Unpacking The Billions: How Much Money Has Iran Really Received?

The JCPOA and the $150 Billion Myth

One of the most persistent claims circulating in public discourse is that the United States "gave" Iran $150 billion as part of the 2015 Joint Comprehensive Plan of Action (JCPOA), often referred to as the Iran nuclear deal. This claim, frequently amplified by political figures, is fundamentally misleading and distorts the true nature of the financial transactions involved. To be clear, the United States **did not give $150 billion to Iran in 2015**. The reality is far more nuanced. In 2015, as part of an international deal with Iran called the Joint Comprehensive Plan of Action, Iran agreed to cut back on its nuclear program in exchange for sanctions relief. The "money" that Iran gained access to was not a direct payment from the U.S. government or any other government. Instead, these funds were **Iranian foreign assets**, which had been frozen in banks around the world due to international sanctions. These assets were Iran's own money, earned primarily from oil sales and other legitimate economic activities prior to the imposition of stringent sanctions. The international sanctions regime, which had been in place for years to pressure Iran over its nuclear ambitions, prevented Iran from accessing these funds. When the JCPOA was implemented, and Iran began to fulfill its commitments to scale back its nuclear activities, a portion of these frozen assets was unfrozen, allowing Iran to repatriate or utilize its own money. As Politifact reported, Donald Trump miscast the money and the terms in the Iran nuclear deal, clarifying that "No, Donald Trump, we are not giving Iran $150 billion for 'nothing'". This distinction is critical: it was Iran's money to begin with, not a payment from any government to buy Iran’s cooperation.Understanding Sanctions and Frozen Assets

To fully grasp the nature of the funds released under the JCPOA, it's essential to understand how international sanctions work and what "frozen assets" truly mean. When a country is under severe international sanctions, its ability to conduct financial transactions globally is severely restricted. This often means that money earned from exports, like oil, cannot be easily transferred back to the country or used for international trade. Instead, these funds accumulate in bank accounts in other nations. Most of Iran's frozen assets, as noted by experts like Suzanne Maloney of the Brookings Institution, were held in central and commercial banks overseas, primarily in Asian countries like South Korea, India, and Japan, which had continued to purchase Iranian oil under specific waivers before the deal. These were not funds held in U.S. banks or under U.S. direct control in the same way. The lifting of sanctions simply allowed Iran to access its own money that had been inaccessible, effectively unblocking its accounts. It's akin to someone having their bank account frozen due to legal issues, and then, once those issues are resolved, they regain access to their own savings. The government didn't "give" them money; it simply removed the impediment to their access. This fundamental misunderstanding often fuels the debate around **how much money have we given Iran**.The $6 Billion Hostage Deal: A Closer Look

More recently, in September 2023, the United States announced an agreement with Iran to secure the freedom for five U.S. citizens who had been detained in the country. As part of this hostage deal, Washington agreed to facilitate the movement of Iran’s money, allowing Iran to access $6 billion of its own funds. This particular sum, like the funds discussed in the JCPOA, was always Iranian money. It originated from Iranian oil sales to South Korea, which had been held in restricted accounts due to U.S. sanctions. The mechanism for accessing these funds was carefully structured. The money was moved from South Korea to Qatar via Europe, where it was placed in an account overseen by Qatar. Crucially, Iran is not at liberty to do whatever it pleases with the $6 billion. The funds are designated for humanitarian purposes, such as purchasing food, medicine, and agricultural products. This restriction is intended to ensure that the money benefits the Iranian people directly and does not flow into activities that could destabilize the region or fund illicit programs. While critics argue that granting financial access to Iran, even with restrictions, undermines efforts to curb its influence in the Middle East, the U.S. administration maintains that strict oversight mechanisms are in place.Distinguishing Funds: Taxpayer Money vs. Iran's Own Assets

