Navigating The US Dollar To Iranian Rial: A Comprehensive Guide

The US Dollar stands as an undeniable titan in the global financial landscape. Its pervasive influence makes it the currency most used in international transactions, a cornerstone of global trade and finance. Beyond its role as a primary reserve currency, several countries officially adopt the US Dollar as their national currency, while countless others permit its use in a de facto capacity, reflecting its universal acceptance and stability. Known colloquially as a "buck" or "greenback," its presence is felt in economies worldwide, including in the complex and often challenging financial environment of Iran.

Understanding the dynamics of the US Dollar to Iranian Rial (USD to IRR) exchange rate is not merely an academic exercise; it's a critical insight into Iran's economic realities. This relationship is shaped by a unique blend of global economic forces, geopolitical pressures, and domestic policies. For anyone looking to comprehend Iran's financial pulse, whether for business, travel, or general knowledge, delving into the intricacies of the USD to IRR conversion is essential. This article will provide a comprehensive overview, drawing on the latest available data to illuminate this crucial exchange rate.

Table of Contents

- The Global Power of the US Dollar

- Understanding the Iranian Rial and Toman

- The Dual Nature of USD to IRR Exchange Rates

- Historical Performance: USD's Strength Against the Rial

- Navigating Currency Conversion: Tools and Tips

- Factors Influencing the USD to IRR Exchange Rate

- The Future Outlook for USD to IRR

- Conclusion

The Global Power of the US Dollar

The US Dollar (USD), with its official code USD and symbol $, is more than just the currency of the United States; it is the linchpin of the international financial system. Its unparalleled liquidity, stability, and widespread acceptance make it the preferred medium for countless cross-border transactions, from commodity trading to international investments. This global dominance means that economic shifts in the US, or policy changes by the Federal Reserve, can send ripples across the world, directly impacting exchange rates and economies far beyond American borders. Many nations peg their currencies to the USD, or hold significant reserves in dollars, recognizing its role as a safe haven asset during times of global uncertainty. Its informal names, "buck" or "greenback," are recognized worldwide, underscoring its cultural as well as economic penetration. This global stature is a critical backdrop when examining its relationship with currencies like the Iranian Rial, which operates under unique domestic and international pressures.Understanding the Iranian Rial and Toman

The official currency of Iran is the Iranian Rial (IRR), represented by the code IRR and the symbol ﷼. Unlike many global currencies that are divided into smaller units (like the dollar into 100 cents), the Rial is practically divided into 0, meaning it does not have widely used smaller denominations in everyday transactions due to its significantly depreciated value. A crucial aspect of understanding currency in Iran is the distinction between the Rial and the Toman. While the Rial is the official currency, Iranians predominantly use the Toman in daily conversations and transactions. The Toman is not a separate currency but rather a unit of account, where 1 Toman is equivalent to 10 Rials. For instance, if something costs 100,000 Toman, it actually costs 1,000,000 Rials. This dual system can be confusing for foreigners but is second nature to locals. When dealing with exchange rates for the US Dollar to Iranian Rial, it's vital to clarify whether the quoted rate refers to Rials or Tomans, as a factor of ten difference is significant. Most official and online converters provide rates in Rials, but the open market often discusses prices in Tomans.The Dual Nature of USD to IRR Exchange Rates

The Iranian currency market is characterized by a unique duality: the existence of both an official exchange rate and a free or open market rate. This distinction is paramount for anyone seeking to understand the true value of the US Dollar to Iranian Rial. This situation largely stems from Iran's economic structure, international sanctions, and government policies aimed at controlling the flow of foreign currency.The Official Rate: Stability Amidst Policy

The official exchange rate, often set by the Central Bank of Iran, is typically used for specific government transactions, essential imports, and official financial reporting. This rate tends to be more stable and significantly lower than the open market rate. According to recent data, as of June 19, 2025, at 15:03 UTC, the official exchange rate stands at **1.00 USD = 42,122.915357 IRR**. This rate is very close to the reported "current exchange rate" of **42,125.0000**. An analysis of the official USD to IRR statistics over recent periods reveals a remarkable consistency:- Last 30 Days (ending around June 19, 2025): The 30-day high was 42,000.0000 IRR, and the 30-day low was also 42,000.0000 IRR. This means the 30-day average was precisely 42,000.0000 IRR, indicating a change of 0.00 over this period.

- Last 90 Days (ending around June 19, 2025): Similarly, the 90-day high for the official rate was 42,000.0000 IRR, and the 90-day low was 42,000.0000 IRR.

