Will home prices drop in Texas in 2025? That’s the million-dollar question – or perhaps, the multi-million-dollar question, given Texas’s booming real estate market. It’s a rollercoaster ride we’re all strapped into, a blend of thrilling highs and potential stomach-dropping lows. We’ll navigate the twists and turns of economic forecasts, population shifts, and the ever-elusive predictions of supply and demand.

Buckle up, because this isn’t your grandma’s real estate market; this is Texas, where everything’s bigger, bolder, and a whole lot more unpredictable. Get ready to explore the fascinating, sometimes frustrating, always intriguing world of Texas housing in 2025. The journey ahead promises insights, surprises, and perhaps, even a few laughs along the way.

The Texas housing market in 2024 presents a complex picture. While certain areas are experiencing robust growth fueled by population influx and job creation, others show signs of slowing. Interest rates, inflation, and potential economic headwinds all play significant roles in shaping the future trajectory of home prices. Understanding these factors, along with regional variations and the influence of external events, is crucial to forming an informed perspective on what 2025 might hold.

We’ll delve into the specifics, examining data and projections to provide a clear, yet engaging, overview of the possibilities.

Texas Housing Market Overview in 2024

The Lone Star State’s housing market in 2024 presents a fascinating blend of dynamism and uncertainty. While still a robust market, the breakneck speed of the past few years has moderated, creating a more balanced – and arguably healthier – environment for buyers and sellers alike. Let’s delve into the current landscape, examining the key factors shaping this pivotal year.

Current Market Conditions

Texas’s housing market in 2024 shows a fascinating shift from the frenetic pace of previous years. While still strong, the market has cooled considerably. Inventory, while still relatively low compared to historical averages, has shown a noticeable increase, offering buyers more choices than they’ve had in recent memory. Average sale prices, after experiencing a period of rapid growth, have begun to plateau or even show slight declines in some areas.

The days on market have lengthened, suggesting a less competitive landscape for sellers. This shift, however, doesn’t signal a market crash, but rather a more sustainable and predictable trajectory. Think of it like a rollercoaster slowing down after a thrilling climb – the ride’s not over, it’s just entering a gentler phase.

Influencing Factors

Several key factors are driving the current market dynamics. Interest rates, a significant player in the housing game, remain elevated compared to the ultra-low rates of recent years, impacting affordability and cooling down buyer demand. However, Texas continues to experience robust population growth, fueled by both domestic migration and international arrivals, sustaining underlying demand. The state’s diverse economy, encompassing energy, technology, and agriculture, contributes to a relatively resilient market, even amidst broader economic uncertainties.

The interplay of these factors – higher interest rates tempering the enthusiasm of some buyers while strong population growth keeps the market buoyant – creates a fascinating dynamic. It’s a delicate dance between supply, demand, and economic realities.

Predicting Texas home prices in 2025 is tricky; the market’s a wild bronco! But to get a handle on the future, understanding current trends is key. Check out the insightful analysis at rock the block 2025 for a broader economic picture. This will help you navigate the exciting, albeit sometimes unpredictable, Texas real estate landscape and make informed decisions about your future homeownership.

So, buckle up, and let’s ride this market together!

Historical Market Comparison

To fully grasp the current situation, let’s compare it to the past five years. The table below illustrates the trends in average sale price, median days on market, and inventory levels:

