Importing To Iran: Unlocking Opportunities In A Dynamic Market

Iran, with its strategic location at the crossroads of Asia and Europe, coupled with a vast domestic market of over 80 million people, stands as a significant player in international trade. For businesses eyeing expansion into new territories, understanding the intricacies of importing to Iran is not just beneficial—it's absolutely crucial. This comprehensive guide aims to demystify the process, offering insights into the regulatory landscape, essential documentation, and best practices for successfully navigating this unique and promising market.

The nation's rich history and diverse economy present promising opportunities for businesses worldwide, yet its import regulations demand meticulous attention to detail and unwavering compliance with applicable laws. While the prospect of importing goods into Iran can seem daunting due to its complex regulatory landscape and geopolitical considerations, it can indeed be a highly lucrative venture for those prepared to undertake the necessary due diligence. By grasping the market opportunities, adhering strictly to regulatory requirements, and adopting proven best practices, businesses can effectively tap into Iran's dynamic and ever-evolving market.

Table of Contents

- The Allure of the Iranian Market

- Understanding Iran's Regulatory Framework

- Essential Documentation for Importing to Iran

- Navigating Iranian Customs Procedures

- The Cost of Importing Goods to Iran

- Iran's Top Imports and Trading Partners

- Best Practices for Successful Importing to Iran

- Tracking and Logistics in Iranian Imports

The Allure of the Iranian Market

Iran is not merely a country; it is a civilization with a deep-rooted trading heritage and a significant economic footprint. Its strategic geographic position, acting as a bridge between East and West, makes it an attractive hub for trade and investment. The sheer size of its population, coupled with a growing middle class, translates into substantial consumer demand for a wide array of goods. Furthermore, Iran’s economy is diverse, encompassing significant sectors like oil and gas, agriculture, manufacturing, and services, all of which require various imported components, machinery, and finished products.

While often perceived as challenging due to international sanctions and complex regulations, the underlying market potential for businesses committed to the venture remains undeniable. The demand for specific goods, as evidenced by its top imports, highlights areas where foreign businesses can find a strong foothold. This inherent demand, combined with Iran's drive for self-sufficiency and modernization, creates a unique environment for those looking to engage in importing to Iran.

Understanding Iran's Regulatory Framework

At the heart of successful importing to Iran lies a thorough understanding of its regulatory framework. Iran's import and export regulations are primarily governed by the Export and Import Regulations Act, alongside a comprehensive Customs Law. These foundational laws are further complemented by the Civil Law and Common Law, which collectively dictate the rules for international trade of goods. This multi-layered legal structure necessitates careful navigation to ensure full compliance.

The regulatory environment is dynamic, with policies frequently updated to reflect economic priorities, domestic production capabilities, and international relations. Businesses must stay informed about tariffs, prohibited goods, and foreign trade policies that directly impact international trade opportunities. For instance, the regular trade policy of the Iranian government can introduce changes that affect the feasibility and profitability of certain imports. These policies are designed to protect domestic industries, manage foreign currency reserves, and align with national development goals.

Key Legislative Bodies

The primary regulating bodies responsible for enacting and overseeing regulations on exportation and importation of goods in Iran are the Islamic Consultative Assembly of Iran (Majlis) and the Ministry of Mine, Industry, and Trade. These entities play a pivotal role in shaping the trade landscape, from setting import duties to defining licensing requirements and even specifying goods that are prohibited or restricted. Their directives and circulars are critical for any business engaged in importing to Iran, as they provide the most current guidelines and requirements.

Essential Documentation for Importing to Iran

The importance of accurate and complete documentation cannot be overstated when importing to Iran. The specific import documents required depend significantly on the nature of the goods being imported. This includes categories such as general goods, personal effects, dangerous goods, livestock, and more. Furthermore, specific goods, like arms and ammunition, health products, food products, and chemicals, are subject to additional, stringent requirements due to their sensitive nature or potential impact on public health and safety.

Beyond standard commercial invoices, packing lists, and bills of lading, importers must be prepared to obtain various permits and licenses. A crucial document is the "goods declaration permit," which must be obtained from the Iran Customs Administration. This permit is fundamental for clearing goods through customs and signifies official approval for the import.