The Open Market Rate: Reflecting Realities

In stark contrast to the stable official rate, the open market rate for the US Dollar to Iranian Rial is highly volatile and significantly higher. This rate is what individuals and businesses typically encounter when exchanging currency in the free market, such as at exchange bureaux or informal channels. It is influenced by a multitude of factors, including supply and demand, political developments, international sanctions, inflation, and public sentiment. Recent data from Thursday, June 19, 2025, vividly illustrates this disparity: "Today, US Dollar has faced a price increase in the open market like yesterday, the price of US Dollar, which reached 905,000 yesterday with an increase of 1000 Rials, today Thursday 19 June 2025 reached 938,000 with an increase of 33,000 Rials (3.65%). The highest price of US Dollar in the last 24 hours was 938,000 Rials and the lowest price was 938,000 Rials." This information reveals several critical points:- Massive Discrepancy: The open market rate (e.g., 938,000 IRR) is orders of magnitude higher than the official rate (e.g., 42,125 IRR). This gap is a clear indicator of economic strain and currency controls.

- Volatility: The open market rate experiences significant daily fluctuations. A 33,000 Rial increase in a single day, representing a 3.65% jump, demonstrates this volatility.

- Real-World Impact: For most Iranians and visitors, this open market rate is the de facto exchange rate, impacting everything from the cost of imported goods to the value of savings.

Historical Performance: USD's Strength Against the Rial

When examining the long-term trend of the US Dollar to Iranian Rial, a clear pattern emerges: the US Dollar has consistently appreciated against the Iranian Rial over time. This trend reflects the significant economic pressures, inflation, and international sanctions that have impacted Iran's currency. Over the past 10 years, the US Dollar has appreciated a staggering **+39.84%** against the Iranian Rial. This substantial increase highlights the continuous weakening of the Rial's purchasing power relative to the dollar. In simpler terms, the US Dollar is currently much stronger than the Iranian Rial. As the data states, "1 USD is equal to 42,125 IRR" (referring to the official rate), while conversely, "1 IRR is worth 0.00002374 USD." Another data point confirms this, stating "1 IRR = 0.000024 USD Jun 17, 2025 21:00 UTC." These figures, while seemingly small, underscore the Rial's low value on the international stage. The question "Is the US Dollar up or down against the Iranian Rial?" or "Is the Iranian Rial up or down against the US Dollar?" can be answered definitively in the long run: the US Dollar has been consistently up, and the Iranian Rial consistently down, particularly in the open market where the real depreciation is felt most acutely.Analyzing Exchange Rate Charts and Data

To truly grasp the historical trajectory, currency charts are invaluable. Platforms like Xe offer "free live currency conversion charts for US Dollar to Iranian Rial," allowing users to "pair exchange rate history for up to 10 years." These "USD to IRR currency charts" provide visual representations of the fluctuations, helping to identify trends, periods of rapid depreciation, and periods of relative stability. Observing these charts reinforces the narrative of the Rial's long-term weakening against the robust US Dollar. Such tools are essential for anyone performing in-depth analysis or simply wishing to track the performance of the US Dollar to Iranian Rial over time.Navigating Currency Conversion: Tools and Tips

For anyone needing to convert amounts between the US Dollar to Iranian Rial, real-time currency converters are indispensable tools. Services offering a "universal currency converter" or a "real-time US Dollar Iranian Rial converter" provide instant access to the latest exchange rates. These tools enable you to "convert your amount from USD to IRR" or vice versa, often by simply entering the amount and clicking submit. The key advantage is that "all prices are updated in real time," ensuring you have the most current information available. Many platforms also offer "live and history US Dollar to Iranian Rial exchange rates charts" and are considered the "best USD to IRR exchange rates tool, converter." These resources are crucial for staying informed, especially given the dynamic nature of the open market rate in Iran. They also allow users to "stay updated with the latest buy and sell rates for various currencies including USD, EUR, GBP, and more." For those dealing with local transactions, some converters might even allow you to "experience seamless currency conversions with Toman as your base currency," which is highly practical for everyday use in Iran.Practical Considerations for Exchange

