Unveiling Iran's Secret Oil Trade: Funding Wars & Evading Sanctions

For years, the international community has grappled with the complex challenge of Iran's nuclear ambitions and its support for proxy groups across the Middle East. Despite a formidable web of sanctions designed to cripple its economy, Tehran continues to project significant power and fund conflicts, from the ongoing war in Ukraine to the devastating attacks by Hamas in Israel. The persistent question remains: how does Iran manage to finance these costly endeavors? The answer lies deep within a clandestine, sophisticated, and sprawling network: inside the secret oil trade that funds Iran's wars.

Many assume that, after years of stringent sanctions, Iran would struggle immensely to secure the necessary funds for its military and political objectives. However, this assumption drastically underestimates Iran's ingenuity and its determination to circumvent international pressure. Far from being isolated, Iran has built a roaring global trade for its oil, funneling tens of billions of dollars annually from illicit oil sales into bank accounts worldwide. This vast, secret treasure is not merely a lifeline for the regime; it is the very lifeblood that fuels its geopolitical ambitions, enabling it to arm militias, develop its nuclear program, and destabilize regions far beyond its borders.

Table of Contents

- The Sanctions Paradox: How Iran Funds Its Wars

- Sahara Thunder: Peeling Back the Layers of Secrecy

- Iran's Dark Fleet: The Lifeline to China

- Funding Global Conflict: From Hamas to Ukraine

- The Economist's Unraveling: Investigative Journalism at its Core

- Decentralization of Oil Sales: A New Evasion Tactic

- The Human Element: Accidental Leaks and Vigilance

- The Broader Implications of Illicit Trade

The Sanctions Paradox: How Iran Funds Its Wars

The international community has long relied on economic sanctions as a primary tool to curb Iran's controversial activities. The premise is straightforward: cut off financial lifelines, and the regime will be forced to change its behavior. Yet, the reality on the ground paints a different picture. In the face of stringent sanctions, Iran has managed to fund wars and arm militias, proving remarkably resilient. Many assume that, after years of sanctions, it would struggle to maintain its regional influence, let alone expand it. This paradox highlights the sophisticated, often invisible, mechanisms Iran employs to generate revenue.

While the exact figures are shrouded in secrecy, intelligence estimates and investigative reports suggest that Iran's illicit oil sales contribute significantly to its national budget. This revenue stream is not merely for day-to-day governance; it directly underwrites the regime's most controversial and destabilizing foreign policy objectives. The ability to circumvent sanctions demonstrates a level of strategic planning and adaptability that challenges conventional wisdom about the effectiveness of economic pressure alone. It forces a deeper look into the operational intricacies of this shadow economy, particularly the crucial role of the secret oil trade that funds Iran's wars.

A Global Network of Illicit Finance

Every year, Iran funnels tens of billions of dollars from illicit oil sales to bank accounts all over the world. This isn't a haphazard operation; it's a meticulously constructed global network designed to obscure the origin of funds and bypass financial oversight. Shell companies, front organizations, and a complex web of intermediaries are used to facilitate transactions, making it incredibly difficult for international bodies to trace the money. The sheer volume of these transactions underscores the scale of this financial architecture, which stretches across continents, involving players in various jurisdictions, often with lax financial regulations.

This elaborate system allows Iran to convert its crude oil, a commodity vital to global energy markets, into liquid assets that can be deployed to support its proxies and strategic initiatives. The funds are then used for a wide array of purposes, from purchasing advanced weaponry and drone technology to providing financial aid to groups like Hezbollah in Lebanon, the Houthis in Yemen, and various militias in Iraq and Syria. Understanding the breadth and depth of this financial web is crucial to comprehending how Iran maintains its operational capabilities despite being largely cut off from legitimate international banking systems.

Sahara Thunder: Peeling Back the Layers of Secrecy

One of the most significant breakthroughs in understanding Iran's clandestine financial operations came through an extraordinary leak. Inside the secret operations of Iranian company Sahara Thunder, revealed and visually reconstructed from more than 10,000 leaked emails, a detailed picture emerged of how Iran conducts its illicit oil trade. This wasn't just a glimpse; it was a deep dive into the inner workings of a key player in Iran's shadow economy, exposing the names, methods, and sheer audacity of those involved in bypassing international sanctions. The sheer volume of data provided an unprecedented level of detail, allowing investigators to connect the dots in a way that was previously impossible.