Types of Permits and Licenses

The regulatory landscape for importing to Iran often necessitates a range of permits and licenses. These can include:

- Goods Declaration Permit: As mentioned, this is mandatory and issued by the Iran Customs Administration.

- Temporary Import License: Required for goods that will be re-exported after a certain period, such as equipment for exhibitions or projects.

- Peremptory Import License: For goods intended for permanent entry into the country.

- Health Certificates: Essential for food products, agricultural goods, and certain chemicals to ensure they meet Iranian health and safety standards.

- Standardization Certificates: For products requiring compliance with Iranian national standards.

- Ministry-Specific Approvals: For items like pharmaceuticals (Ministry of Health), telecommunications equipment (Ministry of ICT), or industrial machinery (Ministry of Industry, Mine, and Trade).

Navigating Iranian Customs Procedures

The procedure for importing a product into Iran can be summarized into a series of steps, each requiring precision and adherence to established protocols. While the exact sequence may vary slightly based on the type of goods and their origin, the general flow involves:

- Market Research and Supplier Identification: Identifying the demand for your product in Iran and finding reliable suppliers.

- Understanding Regulations: Thoroughly researching and understanding the specific import regulations, tariffs, and prohibitions for your chosen goods.

- Obtaining Necessary Licenses/Permits: Applying for and securing all required import licenses and permits from relevant Iranian authorities before shipment.

- Contracting and Payment: Finalizing commercial contracts and arranging payment, often through complex financial channels due to international sanctions affecting banking.

- Shipping and Logistics: Arranging for the transportation of goods to an Iranian port or border crossing.

- Customs Declaration: Submitting a detailed goods declaration to the Iran Customs Administration, accompanied by all necessary documentation.

- Customs Valuation and Duty Assessment: Iranian customs will assess the value of the goods and calculate applicable customs duties, taxes, and other charges.

- Payment of Duties and Taxes: Remitting the assessed duties and taxes.

- Customs Clearance and Release: Once all requirements are met and payments are confirmed, goods are cleared and released for domestic distribution.

Understanding the challenges traders face and the best practices to navigate the complex trade environment in Iran is paramount. This includes being prepared for potential delays, changes in policy, and the need for robust local representation to facilitate smooth customs procedures. The intricate nature of these steps underscores the need for expertise and experience when importing to Iran.

The Cost of Importing Goods to Iran

When considering importing to Iran, one of the most critical factors is the overall cost. The cost of importing depends on several variables, making it essential for businesses to conduct a thorough financial assessment. These factors include:

- Type of Goods: Different goods attract varying customs duties and taxes based on their classification (HS Code). Sensitive or luxury items may incur higher tariffs.

- Shipping Method: Air freight is faster but more expensive than sea freight, which is generally more economical for bulkier goods.

- Customs Duties and Taxes: These are levied by the Iranian government and can include import duties, commercial profit tax, value-added tax (VAT), and other levies. These rates can change based on government policy.

- Logistical Costs: This encompasses freight charges, insurance, warehousing fees, port charges, and inland transportation within Iran.

- Documentation and Licensing Fees: Costs associated with obtaining necessary permits, certificates, and processing fees.

- Brokerage Fees: Fees paid to customs brokers or agents who assist with customs clearance.

- Currency Exchange Rates: Fluctuations in the Iranian Rial (IRR) against major currencies can significantly impact the final cost.

Businesses must account for all these elements to arrive at a realistic cost projection for importing to Iran, ensuring profitability and avoiding unexpected expenses. Staying informed about tariffs and foreign trade policies is crucial for accurate cost estimation.

Iran's Top Imports and Trading Partners

Examining Iran's import statistics provides valuable insights into market demand and potential opportunities for international suppliers. On the import side, Iran's top imports include broadcasting equipment, corn, soybeans, motor vehicle parts, and rice. This diverse list reflects both industrial needs and consumer demands, indicating areas where foreign businesses can find ready markets. The need for broadcasting equipment points to infrastructure development and media consumption, while agricultural products like corn, soybeans, and rice highlight the country's reliance on food imports to supplement domestic production.