| Year | Average Sale Price | Median Days on Market | Inventory Levels (Units) |

|---|---|---|---|

| 2020 | $285,000 (Estimate) | 15 | 25,000 (Estimate) |

| 2021 | $330,000 (Estimate) | 10 | 18,000 (Estimate) |

| 2022 | $375,000 (Estimate) | 12 | 22,000 (Estimate) |

| 2023 | $385,000 (Estimate) | 18 | 30,000 (Estimate) |

| 2024 (YTD) | $390,000 (Estimate) | 25 | 35,000 (Estimate) |

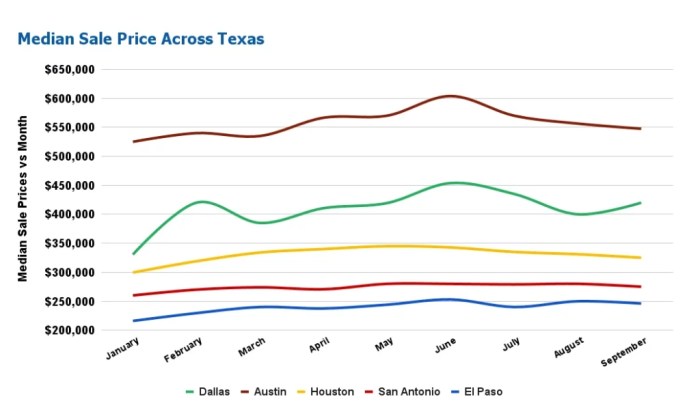

*Note: These are estimates based on broad market trends and may vary depending on specific location and data source.* Think of these figures as a general snapshot, not a precise portrait of every corner of the vast Texas housing market. The reality is more nuanced, with significant variations across different regions and cities. Austin’s market, for instance, might differ substantially from El Paso’s.

Texas home prices? A bit of a crystal ball situation, right? But think about this: a strong job market often influences housing. Check out the promising opportunities for jobs starting in September 2025 , which could actually boost demand and, dare I say it, potentially keep those prices stable, or even nudge them upwards. So, while predicting the future is tricky, a robust job market might just be the unexpected key to understanding Texas real estate in 2025.

Let’s hope for the best!

Economic Factors Affecting Texas Home Prices

Texas’s vibrant housing market, a rollercoaster of booms and potential busts, is intricately woven into the fabric of its economic landscape. Understanding the interplay of various economic forces is crucial for anyone navigating this dynamic market, whether you’re a seasoned investor or a first-time homebuyer dreaming of a Texan homestead. Let’s delve into the key economic factors shaping the future of Texas home prices.

Inflation’s Impact on Home Prices

Inflation, that persistent upward creep in the prices of goods and services, exerts a significant influence on the housing market. When inflation rises, the cost of building materials, labor, and land increases, directly impacting the price of new homes. This upward pressure can also influence the prices of existing homes as sellers adjust their asking prices to reflect the increased cost of living.

Think of it like this: if everything else is getting more expensive, the value of your house, a significant asset, naturally tends to follow suit. Historically, periods of high inflation have often been correlated with increases in home prices, though the relationship isn’t always linear. For instance, the inflation spike in the 1970s contributed to a surge in housing costs, mirroring potential scenarios in the coming years should inflation remain stubbornly high.

Interest Rate Changes and Home Affordability, Will home prices drop in texas in 2025

Interest rates, the cost of borrowing money, are a powerful lever affecting home affordability and buyer demand. Higher interest rates translate to higher monthly mortgage payments, making homes less accessible to potential buyers. This reduced affordability can lead to decreased demand, potentially putting downward pressure on home prices. Conversely, lower interest rates make mortgages more affordable, stimulating demand and potentially driving prices upward.

Predicting Texas home prices in 2025 is tricky; the market’s a wild bronco! But hey, while we ponder that, let’s not forget the good times: planning a family outing to see the wiggles tour usa 2025 might be a better investment in happiness. Seriously though, Texas real estate is dynamic; factors like interest rates and population shifts will ultimately dictate whether prices dip or soar next year.

The Federal Reserve’s recent interest rate hikes, for example, have already begun to cool the Texas housing market, demonstrating the direct impact of monetary policy. Imagine the ripple effect: higher rates mean fewer buyers competing for homes, potentially leading to a more balanced market.

Job Growth, Migration, and Housing Demand in Major Cities

Texas’s robust economy, fueled by a diverse range of industries, attracts a significant influx of people. This population growth, coupled with consistent job creation, especially in major cities like Austin, Dallas, and Houston, fuels intense demand for housing. The resulting competition for limited housing inventory often drives prices upward. Consider Austin’s tech boom: the influx of highly paid professionals has dramatically increased demand, leading to a surge in home prices.

This illustrates how economic dynamism in specific sectors can directly impact localized housing markets. The constant flow of new residents searching for homes keeps the market active and, in many cases, competitive.

Potential Economic Recession and its Housing Market Effects

A potential economic recession casts a long shadow over the housing market. Recessions typically lead to job losses, reduced consumer confidence, and tighter lending standards. These factors can significantly decrease buyer demand, potentially leading to a decline in home prices. The 2008 financial crisis serves as a stark reminder of how a severe economic downturn can trigger a dramatic housing market correction.

