Decoding US Imports From Iran: A Sanctions-Driven Landscape

The complex and often opaque nature of trade relations between the United States and Iran is a topic of significant geopolitical and economic interest, particularly when examining imports from Iran to US. This relationship is primarily shaped by a dense web of international sanctions, making direct trade flows highly restricted and challenging to track. Understanding the dynamics of these imports requires delving into historical data, specific commodity flows, and the pervasive impact of these sanctions on economic interactions.

This article aims to shed light on the limited yet notable instances of goods entering the US from Iran, exploring the types of products involved, the legal frameworks governing such transactions, and the broader context of a relationship defined more by restrictions than by robust commerce. We will draw upon available economic data and expert insights to paint a clearer picture of this unique trade corridor.

Table of Contents

- A Historical Glimpse: US Imports from Iran (1985-Present)

- The Shadow of Sanctions: Navigating Legal Complexities

- Unpacking the Numbers: Recent Trade Figures

- The Oil Factor: A Diminished Flow

- Broader US Trade Landscape: A Contrast

- Geopolitical Tensions and Trade Outlook

- Expert Insights and Data Reliability

- Conclusion

A Historical Glimpse: US Imports from Iran (1985-Present)

The economic relationship between the United States and Iran has undergone dramatic shifts since the mid-1980s. Historically, the US was a significant importer of Iranian oil and other goods. However, the imposition of various sanctions regimes, particularly intensified after the Iranian Revolution and further tightened over concerns about Iran's nuclear program and support for terrorism, has severely curtailed this trade. Economic data for U.S. imports of goods by customs basis from Iran (imp5070) from January 1985 to April 2025 reveals a trajectory marked by sharp declines and periods of near-total cessation of direct trade. This long-term dataset, which focuses on goods, provides a critical backdrop for understanding the current landscape of imports from Iran to US. It's important to note that the table reflects only those months for which there was actual trade, underscoring the sporadic and often minimal nature of these transactions over the decades. The figures, always in millions of U.S. Dollars on a nominal basis and not seasonally adjusted unless specified, highlight the dramatic impact of political decisions on economic flows.

The Shadow of Sanctions: Navigating Legal Complexities

Perhaps the most defining characteristic of any discussion regarding imports from Iran to US is the pervasive influence of international sanctions. These restrictions are not merely economic deterrents; they are complex legal frameworks that demand meticulous attention from anyone considering trade. Before importing, it is absolutely crucial to understand the sanctions relevant to Iran and determine if your desired products are subject to restrictions. The penalties for non-compliance can be severe, ranging from hefty fines to imprisonment.

For this reason, seeking legal counsel is not just advisable but often a necessity. Expert legal guidance can help navigate the intricate web of regulations, which are frequently updated and can be highly nuanced. In some cases, specific licenses may be required to import goods from Iran legally, even for categories that might otherwise seem permissible. These prohibitions are broad, applying to transactions by United States persons in locations outside the United States with respect to goods or services which are of Iranian origin or are owned or controlled by the Government of Iran. This means that even if a transaction occurs entirely outside US borders, a US person involved could still be in violation. Furthermore, persons may not import such goods or services into or export them from foreign locations if they originate from or are controlled by the Iranian government. This comprehensive approach to sanctions effectively creates a formidable barrier to any significant imports from Iran to US.

Unpacking the Numbers: Recent Trade Figures

Given the stringent sanctions, the volume of direct trade, particularly imports from Iran to US, remains remarkably low. According to the United Nations Comtrade database on international trade, Iran's exports to the United States were valued at a mere US$112.71 thousand during 2022. This figure underscores the effectiveness of the sanctions in stifling direct commercial ties. To put this into perspective, the United States' total exports were valued at US$2.06 trillion, and in 2024, the United States had a trade deficit of US$1.29 trillion, highlighting just how minuscule the trade with Iran is in the grand scheme of US global commerce.