Sahara Thunder, as revealed by the leaked documents, appears to be a central cog in Iran's machinery for oil sales and revenue generation. Its operations highlight the intricate logistical and financial maneuvers required to move vast quantities of crude oil across international waters, process payments, and ultimately transfer funds back to Tehran or its designated beneficiaries. The revelations from Sahara Thunder's internal communications provided concrete evidence of how the secret oil trade that funds Iran's wars operates on a day-to-day basis, detailing everything from shipping routes to payment methods.

The Digital Footprint: Leaked Emails as Evidence

The "10,000 leaked emails" from Sahara Thunder were a goldmine for investigators. In an age where digital communication is ubiquitous, even clandestine operations leave a digital footprint. These emails provided a rare, unfiltered look into the operational details of Iran's oil smuggling. They contained discussions about tanker movements, fake shipping documents, payment arrangements, and the constant cat-and-mouse game played with international surveillance. The visual reconstruction of these operations, based on the email data, allowed for a clearer understanding of the physical and financial pathways used to move Iran's oil.

Such a massive data leak is incredibly rare and offers invaluable intelligence. It allowed analysts to check and verify what they were told by other sources, and flesh out the detail, building a comprehensive picture of the network. This level of transparency into a highly secretive world is a testament to the power of investigative journalism and the vulnerabilities inherent even in the most carefully guarded operations. The insights gained from these emails have been instrumental in understanding the scale and sophistication of the secret oil trade that funds Iran's wars.

Iran's Dark Fleet: The Lifeline to China

A crucial component of Iran's illicit oil trade is its "dark fleet" of oil tankers. These vessels operate under the radar, often turning off their transponders or manipulating their Automatic Identification System (AIS) signals to avoid detection. Iran's dark fleet of oil tankers clandestinely delivers crude to China, which has emerged as Tehran's most significant partner in this illicit trade. China's insatiable demand for energy, coupled with its willingness to purchase discounted oil, makes it an ideal destination for Iran's sanctioned crude. This relationship is a cornerstone of Tehran's economy, providing a consistent, albeit risky, revenue stream.

The journey of these tankers is fraught with peril. They navigate treacherous waters, constantly aware of international efforts to track and interdict their shipments. The risks include seizure, blacklisting, and severe penalties for those involved. Yet, the economic imperative for Iran, and the financial incentives for the buyers, outweigh these dangers, ensuring the continued operation of this shadow shipping industry. The sheer volume of oil flowing through this pipeline is staggering, demonstrating the critical role China plays in sustaining Iran's financial architecture.

The Economics of Evasion: Discounts and Risks

The clandestine nature of this trade comes at a significant cost for Iran. To entice buyers, particularly China, Iran offers substantial discounts on its crude oil, often well below the international benchmark prices like West Texas Intermediate crude, a U.S. benchmark. These discounts are necessary to compensate buyers for the inherent risks associated with purchasing sanctioned oil, including potential secondary sanctions, reputational damage, and the logistical complexities of handling illicit cargo. The lower price point also makes Iranian oil highly attractive, especially to economies looking for cheaper energy sources.

Beyond the discounts, Iran also faces high operational costs and risks associated with maintaining its dark fleet and the elaborate network of intermediaries. Insurance premiums are exorbitant or non-existent, maintenance is difficult to arrange openly, and the constant need to evade surveillance adds layers of expense and complexity. Despite these challenges, the trade remains highly profitable for Tehran, underscoring the vast margins involved in legitimate oil sales and the lengths to which Iran is willing to go to secure its funding. The economic calculations behind this evasion strategy reveal a pragmatic approach to survival and power projection.

Funding Global Conflict: From Hamas to Ukraine

The revenue generated from this huge, secret treasure is not merely theoretical; it has tangible, devastating consequences across the globe. This money was used to fund Hamas’s attack on Israel a year ago, an event that plunged the region into renewed conflict and tragically cost thousands of lives. The precision and scale of that assault required significant financial backing, and Iran's illicit oil sales provided a substantial portion of it. This direct link between oil revenue and acts of terror highlights the urgent need to disrupt these financial flows.

Beyond the Middle East, Iran's illicit oil funds also support swarms of Russian drones in Ukraine. Tehran has become a key supplier of advanced drone technology to Moscow, playing a significant role in the ongoing conflict. This strategic alliance demonstrates Iran's willingness to leverage its financial power to support its allies and challenge Western interests globally. Furthermore, a portion of these funds is allocated to Iran’s own nuclear program, a highly sensitive issue that continues to be a major point of contention with the international community. The ability to self-finance such a program, despite sanctions, underscores the effectiveness of Iran's shadow economy and the critical importance of understanding inside the secret oil trade that funds Iran’s wars.