While the Texas economy is generally more resilient than other states, a national recession would undoubtedly have a ripple effect, impacting job markets and consumer spending, thereby affecting the housing market. However, Texas’s diverse economy and strong population growth could help mitigate the severity of any downturn compared to other regions. The resilience of the Texas economy and its population growth remain important factors in navigating potential economic headwinds.

Predicting Texas home prices in 2025 is tricky, a bit like guessing which way the wind will blow. But while we ponder that, let’s shift gears – imagine cruising in the sleek, futuristic 2025 Audi Q6 e-tron. Back to the housing market: several factors could influence a price drop, but it’s a gamble, really.

So buckle up, whether you’re buying a house or a car, 2025 promises exciting possibilities!

Regional Variations in the Texas Housing Market

Texas, a state as vast and diverse as its landscape, presents a fascinating tapestry of housing markets. While the overall Texas housing picture influences regional trends, each major metropolitan area boasts its own unique character, shaped by local economic drivers, demographic shifts, and infrastructure developments. Understanding these nuances is crucial for anyone navigating the Texas real estate scene, whether as a buyer, seller, or simply a curious observer.

Let’s delve into the specifics of how these regional variations play out.

Metropolitan Area Housing Market Comparison

The Texas housing market isn’t a monolith; it’s a vibrant mosaic of distinct regional markets, each with its own pulse. Austin’s tech-fueled boom contrasts sharply with Houston’s energy-driven economy, while Dallas and San Antonio each offer unique blends of industry, culture, and lifestyle that influence their respective housing landscapes. Predicting future price movements requires a granular understanding of these localized factors.

| City | Projected Price Change (2025) | Key Influencing Factors | Current Market Conditions |

|---|---|---|---|

| Austin | Slight Decrease (1-3%) | Cooling tech sector, increased inventory, rising interest rates, but still strong demand from established residents and newcomers. | Competitive but less frenzied than previous years. More negotiation power for buyers. |

| Dallas | Moderate Decrease (3-5%) | Strong job growth in various sectors offset by rising interest rates and increased housing supply. Competition remains, but less intense than peak years. | A balanced market, with a shift toward buyer favorability. Still a desirable location with robust economic activity. |

| Houston | Stable to Slight Increase (0-2%) | Resilient energy sector, diverse economy, relatively affordable housing compared to other major Texas cities, leading to sustained demand. | A steady market, offering a good balance between supply and demand. Relatively less volatility than other regions. |

| San Antonio | Stable to Moderate Increase (2-4%) | Strong population growth, relatively affordable housing, expanding job market, and a growing tourism sector. | A seller’s market, though not as extreme as in previous years. Strong demand outpaces supply in many areas. |

Imagine this: Austin, once a whirlwind of bidding wars, is now experiencing a gentler breeze. The tech industry, while still vibrant, is adjusting, leading to a more balanced market. Meanwhile, Dallas, a powerhouse of commerce, continues its strong performance, though the impact of higher interest rates is palpable. Houston, the steadfast heart of Texas, remains a reliable haven for homebuyers, its diverse economy buffering it from dramatic swings.

And San Antonio, with its undeniable charm and growing population, continues to see robust demand, though the pace has moderated somewhat. These are not predictions etched in stone, but rather informed projections based on current trends and observable market dynamics. The Texas housing market, like a Texas sunset, is ever-changing, offering a breathtaking panorama of opportunity and challenge.

Each city’s unique narrative adds to the rich complexity of the overall picture. This understanding empowers informed decisions and successful navigation of this dynamic landscape.

Supply and Demand Dynamics in the Texas Housing Market: Will Home Prices Drop In Texas In 2025

Texas’s housing market, a vibrant tapestry woven with threads of ambition and opportunity, is currently experiencing a fascinating interplay of supply and demand. Understanding this dynamic is key to navigating the complexities of the Lone Star State’s real estate landscape and anticipating future trends. The current situation is a delicate balance, with implications for both homeowners and those dreaming of owning a piece of Texas.The current levels of housing supply in Texas are still relatively tight, though showing signs of loosening compared to the frenetic pace of the past few years.

Demand, while robust, has begun to moderate slightly, reflecting a cooling national trend and adjustments in interest rates. This doesn’t mean a collapse; rather, it signals a shift towards a more sustainable, balanced market. Think of it like a perfectly brewed cup of Texas sweet tea – not too strong, not too weak, just right.