A common misconception, often propagated by critics, is that the money freed in these deals comes directly from American taxpayers. This is a crucial point to clarify when discussing **how much money have we given Iran**. As established, both the larger sum associated with the JCPOA and the recent $6 billion were Iranian foreign assets. They were funds Iran had legitimately earned through trade, primarily oil exports, which had then been frozen in overseas banks due to sanctions. The U.S. government did not appropriate funds from its treasury or collect new taxes from its citizens to transfer to Iran in these instances. Instead, it facilitated the unblocking of Iran's own money, which had been held in third-country banks. The narrative that American taxpayers are directly funding the Iranian regime through these deals is therefore inaccurate. The frustration expressed by some, such as the sentiment captured in a social media post by Shirlee Baner on December 11, 2024 – "We have Americans crying in need from hurricanes and no one from freaking FEMA to help but we help every piece of human trash on the planet except Americans" – highlights a deep-seated public concern about resource allocation. However, it's vital to distinguish between actual U.S. foreign aid or domestic spending and the unfreezing of another nation's own assets. These are distinct financial mechanisms with different implications.Allegations of Terrorism Funding: Fact vs. Speculation

One of the most significant concerns surrounding any financial access granted to Iran is the potential for these funds to be diverted to support terrorist groups or destabilizing activities in the Middle East. Critics frequently raise this alarm, suggesting that even if the money is Iran's own, its newfound liquidity could indirectly bolster its illicit networks. It is true that Iran has a long history of supporting various proxy groups in the region, including Hezbollah in Lebanon, Houthi rebels in Yemen, and various factions in Iraq and Syria. Iran's relationship with Hamas, for instance, has heightened tensions between Washington and Tehran, especially after the militant group attacked U.S. ally Israel on October 7, killing hundreds of civilians. The concern is legitimate: does increased financial flexibility for Iran translate into more funding for these groups? Regarding the money freed in 2015 as part of the JCPOA, while some critics have suggested it may have allowed Iran to provide funding for terrorist groups, there’s not enough concrete evidence to say the money freed in the agreement directly went to such activities. Experts and intelligence agencies have largely stated that Iran prioritized using the unfrozen assets for domestic economic recovery, including paying back debts, improving infrastructure, and addressing the needs of its population, which had suffered significantly under sanctions. Iran also tapped into small amounts of that money to pay its UN dues several times, a standard diplomatic obligation. While any additional financial breathing room for Iran could, in theory, free up other resources for malign activities, directly tracing the unfrozen funds to specific terrorist acts remains challenging and largely unsubstantiated by concrete evidence from the 2015 release. The $6 billion recently released for humanitarian purposes is under even stricter monitoring to prevent diversion.The "Cash Payment" Controversy: $1.8 Billion in Context

Beyond the frozen assets, another point of contention that often arises when discussing **how much money have we given Iran** is the specific claim of a "cash payment" of $1.8 billion. This particular transaction, often highlighted by figures like Donald Trump, who remarked, "the Iran deal is a terrible deal. We gave $1.8 billion in cash. That’s actual cash, barrels of cash. It should have never been made. But we will be talking about it," requires a separate explanation. This $1.8 billion (often cited as $1.7 billion initially) was not part of the nuclear deal itself, nor was it a new payment. It was the settlement of a decades-old financial dispute between the U.S. and Iran. This money originated from an Iranian trust fund established in 1979, before the Iranian Revolution, when Iran paid the U.S. for military equipment that was never delivered due to the revolution and the subsequent freezing of Iranian assets. The funds were held in a U.S. Treasury account. For years, Iran had sought the return of this money, and the dispute had been before the Hague Tribunal. In 2016, the U.S. agreed to settle the claim, returning the principal amount of $400 million, plus $1.3 billion in accrued interest. The reason it was delivered in cash, rather than through electronic transfer, was largely due to the ongoing sanctions against Iran, which made it difficult to process large electronic transactions through international banking systems. While the visual of "barrels of cash" certainly fueled public outrage and political criticism, it was, in essence, a legal settlement of an old debt, not a new "gift" or payment tied directly to the nuclear agreement's terms for sanctions relief on frozen assets.Economic Impact and Sanctions Strategy