The Economist's Unraveling: Investigative Journalism at its Core

Much of the detailed understanding of Iran's illicit oil trade stems from rigorous investigative journalism. An investigation by The Economist unravels the illicit oil sales that fill the country’s coffers, providing unparalleled insights into the mechanisms, key players, and financial flows. This type of deep-dive reporting is essential for shedding light on opaque systems that governments and international bodies struggle to penetrate. The Economist's commitment to exposing these truths, often through painstaking analysis of leaked documents and interviews, serves as a vital public service.

For those interested in understanding the nuances of global politics, business, science, and technology, resources like The Economist's podcasts offer invaluable perspectives. Listening to what matters most, from global politics and business to science and technology—subscribing to Economist podcasts+ can provide continuous updates and expert analysis on complex topics like Iran's shadow economy. Such platforms play a crucial role in disseminating information and fostering informed public discourse, which is vital for holding powerful entities accountable and for developing effective policy responses to challenges like the secret oil trade that funds Iran's wars.

Decentralization of Oil Sales: A New Evasion Tactic

In a strategic shift to further complicate sanctions enforcement, Iran has begun to decentralize its oil sales operations. Initially, the trade was likely managed by a more centralized entity, but now, an increasing volume of oil is allocated to ministries, religious institutions, and even pension funds, allowing them to sell oil independently. This move serves multiple purposes: it broadens the network of actors involved, making it harder to track and sanction all participants; it creates internal competition, potentially boosting efficiency; and it distributes the risk across a wider array of entities, making the overall system more resilient to external pressure.

This decentralization represents an evolution in Iran's evasion tactics. By empowering various state-affiliated and quasi-private entities to engage directly in oil sales, Tehran is effectively creating a multi-headed hydra, where cutting off one channel does not cripple the entire operation. This approach leverages existing institutional structures within Iran, blurring the lines between state-controlled and ostensibly independent economic activities. It further complicates the efforts of international bodies to pinpoint and disrupt the flow of funds, making the task of dismantling the secret oil trade that funds Iran's wars even more challenging.

The Human Element: Accidental Leaks and Vigilance

Despite the sophisticated nature of Iran's illicit operations, the human element remains a critical factor, both as a vulnerability and a source of insight. If you’ve ever felt bad about making a mistake at work, just imagine being the analyst that accidentally messes up the Iranian oil smuggling ledger spreadsheet and saves over the last version. Such seemingly minor errors can have massive consequences, potentially exposing entire networks or providing crucial leads to investigators. While this specific scenario might be hypothetical, it underscores the constant risk of human error in highly sensitive operations, even those designed for maximum secrecy.

Conversely, human sources, whistleblowers, and dedicated intelligence analysts are often the ones who uncover these intricate schemes. The painstaking work of piecing together fragmented information, cross-referencing data, and verifying claims is essential. It's a continuous battle of wits between those trying to hide and those trying to expose. The vigilance of intelligence agencies, financial crime units, and investigative journalists is paramount in identifying and disrupting the flow of funds that fuel Iran's regional and global ambitions. The insights gained from these efforts are vital in understanding and combating inside the secret oil trade that funds Iran's wars.

The Broader Implications of Illicit Trade

The existence and persistence of Iran's secret oil trade have far-reaching implications beyond just funding its military and nuclear programs. It undermines the global sanctions regime, setting a precedent that other rogue states might seek to emulate. It distorts international oil markets by introducing discounted, untraceable crude, affecting legitimate producers and traders. Furthermore, it fosters a culture of illicit finance, potentially empowering criminal networks and making it harder to combat money laundering and terrorist financing worldwide.

The resilience of this trade also raises questions about the effectiveness of current international policies and the need for more coordinated and innovative approaches to sanctions enforcement. It highlights the importance of intelligence gathering, financial forensics, and international cooperation to identify and dismantle these complex networks. As long as Iran can generate substantial revenue from its illicit oil sales, its capacity to project power and destabilize regions will remain largely unchecked. Addressing this challenge requires a comprehensive strategy that targets not only the physical movement of oil but also the intricate financial architecture that supports it, ensuring that the world truly understands inside the secret oil trade that funds Iran's wars.