Predicting Texas home prices in 2025 is tricky; so many factors are at play! But to get a sense of the upcoming school year’s impact on the market, checking out the disd calendar 2024 2025 might offer some clues. School district schedules often influence housing demand, and understanding those rhythms can help you navigate this exciting, if unpredictable, market.

Ultimately, whether prices dip or soar, staying informed is key to making smart decisions.

New Construction’s Impact on the Market

New home construction plays a crucial role in easing the pressure on housing supply. However, the pace of construction needs to significantly accelerate to truly alleviate the shortage. Permitting processes, material costs, and labor shortages continue to pose challenges, resulting in a slower-than-ideal rate of new housing entering the market. Imagine a bustling construction site – the more houses built, the more options for buyers, leading to potentially lower prices or slower price appreciation.

Conversely, delays in construction can exacerbate the existing supply shortage, pushing prices upwards. The impact of new construction is therefore directly proportional to its speed and efficiency. A significant increase in new builds could lead to a noticeable shift in the market’s equilibrium, potentially resulting in a stabilization or even a slight decrease in prices in certain areas.

Conversely, continued slowdowns in new construction would likely maintain or even increase existing price pressures.

The Influence of Building Regulations and Zoning Laws

Building regulations and zoning laws significantly impact the housing supply. Stricter regulations, while intended to ensure quality and safety, can increase construction costs and timelines, thus reducing the number of new homes available. Conversely, more lenient regulations or streamlined permitting processes can potentially boost construction activity and increase supply. For example, changes in zoning that allow for higher density developments or mixed-use projects could create more housing options in already established communities.

Conversely, overly restrictive zoning practices can limit the availability of land for development, directly affecting the market’s ability to meet demand. The interplay between regulations and supply is a complex one, often a delicate dance between preserving character and meeting the needs of a growing population. A well-balanced approach is crucial for a healthy and thriving housing market.

Investor Activity’s Role in Shaping the Market

Investor activity, a prominent force in many real estate markets, significantly impacts the Texas housing market. Large-scale investors purchasing properties, particularly for rental purposes, can reduce the number of homes available for individual buyers, thereby intensifying competition and potentially driving up prices. This can be particularly pronounced in areas experiencing rapid population growth. However, investor activity isn’t always negative.

Investors often contribute to the renovation and upkeep of properties, improving overall housing quality. Their presence also helps to maintain a consistent flow of rental properties, providing housing options for those who might not be ready to purchase a home. The net effect of investor activity is a complex issue, depending on the scale of their investment and their investment strategies.

The key is balance – a market where investors contribute to the overall health of the community without unduly impacting the ability of individual buyers to enter the market. A balanced approach, where both individual buyers and investors can thrive, is the ideal scenario. This requires careful monitoring and perhaps even some strategic policy interventions. The future of the Texas housing market depends, in part, on navigating this dynamic effectively.

Potential Scenarios for Texas Home Prices in 2025

Crystal balls are notoriously unreliable when it comes to predicting the future, especially in the rollercoaster world of real estate. However, by analyzing current trends and economic indicators, we can paint three plausible pictures of the Texas housing market in 2025. These scenarios, while not definitive, offer a range of possibilities to help you navigate the complexities ahead.

Scenario 1: Significant Price Drop

This scenario envisions a considerable decline in Texas home prices, perhaps a 10-15% drop from current levels. This dramatic shift rests on several key assumptions: a significant economic downturn, leading to widespread job losses and reduced consumer confidence; a substantial increase in housing inventory, flooding the market with available properties; and a tightening of lending standards, making mortgages harder to obtain.

Imagine a graph showing a steep downward slope for home prices, impacting first-time homebuyers positively by making homes more affordable, but severely impacting investors who purchased at peak prices. The visualization would show a stark contrast between the jubilant first-time homebuyers and the more somber faces of investors facing potential losses. This scenario mirrors, to some extent, the market corrections seen in other states following periods of rapid growth.

Think of the housing market crash of 2008, though this scenario is not predicted to be of the same magnitude.

Scenario 2: Moderate Price Drop

A more moderate decline, perhaps in the 5-10% range, is the second possibility. This scenario assumes a less severe economic slowdown, with some job losses but overall economic stability. Housing inventory would increase moderately, easing the pressure on prices but not causing a market flood. Lending standards would remain relatively accessible, though possibly with slightly higher interest rates.