The discussion around **how much money have we given Iran** is intrinsically linked to the broader strategy of economic sanctions and their effectiveness. The U.S. has historically used sanctions as a primary tool to pressure Iran, particularly concerning its nuclear program and regional activities. The Trump administration, for example, pursued a "maximum pressure" strategy after withdrawing from the JCPOA, aiming to cripple Iran's economy and force it to renegotiate a new deal. This strategy involved re-imposing and intensifying sanctions, especially on Iran's oil exports, which are the lifeblood of its economy. Under the Trump administration’s "maximum pressure" strategy, Iran averaged around 775,000 barrels per day of oil exports, according to United Against Nuclear Iran, a group of former U.S. officials. However, following a period of reduced sanctions enforcement or the potential for a renewed deal, Iran's oil exports have seen an increase. This is up 80% from the previous average, indicating a significant boost in revenue generation for the regime. The prospect of further sanctions relief or a new agreement could lead to Iran accessing even more of its frozen assets. Some analysts suggest that the regime could receive a payday of around $90 billion the moment a U.S. administration ends sanctions. This potential influx of funds raises questions about Iran's future economic stability, its capacity to fund its regional proxies, and its ability to withstand external pressure. The debate isn't just about past transactions but also about the potential future financial leverage Iran might gain, impacting global energy markets and regional power dynamics.Public Perception and Misinformation

The public discourse surrounding financial dealings with Iran is often characterized by strong emotions and a significant amount of misinformation. Social media posts distort the sources of the money, leading to widespread misunderstandings about the nature of the funds and the agreements involved. The complexity of international finance, sanctions regimes, and diplomatic agreements makes it easy for simplified or outright false narratives to take hold. The sentiment expressed by Shirlee Baner, lamenting aid to other nations while domestic needs go unmet, resonates deeply with many Americans. This feeling of perceived injustice, where foreign entities seem to receive financial benefits while citizens face hardships, makes fertile ground for misinterpretations about "giving" money to countries like Iran. When the true nature of the funds—Iran's own money, unfrozen—is obscured, it fuels a sense of betrayal or misprioritization. Politicians and media outlets, on all sides of the spectrum, sometimes contribute to this confusion by using imprecise language or selectively highlighting facts to support a particular agenda. For instance, referring to the unfreezing of Iran's assets as a "payment" or "gift" fundamentally misrepresents the transaction. This highlights the critical need for accurate, clear communication from official sources and a commitment from the public to seek out verified information rather than relying on sensationalized claims. Understanding **how much money have we given Iran** requires navigating this complex landscape of information and misinformation.Broader Geopolitical Implications

The financial interactions with Iran are not just about numbers; they have profound geopolitical implications. Critics argue that granting financial access to Iran, even if it's their own money, undermines efforts to curb its influence in the Middle East. They contend that any economic relief, regardless of its source, frees up other resources that Iran can then use to support its ballistic missile program, its nuclear ambitions, or its regional proxies. Alliances with Iran, particularly its growing ties with countries like Russia and China, threaten to undo much of the progress made in stabilizing the region and promoting Western interests. Conversely, proponents of diplomatic engagement argue that providing Iran with a pathway to economic relief, tied to verifiable nuclear concessions, is the most effective way to prevent nuclear proliferation and avoid military confrontation. They also point to the fact that denying Iran access to its own funds can exacerbate internal economic hardship, potentially leading to instability or a more hardline stance from the regime. It's also important to consider the broader context of U.S. foreign aid and alliances. For example, Israel — a protégé of the United States since its 1948 founding — is the biggest recipient of U.S. military aid, often receiving record military aid to Israel. This context underscores the complex web of financial relationships and strategic alliances that define U.S. foreign policy in the Middle East. The debate over **how much money have we given Iran** is thus part of a larger, intricate discussion about regional stability, global power dynamics, and the effectiveness of different foreign policy tools.Conclusion

The question of "how much money have we given Iran" is far more complex than often portrayed in public discourse. It is crucial to distinguish between direct payments from the U.S. government and the unfreezing of Iran's own assets, which were held overseas due to international sanctions. The widely cited $150 billion figure related to the JCPOA was Iran's money, not a U.S. handout. Similarly, the recent $6 billion released in exchange for the freedom of U.S. citizens was also Iran's money, specifically earmarked for humanitarian purposes and subject to strict oversight. The $1.8 billion "cash payment" was a settlement of a decades-old debt, a separate legal matter from the nuclear deal. Understanding these distinctions is vital for informed public debate. While legitimate concerns exist about Iran's use of its financial resources, particularly regarding its support for regional proxies and its nuclear program, it is essential to base these discussions on accurate facts rather than misinformation. The narrative that American taxpayers are directly funding the Iranian regime through these specific transactions is largely inaccurate. We encourage readers to delve deeper into these topics, consult reputable sources like Politifact and academic analyses, and engage in informed discussions. By doing so, we can move beyond sensationalized headlines and develop a more nuanced understanding of the intricate financial and geopolitical realities that shape U.S.-Iran relations. Share this article to help clarify these complex issues, and explore other related content on our site for more in-depth analysis of international affairs.