Conclusion

The narrative of Iran as an isolated nation, crippled by sanctions, is a dangerous oversimplification. As revealed by extensive investigations and leaked documents, Iran has meticulously constructed a robust and resilient shadow economy, primarily driven by its secret oil trade. This clandestine network, involving a "dark fleet" of tankers, sophisticated financial maneuvers, and a willingness to operate in the gray areas of international law, generates tens of billions of dollars annually. This immense wealth is then channeled to fund its proxies, like Hamas, support allies like Russia in Ukraine, and advance its controversial nuclear program, directly contributing to global instability.

The insights provided by sources like The Economist and the unprecedented leak from Sahara Thunder offer a critical understanding of how Iran circumvents sanctions and maintains its geopolitical leverage. It underscores the urgent need for enhanced international cooperation, more sophisticated enforcement mechanisms, and continuous vigilance to disrupt these illicit financial flows. Understanding the intricacies of inside the secret oil trade that funds Iran's wars is not merely an academic exercise; it is essential for fostering global security and stability. What are your thoughts on the effectiveness of current sanctions, and what more do you believe can be done to dismantle this secret trade? Share your insights in the comments below, and consider sharing this article to help shed more light on this critical issue.

- Weather Rasht Gilan Iran

- Crown Prince Of Iran

- Iran Revolutionary

- Qajar Iran

- United States And Iran Conflict

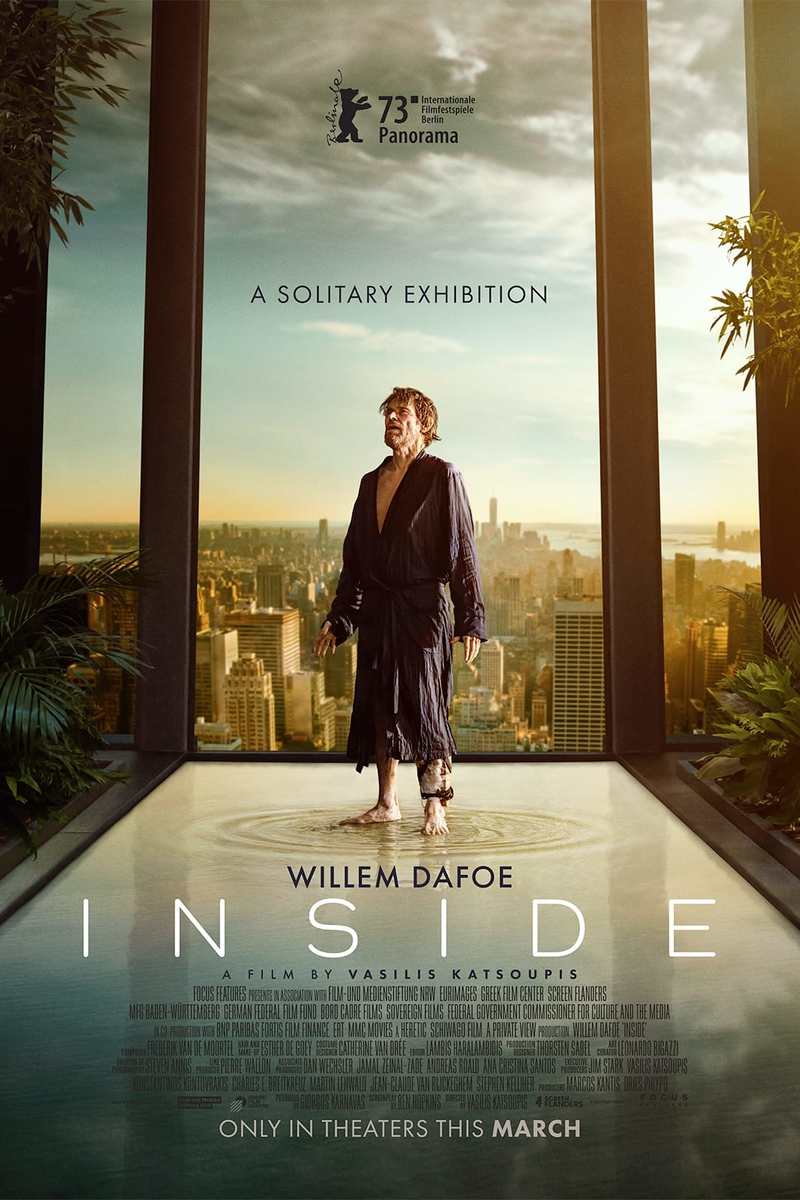

Inside | Movie fanart | fanart.tv

Inside DVD Release Date May 30, 2023

INSIDE (2016) Fan Theories (WMG) - TV Tropes