Beyond just knowing the rates, understanding the practicalities of currency exchange in Iran is vital. The phrase "Hold or fold as Iran risk and Fed" encapsulates the inherent volatility and risk associated with the Iranian market. Economic sanctions, geopolitical tensions, and domestic policies significantly influence the availability and cost of foreign currency. For travelers or businesses, it's crucial to be aware of the difference between the official rate (which might be encountered in very limited, specific government-controlled transactions) and the open market rate (which is the realistic rate for most cash exchanges). Accessing "live Iranian Rial (IRR) exchange rates and gold price in Iran's free market" is often the most reliable way to gauge the actual value of your money. Always verify the current rates from multiple reliable sources before conducting any significant exchange. Due to the complexities, carrying cash (USD or EUR) and exchanging it locally at reputable exchange offices is often the most practical approach for visitors, as international credit and debit cards generally do not function in Iran due due to sanctions.Factors Influencing the USD to IRR Exchange Rate

The exchange rate between the US Dollar to Iranian Rial is not static; it is a sensitive barometer of various intertwined factors, both domestic and international. Understanding these influences is key to comprehending the Rial's persistent depreciation and the volatility of the open market rate.- International Sanctions: Perhaps the most significant factor, sanctions imposed by the US and other international bodies severely restrict Iran's access to global financial systems and its ability to sell oil and other commodities. This limits the inflow of foreign currency, particularly US dollars, into the country, creating scarcity and driving up the dollar's value in the open market.

- Oil Prices and Exports: As a major oil producer, Iran's economy is heavily reliant on oil revenues. Fluctuations in global oil prices directly impact the amount of foreign currency the government earns. Lower oil prices or reduced export capacities due to sanctions mean less foreign currency entering the system, putting downward pressure on the Rial.

- Government Economic Policies: Domestic policies, including monetary policy (e.g., interest rates, money supply), fiscal policy (e.g., government spending, budget deficits), and currency controls, play a crucial role. Attempts to fix or artificially support the Rial, while creating an official rate, often lead to a thriving black market where the true economic pressures are reflected.

- Inflation: Iran has historically grappled with high inflation. When the cost of goods and services within Iran rises rapidly, the purchasing power of the Rial diminishes, leading to its depreciation against more stable currencies like the US Dollar.

- Geopolitical Developments: Regional tensions, international diplomatic relations, and domestic political stability can all have a profound impact on investor confidence and capital flight, directly affecting the demand for and supply of foreign currency. News related to the Joint Comprehensive Plan of Action (JCPOA) or other diplomatic efforts often causes immediate shifts in the open market rate.

- Public Confidence: Public sentiment and expectations about the economy and the future value of the Rial can also drive its depreciation. If people anticipate further weakening of the Rial, they may rush to convert their savings into more stable assets like gold or foreign currency, exacerbating the depreciation.

The Future Outlook for USD to IRR

Predicting the future trajectory of the US Dollar to Iranian Rial exchange rate is inherently challenging, given the multitude of variables at play. The dual exchange rate system is likely to persist as long as significant international sanctions remain in place and the Iranian government continues its current economic management strategies. Any significant shift in the USD to IRR rate would largely depend on major geopolitical developments, such as a breakthrough in nuclear negotiations leading to the lifting of sanctions, or a drastic change in Iran's domestic economic policies. Should sanctions be eased, a greater influx of foreign currency from oil exports and international trade could potentially strengthen the Rial in the open market, narrowing the gap between the official and unofficial rates. Conversely, increased tensions or stricter sanctions would likely lead to further depreciation of the Rial. Domestically, the government's ability to control inflation and manage its budget will also be critical. High inflation will continue to erode the Rial's value, pushing the open market rate higher. For the foreseeable future, the US Dollar to Iranian Rial relationship will remain a key indicator of Iran's economic health and its integration (or lack thereof) with the global economy. Individuals and businesses engaging with the Iranian market will need to remain vigilant, relying on real-time data and expert analysis to navigate its complexities.Conclusion

In conclusion, the relationship between the US Dollar to Iranian Rial is a microcosm of Iran's broader economic and geopolitical landscape. The US Dollar, as the world's leading reserve currency, maintains its strength, while the Iranian Rial faces persistent challenges, evident in its long-term depreciation and the significant disparity between its official and open market exchange rates. As of June 2025, the official rate hovers around 42,000 Rials to the dollar, a stark contrast to the volatile open market rate which recently saw the dollar trade at 938,000 Rials. This dual system, coupled with factors like international sanctions, oil prices, and domestic policies, creates a complex environment for currency exchange. For anyone involved with Iran, whether as a traveler, investor, or simply an observer, understanding these nuances and utilizing reliable, real-time currency converters is absolutely essential. The historical trend clearly shows the dollar's appreciation against the rial, a testament to the ongoing economic pressures. We hope this comprehensive guide has shed light on the intricate dynamics of the US Dollar to Iranian Rial exchange rate. What are your thoughts on the future of the Rial? Have you had experiences with currency exchange in Iran? Share your insights in the comments below! If you found this article informative, please consider sharing it with others who might benefit, and explore our other articles for more in-depth economic analyses.