With Inflation Ravaging Currency, Iran Is Changing Names and Numbers

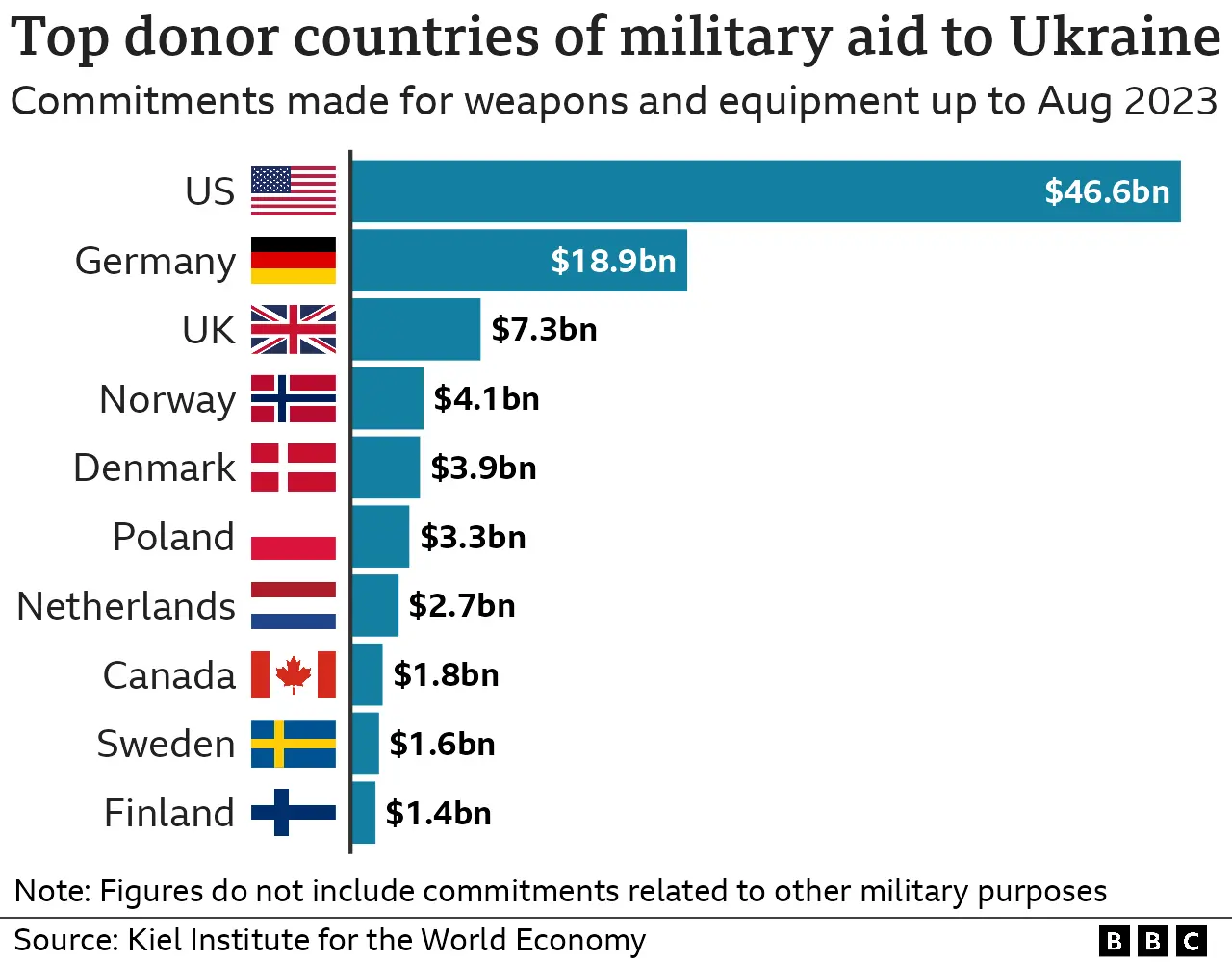