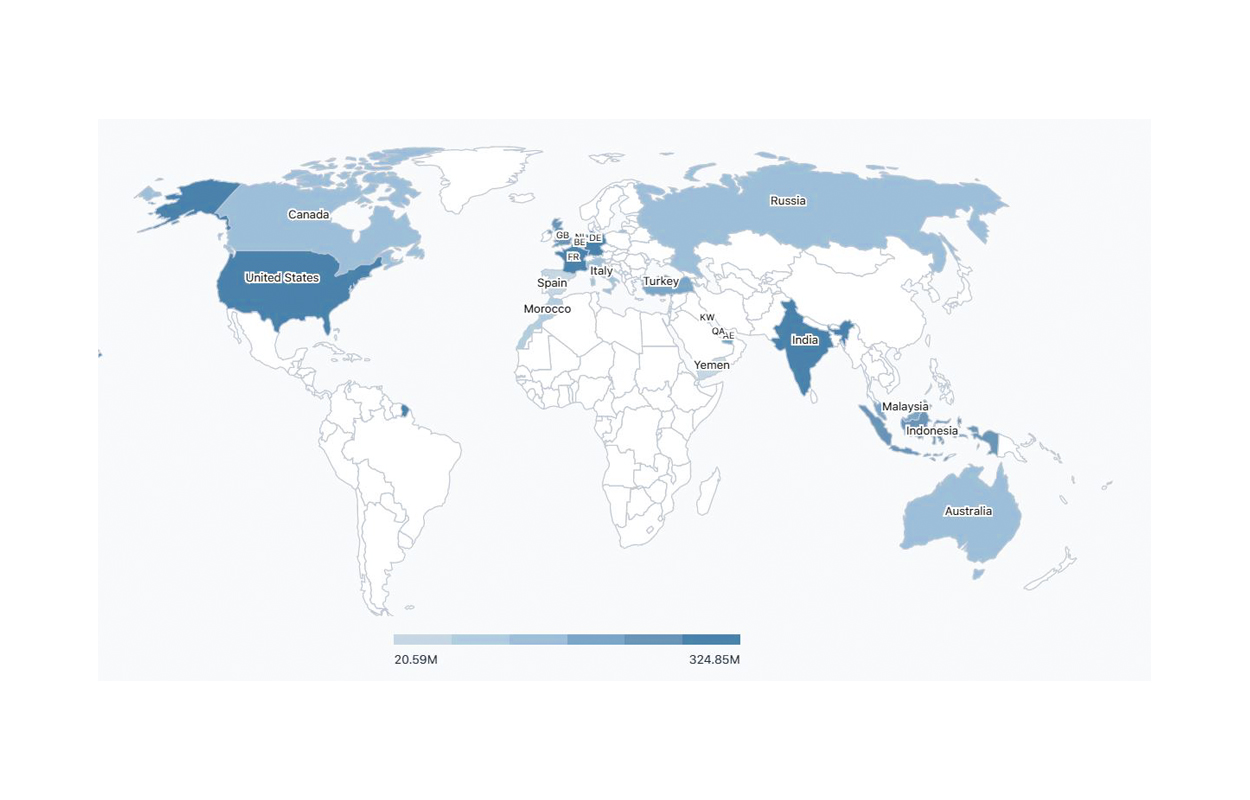

The primary countries exporting to Iran were China, the United Arab Emirates (UAE), Brazil, Turkey, and India. This demonstrates a global network of trade partners, with Asian and Middle Eastern countries playing a dominant role due to geographical proximity and established trade routes. These relationships underscore the resilience of Iran's trade despite external pressures.

Historically, imports in Iran have shown significant fluctuations. For instance, imports in Iran increased to 18,316 USD million in the fourth quarter of 2024 from 18,247 USD million in the third quarter of 2024. Over a longer period, imports in Iran averaged 13,394.29 USD million from 1974 until 2024, reaching an all-time high of 26,131.00 USD million in the first quarter of 2011 and a record low of 2,917.00 USD million in the second quarter of 1999. These figures illustrate the dynamic nature of Iran's import market, influenced by global economic conditions, domestic policies, and international relations. While the specific context for "a slight decrease of 5% in volume and 7% in value compared to the previous year" is not provided, it serves as a reminder that trade volumes can fluctuate, necessitating continuous market monitoring.