- Oliver North Iran Contra Affair

- Irans Allies

- Traditional Iran Clothes

- Iran In The 70s Vs Now

- American Hostages In Iran 1979

However, another data point offers a slightly different perspective, though still within the context of extremely limited trade. Tasnim News Agency reported, citing the latest statistics released by the American Statistical Association (ASA), that imports from Iran stood at $50.5 million in the first 11 months of 2023, registering a 12 percent rise compared to the previous year’s same period. This figure, while significantly higher than the UN Comtrade data for 2022, still represents a fractional amount of overall US imports. The discrepancy between the UN Comtrade data and the Tasnim/ASA report could stem from various factors, including different reporting methodologies, the inclusion of specific, narrowly defined categories of goods, or even indirect trade routes that eventually get attributed. It is crucial for readers to understand that due to the international sanctions, pinpointing exact and consistent figures for imports from Iran to US can be challenging, and various sources may present data based on different scopes or definitions.

Beyond the Headlines: The Case of Nuts and Dried Fruits

One specific category that occasionally garners attention in discussions about imports from Iran to US is nuts and dried fruits. The US imported approximately $360 million worth of nuts and dried fruits in 2023. While this is a substantial figure for this commodity group, it is critical to understand that this represents the total US import of these items from all global sources. Due to international sanctions, it’s exceptionally difficult to pinpoint the exact amount sourced directly from Iran within this total. Historically, Iran has been a significant producer of pistachios and other dried fruits, and while direct trade is heavily restricted, some Iranian-origin products might find their way to international markets through third countries, making their ultimate origin difficult to trace for official import statistics into the US. This highlights the complexity of tracking goods in a sanctions environment, where direct official channels are largely closed.