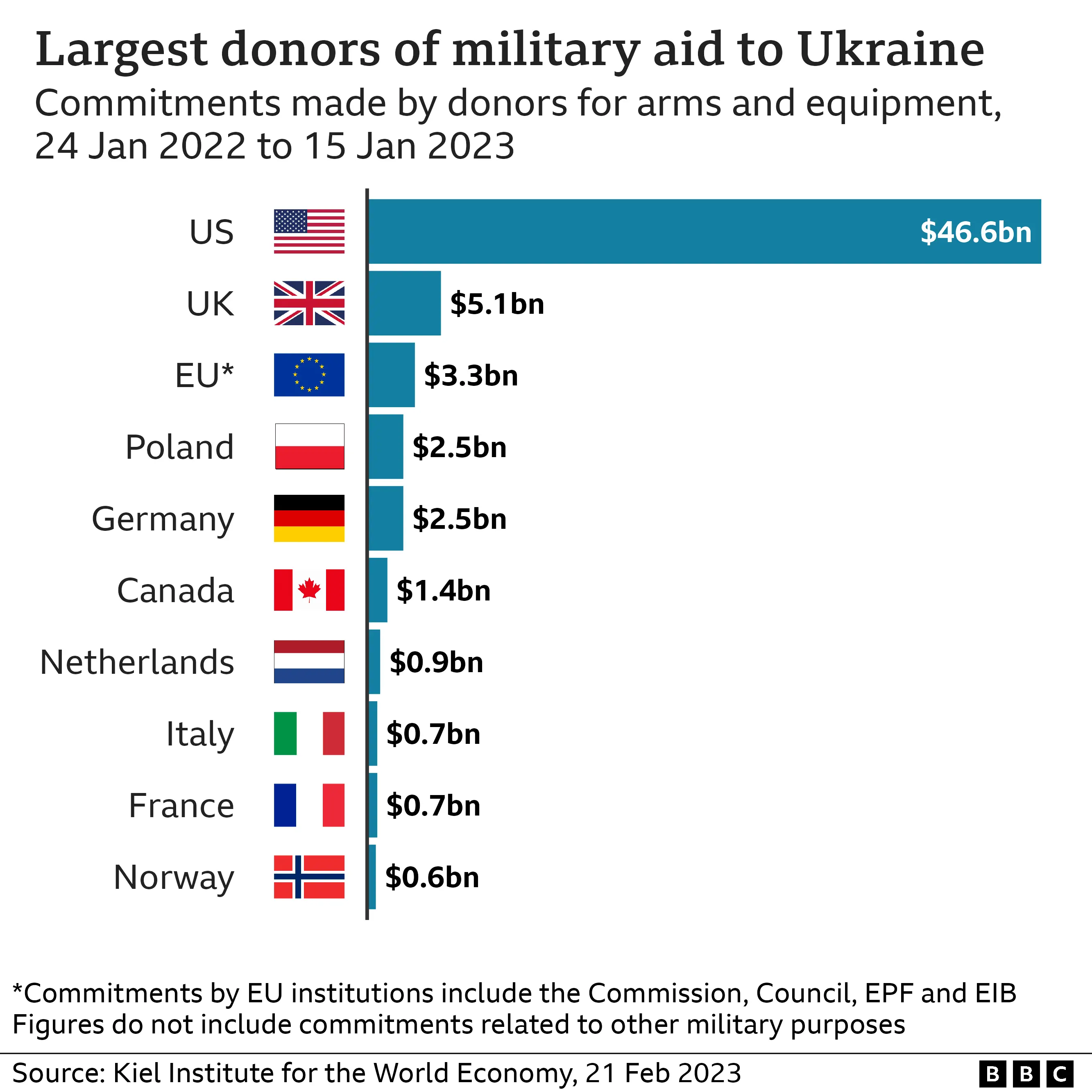

How Norway outstrips US on Ukraine spending

EU gives Ukraine €2bn of ammunition after shell plea