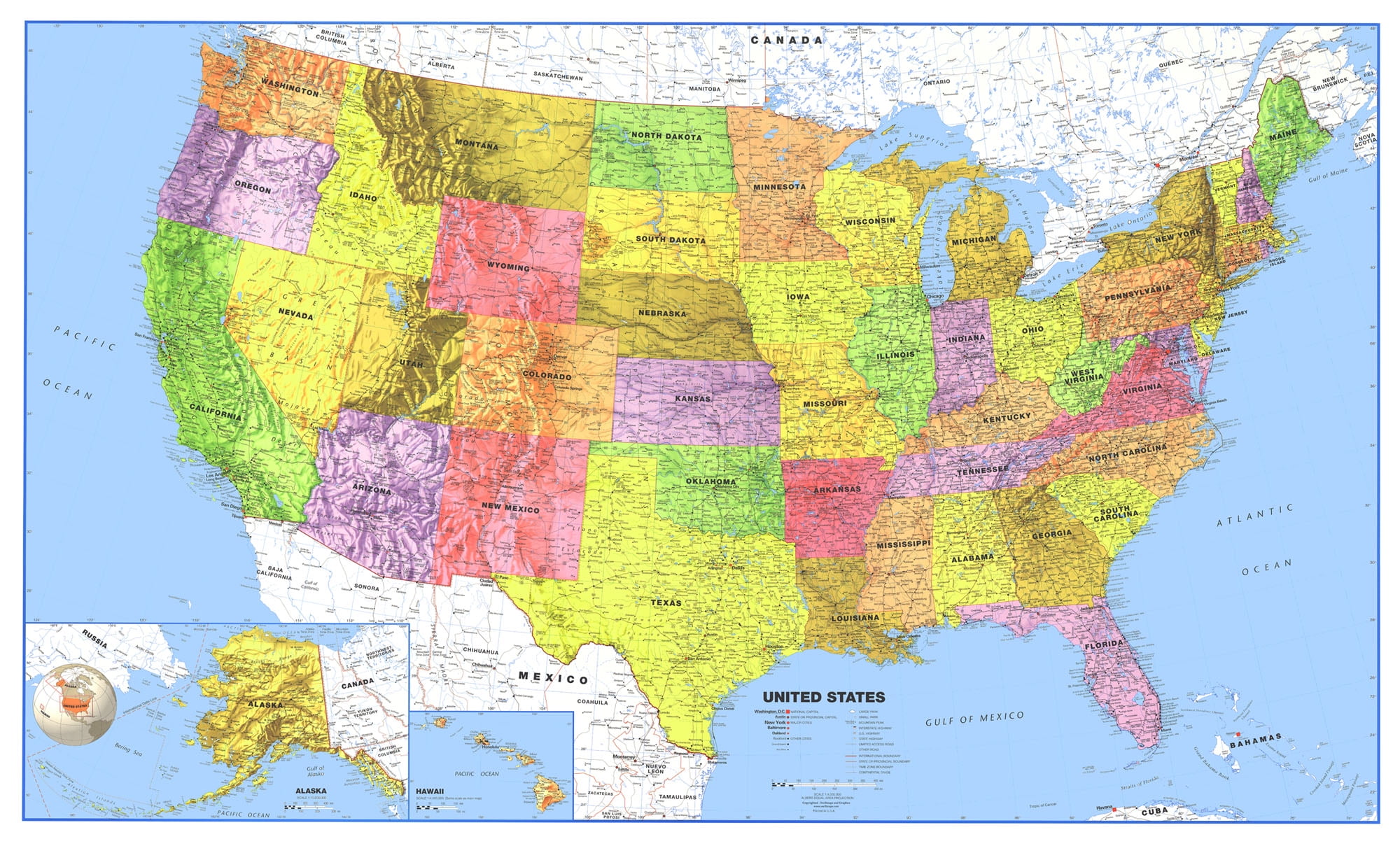

USA Map. Political map of the United States of America. US Map with

United States Map Maps | Images and Photos finder

Mapas de Estados Unidos - Atlas del Mundo