The Oil Factor: A Diminished Flow

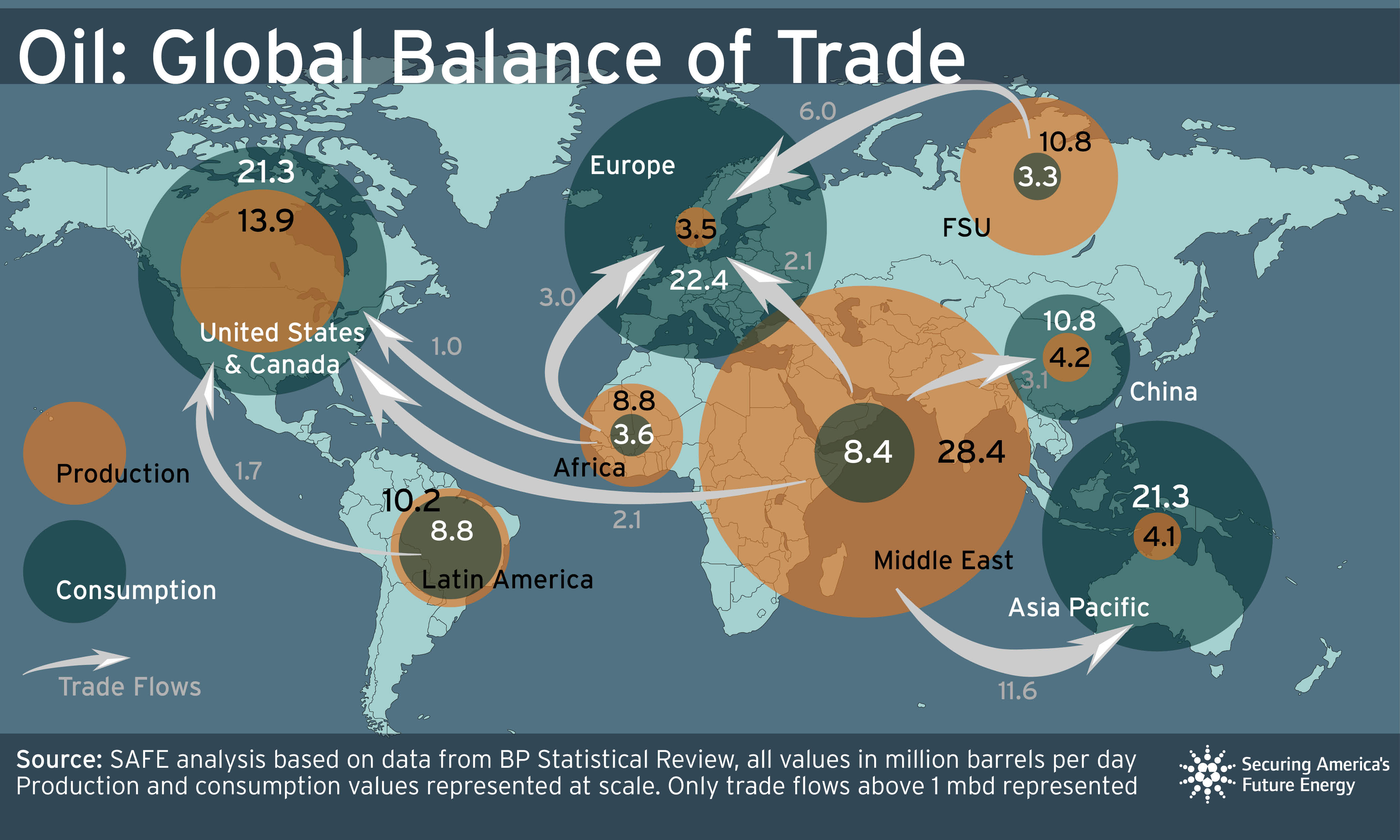

Historically, crude oil was the primary commodity defining imports from Iran to US. However, this has dramatically changed. US crude oil imports measures the monthly number of barrels imported from Iran to the United States, with numbers released by the EIA (Energy Information Administration) providing insights into this highly sensitive sector. The data clearly illustrates the severe impact of sanctions on this trade. For instance, US crude oil import from Iran was at a current level of 752 thousand barrels in October 2023. While this might seem like a substantial number on its own, it represents a tiny fraction of the overall US oil imports, which primarily come from Canada, Mexico, and Saudi Arabia. For context, a chart shows oil imports from Iran in March 2019 (barrels per day), illustrating how even in recent years, these imports have been sporadic and subject to the prevailing geopolitical climate and sanction waivers, which have largely been removed.

The comprehensive nature of sanctions means that imports from Iran of crude oil and petroleum products (measured in thousand barrels per day) have been reduced to negligible levels across most months in recent years. The intent of these sanctions is to cut off Iran's primary source of revenue, thereby pressuring its government to alter its policies. This strategic objective has largely been achieved, making direct Iranian oil a rare sight in US refineries.

Strategic Petroleum Reserve and Oil Imports

It's important to clarify that when discussing US crude oil imports, the figures often include imports for storage in the Strategic Petroleum Reserve (SPR). The SPR is the world's largest supply of emergency crude oil, maintained by the US Department of Energy. While the SPR is designed to mitigate supply disruptions, any crude oil from Iran would only enter this reserve if specific, highly exceptional circumstances or waivers were in place, which is not the current operational norm given the sanctions. The inclusion of SPR data in overall import figures is a standard statistical practice, but it does not imply ongoing, significant imports of Iranian oil for strategic reserves under the current sanctions regime. Totals in such reports may not always equal the sum of components due to independent rounding, a common statistical caveat for large datasets.

Broader US Trade Landscape: A Contrast

To fully appreciate the limited scope of imports from Iran to US, it’s useful to place it within the context of the broader United States trade landscape. The US is a global trading powerhouse, with total exports valued at US$2.06 trillion. In 2024, the United States had a trade deficit of US$1.29 trillion, reflecting its vast appetite for imported goods. The United States' main import partners include major economies like China, Mexico, Canada, and various European nations, from whom it imports a diverse range of products. The top three import commodities for the US are typically electrical and electronic equipment, vehicles (other than railway and tramway), and machinery.

This stark contrast highlights the degree to which Iran has been isolated from the mainstream US economy. While the US engages in trillions of dollars worth of trade annually with countries across the globe, the direct trade with Iran, particularly imports from Iran to US, registers in the thousands or low millions of dollars, primarily due to the comprehensive sanctions. This economic isolation is a direct consequence of long-standing political and security concerns, making Iran a unique case in US trade policy.

Geopolitical Tensions and Trade Outlook

The already constrained trade relationship between the US and Iran is perpetually overshadowed by escalating geopolitical tensions in the Middle East. Recent developments, such as Israel launching airstrikes targeting sites in Iran, including facilities central to Tehran's nuclear program, underscore the volatility of the region. While Iran's energy export infrastructure has so far been largely spared in direct military confrontations, the mere threat of escalation has profound implications for global energy markets and, by extension, any potential for increased imports from Iran to US.

