector, and its strategic location provides advantageous access to key markets. The consistent demand from major importers like China also offers a stable outlet for its oil, ensuring that "how much oil in Iran" is produced will always find a buyer. Ultimately, the trajectory of Iran's oil industry will be shaped by its ability to attract investment, adopt new technologies, and navigate the intricate landscape of international relations. The sheer volume of oil beneath its soil guarantees its relevance, but the effective utilization of this wealth will depend on strategic decisions made in the coming years.Conclusion

In conclusion, the question of "how much oil in Iran" reveals a nation endowed with immense hydrocarbon wealth, possessing approximately 157 billion barrels of proven crude oil, accounting for 12% of global reserves. This vast resource base is supported by 145 discovered fields and 205 oil reservoirs, underscoring its significant potential. Despite facing persistent international sanctions, Iran has demonstrated remarkable resilience, maintaining considerable oil production levels, averaging over 3.4 million barrels per day historically, and showing recent increases towards 4.22 million barrels per day. Its domestic consumption is substantial, ranking 12th globally, while its exports, particularly to China, remain a critical economic lifeline, with recent figures showing a surge to 1.812 million barrels per day in October. Iran's oil industry is not merely an economic engine but a geopolitical instrument, profoundly shaping its national budget, foreign policy, and regional influence. The future of this vital sector hinges on its ability to overcome the challenges posed by sanctions, attract necessary investments for modernization, and strategically manage its resources. As a pivotal player in the global energy market, the ongoing developments in "how much oil in Iran" is produced and exported will continue to have far-reaching implications for energy security and international relations. We hope this comprehensive overview has shed light on the intricate dynamics of Iran's oil wealth. What are your thoughts on Iran's role in the global energy landscape? Share your perspectives in the comments below, or explore our other articles on global energy markets to deepen your understanding of these critical topics.

Iran Supply Cut Not a Problem, There's Enough Oil: IEA

Iran Oil Map - MapSof.net

How Much Oil Does Iran Produce? - Oil Markets Daily (NYSEARCA:USO