Our visual representation here would show a gentler downward slope on the price graph, representing a more manageable adjustment. First-time homebuyers would still benefit from more affordable options, though not to the same extent as in Scenario 1. Investors would likely experience some losses, but less dramatic than in the previous scenario. This situation could be likened to the minor corrections the market experienced in certain Texas cities following periods of intense growth.

Scenario 3: No Significant Change

This optimistic scenario suggests that Texas home prices will remain relatively stable in 2025. This outcome hinges on a robust Texas economy, sustained job growth, and a relatively balanced supply and demand dynamic in the housing market. Interest rates would ideally remain relatively low, continuing to encourage home buying. The visual representation would be a relatively flat line on the price graph, suggesting a period of market consolidation.

First-time homebuyers might face challenges due to continuing competition, but not as severe as in a price surge scenario. Investors would maintain their positions and potentially see modest returns. This scenario reflects the resilience of the Texas economy in previous periods of national uncertainty, demonstrating the state’s unique position in the national landscape. It’s a hopeful picture, but one that requires a continuation of positive economic indicators.

External Factors Affecting the Texas Housing Market

The Texas housing market, while vibrant and dynamic, isn’t an island unto itself. Its fortunes are inextricably linked to broader national and even global economic trends, as well as unforeseen events and the ever-evolving technological landscape. Understanding these external forces is crucial for anyone navigating the Texas real estate scene, whether buyer, seller, or investor. Let’s delve into the key influences shaping the future of Texas homes.National Economic Trends and Their Ripple Effects on Texas HousingNational economic shifts, like interest rate hikes by the Federal Reserve, directly impact mortgage affordability.

Higher rates cool down buyer enthusiasm, leading to decreased demand and potentially lower prices. Conversely, periods of low interest rates, as seen in recent years, can fuel a housing boom, driving prices upward. Recessions, too, can have a chilling effect, as job losses reduce purchasing power and lenders become more cautious. The strong Texas economy often acts as a buffer, but it’s not immune to national downturns.

Think of the 2008 financial crisis; even Texas experienced a slowdown, though its recovery was relatively swift compared to other states. The health of the national economy, therefore, acts as a significant predictor of Texas housing market trends.

National Economic Impacts on Texas Housing

The interconnectedness of the U.S. economy means that a national recession, for example, could dampen the Texas housing market, even if the state’s economy remains relatively strong. Reduced consumer confidence nationwide often translates into fewer buyers in Texas, impacting demand and potentially lowering prices. Conversely, periods of robust national economic growth typically lead to increased demand and higher prices in Texas, reflecting the state’s economic vitality and its attractiveness to migrants from other parts of the country.

The impact isn’t uniform across the state; metropolitan areas tend to be more sensitive to national trends than smaller, more rural communities.

Unforeseen Events and Their Potential Impact

Texas, like any region, faces the possibility of unforeseen events that can significantly disrupt the housing market. Major natural disasters, such as hurricanes or severe droughts, can cause widespread damage, reducing housing supply and driving up prices in affected areas. The rebuilding process, while creating construction jobs, can also strain resources and lead to temporary shortages of materials and skilled labor.

Political changes, both at the state and national level, can also play a role. Significant policy shifts affecting zoning regulations, tax incentives, or immigration could influence housing demand and availability. For example, changes in immigration policy could affect the supply of labor in the construction industry and the demand for housing in certain regions.

Technological Advancements Reshaping the Texas Real Estate Landscape

Technology is revolutionizing the Texas real estate industry, impacting everything from property searches to closing processes. Online platforms offer unprecedented access to listings, empowering buyers with more information and options. Virtual tours and 3D models enhance the home-buying experience, allowing potential buyers to explore properties remotely. AI-powered tools are assisting agents in pricing properties, analyzing market trends, and even automating certain tasks.

Blockchain technology holds the promise of streamlining transactions, increasing transparency, and reducing fraud. The adoption of these technologies is ongoing, but their cumulative effect is likely to be a more efficient, transparent, and consumer-friendly real estate market. These technological advancements are not only making the process smoother but also changing the way people buy and sell homes, adding a layer of convenience and efficiency previously unimaginable.

The Texas real estate market is actively embracing these innovations, making it a forward-thinking and dynamic sector.