For instance, the possibility of a wider conflict raises concerns about oil supply disruptions. China, for example, could face major oil supply disruptions if war between Israel and Iran escalates further, as Beijing remains heavily reliant on crude oil imports from the Middle East, much of which transits through vulnerable choke points. While this directly impacts China, it indirectly affects global oil prices and supply chains, further solidifying the US stance on limiting oil imports from Iran to maintain pressure and avoid contributing to a volatile revenue stream. The political climate remains the primary determinant of trade policy, far outweighing any commercial incentives.

The Future of Trade: A Sanctions-Bound Horizon

Looking ahead, the future of imports from Iran to US appears to remain tightly bound by the existing sanctions regime. Significant changes in trade volume or commodity types are highly unlikely without a fundamental shift in geopolitical relations and a re-evaluation of the sanctions by the US government. Any easing of restrictions would likely be contingent on Iran's adherence to international agreements, particularly concerning its nuclear program, and a de-escalation of regional tensions. Until such a shift occurs, the trade corridor will remain largely closed, with only minimal, highly specific, and legally permissible imports finding their way into the US market. The current data from the United States and around the world relating to economic and political issues consistently points to a prolonged period of limited direct trade.

Expert Insights and Data Reliability

When analyzing imports from Iran to US, it's vital to rely on credible sources and understand the inherent challenges in data collection. Economic data for U.S. imports of goods by customs basis from Iran (imp5070) from various governmental and international bodies, such as the EIA and the United Nations Comtrade database, provides the most authoritative insights. These organizations employ rigorous methodologies to collect and disseminate trade statistics, adhering to international standards. However, it's also important to acknowledge that all figures are in millions of U.S. Dollars on a nominal basis and are not seasonally adjusted unless otherwise specified. Details may not equal totals due to rounding, a common statistical practice that can lead to minor discrepancies when comparing aggregated data. Furthermore, the table reflects only those months for which there was trade, meaning periods of zero trade are often simply omitted, which can make long-term trend analysis challenging without the full context.

The presence of sanctions adds another layer of complexity. The illicit nature of some trade, or trade routed through third countries to obscure origin, means that official statistics may not capture the entire picture. This necessitates a cautious approach when interpreting figures and a reliance on multiple sources to triangulate information. For instance, while the EIA provides data on US crude oil imports, the broader context of global oil markets and geopolitical events is often provided by news agencies like Tasnim News Agency, which may cite local statistical associations like the American Statistical Association (ASA) for specific figures.

Understanding the Data Caveats

To ensure a robust understanding of imports from Iran to US, it's crucial to be aware of the caveats associated with trade data. For example, when examining crude oil imports, it's noted that crude oil includes imports for storage in the Strategic Petroleum Reserve. While important for national energy security, these specific transactions might not reflect ongoing commercial demand for Iranian oil. Similarly, discrepancies between different databases, such as the UN Comtrade and reports from national statistical agencies, can arise from varying classification systems, reporting thresholds, or the inclusion/exclusion of specific types of transactions (e.g., re-exports, transit trade). Always refer to the definitions, sources, and notes provided by the data publishers for more comprehensive information on any given table or dataset. This critical approach ensures that the insights drawn are as accurate and trustworthy as possible, reflecting the true, albeit limited, nature of imports from Iran to US.

Conclusion

The landscape of imports from Iran to US is undeniably shaped by a complex interplay of historical factors, stringent sanctions, and ongoing geopolitical tensions. While once a significant trading partner, particularly in the energy sector, Iran's direct economic interaction with the United States has been reduced to minimal levels. Current data indicates that direct imports are extremely low, with only niche categories like certain agricultural products potentially finding their way into the US market, often through indirect channels or under specific, limited exemptions.

The pervasive nature of US sanctions means that any individual or entity considering imports from Iran must navigate a highly restrictive legal environment, often requiring specialized legal counsel and specific licenses. The future of this trade relationship remains firmly tied to political developments, with any significant increase in imports from Iran to US contingent on major policy shifts and a de-escalation of regional conflicts. For those interested in the intricate dynamics of international trade and sanctions, this unique case offers a compelling study. We encourage you to share your thoughts in the comments below or explore our other articles on international trade and economic sanctions for further insights.

US Penalizes Chinese Companies for Aiding Iran’s Oil Exports - The New

US Petroleum Use, Production, and Import-Export from the EIA | Energy Blog

The Fuse | Europe's Oil Import Dilemma