Best Practices for Successful Importing to Iran

Successfully importing goods into Iran requires more than just understanding the regulations; it demands a strategic approach and adherence to best practices. Here are key considerations:

- Thorough Due Diligence: Before committing, conduct extensive research on market demand, competitor analysis, and the specific regulatory landscape for your product.

- Local Partnership: Collaborating with experienced local agents, distributors, or customs brokers is invaluable. They possess intimate knowledge of Iranian laws, cultural nuances, and established networks, which can significantly streamline the import process.

- Compliance First: Always prioritize compliance with all Iranian laws, including the Export and Import Regulations Act, Customs Law, Civil Law, and Common Law. Ignorance of the law is not an excuse and can lead to severe penalties.

- Financial Planning: Be prepared for complex financial transactions. Due to international sanctions, traditional banking channels might be restricted. Explore alternative, compliant payment mechanisms and ensure all transactions adhere to international and Iranian regulations. The government of Iran, including banks owned or controlled by the government of Iran, or persons in Iran, are subject to various financial regulations, though some transactions, such as the exportation of informational material, might be exempt or authorized to process transfers related to specific activities.

- Contingency Planning: Develop strategies to mitigate potential risks, such as unexpected policy changes, logistical delays, or currency fluctuations.

- Clear Communication: Maintain open and transparent communication with all stakeholders, including suppliers, logistics providers, customs officials, and local partners.

- Stay Informed: Regularly monitor updates from the Ministry of Mine, Industry, and Trade, and the Islamic Consultative Assembly regarding trade policies, tariffs, and prohibited goods.

By adopting these best practices, businesses can navigate the complexities of the Iranian trade environment more effectively, increasing their chances of successfully tapping into Iran's diverse and dynamic market.

Tracking and Logistics in Iranian Imports

Efficient logistics and reliable tracking are vital components of any successful import operation, and importing to Iran is no exception. Given the potential for delays and the importance of timely delivery, a robust logistics strategy is essential. This includes selecting appropriate shipping methods (sea, air, or land, depending on the goods and urgency), reliable freight forwarders, and ensuring proper insurance coverage.

Many logistics providers specializing in the Iranian market offer comprehensive tracking updates throughout the import process. This means businesses can monitor their goods from the moment they are shipped until they arrive in Iran, providing transparency and peace of mind. Such tracking capabilities are invaluable for managing inventory, planning distribution, and responding to any unforeseen logistical challenges. The ability to track shipments in real-time helps businesses maintain control and reduces uncertainty in a market that demands precision.

Conclusion

Importing to Iran presents a compelling opportunity for international businesses seeking to expand their global footprint. Iran’s strategic location and vast market potential make it a significant player in international trade, offering promising avenues for growth. However, this potential comes hand-in-hand with a complex regulatory landscape that demands careful attention to detail, rigorous compliance, and a deep understanding of local procedures.

From understanding the intricacies of its import procedures and the specific documents required, to navigating customs regulations and managing the associated costs, every step in the import journey into Iran requires expertise and foresight. By staying informed about the regular trade policy of the Iranian government, recognizing the importance of permits like the "goods declaration permit," and adopting best practices for market entry, businesses can significantly enhance their prospects of success. While challenges exist, particularly concerning financial transactions due to international sanctions, the lucrative venture of importing goods into Iran remains accessible for those willing to invest in meticulous planning and strategic partnerships.

Are you considering entering the Iranian market or looking to optimize your existing import operations? Share your thoughts or questions in the comments below, or explore our other guides for more insights into global trade opportunities.

Dates Importing Countries | Iran Dried Fruits corporation

Ten Countries After Importing Iran-Made Anti-Corona Products - Iran

Why did Iran stop importing rice, tea from India? - TRENDS MENA