Iran's Gold: How Much Does The Nation Truly Hold?

The question of how much gold does Iran have is one that often sparks curiosity, shrouded in a veil of geopolitical complexities and economic sanctions. Unlike many nations that regularly disclose their gold reserves to international bodies, Iran's figures are less transparent, making it a subject of ongoing speculation and analysis. This opacity is not merely coincidental; it's often a strategic move by countries facing external pressures, using their precious metal holdings as a silent bulwark against economic uncertainties and as a symbol of sovereign wealth.

Delving into the depths of Iran's gold reserves requires navigating a landscape where official reports are scarce, and external estimates are often based on fragmented data. From domestic production and strategic imports to the intricate dynamics of its internal gold market, understanding Iran's relationship with this precious metal offers crucial insights into its economic resilience and its approach to navigating a challenging global financial environment. This article aims to piece together the available information, offering a comprehensive look at Iran's gold holdings and the factors influencing them.

Table of Contents

- The Elusive Nature of National Gold Reserves

- Iran's Reported Gold Holdings: A Historical Glimpse

- Gold Production Within Iranian Borders

- Iran's Recent Gold Imports: A Strategic Surge

- The Multifaceted Role of Gold in Iran's Economy and Geopolitics

- Comparing Iran's Gold Holdings: A Global Perspective

- Challenges in Ascertaining Iran's True Gold Reserves

- The Future Trajectory of Iran's Gold Strategy

The Elusive Nature of National Gold Reserves

Determining the exact gold reserves of any nation can be a complex task, but for countries like Iran, the challenge is amplified by geopolitical factors and a lack of transparent reporting. Globally, the percentage share held in gold of total foreign reserves is typically calculated by the World Gold Council, using methodologies that often rely on official submissions from central banks. The value of gold holdings is then calculated using the end-of-quarter LBMA gold price, which is published daily by ICE Benchmark Administration. For the value of other reserves, data is often taken from the International Monetary Fund's (IMF) International Financial Statistics (IFS) table 'total reserves minus gold'. However, this standard reporting framework often bypasses nations under heavy sanctions or those that prefer to keep their strategic assets undisclosed.

This page, which provides values for gold reserves reported in several countries, often finds itself with limited or outdated information when it comes to Iran. The strategic ambiguity surrounding Iran's financial assets, particularly its gold, serves multiple purposes. It can complicate efforts by external powers to assess the country's economic vulnerability, provide a hedge against currency fluctuations, and act as a tangible asset that is less susceptible to freezing or seizure compared to foreign currency reserves held abroad. Therefore, when we ask, "how much gold does Iran have?", we are often piecing together a puzzle from various indirect indicators rather than relying on a single, definitive figure.

Iran's Reported Gold Holdings: A Historical Glimpse

While current official figures are hard to come by, there have been notable instances where Iran's gold holdings were publicly referenced, offering a rare glimpse into its reserves. One significant report emerged in January 2012, when the head of Tehran's Chamber of Commerce stated that Iran had acquired a substantial 907 tons of gold. This acquisition was reportedly made at an average price of $600 per ounce, valuing the total holdings at approximately $54 billion at the then-current market price. This revelation was particularly striking as it indicated a deliberate strategy to convert a significant portion of its foreign exchange reserves into a more resilient asset.

Indeed, it was noted that Iran had changed 15% of its foreign exchange reserves into gold, a move clearly influenced by the tightening sanctions against the country. This strategic shift underscores gold's role as a shield against the financial isolation imposed by international sanctions. By holding a substantial amount of its wealth in physical gold, Iran aimed to circumvent the vulnerabilities associated with holding foreign currencies in bank accounts that could be frozen or restricted. This historical data point provides a crucial benchmark when attempting to understand how much gold does Iran have, highlighting a period of aggressive accumulation in response to external pressures.

Gold Production Within Iranian Borders

Beyond strategic purchases, Iran also possesses its own domestic gold production capabilities, contributing to its overall gold supply. Key information about Iran's gold production indicates a consistent output in recent years. For instance, Iran's gold production was reported at 7,000.000 kg in December 2022, a figure that remained constant from the previous year's 7,000.000 kg in December 2021. While these annual figures are significant, the historical data reveals a fluctuating trend. Iran's gold production data is updated yearly, averaging 856.000 kg from December 1990 to 2022, with 33 observations. This long-term average suggests that while current production is robust, it has not always been at this level.

One notable source of this domestic supply is the gold mine in the city of Takab in West Azerbaijan Province. Until 2012, this was Iran's largest gold mine, boasting over 4 tons of proven gold reserves. The mine is also known for its high yield, with approximately 5.81 grams of gold able to be netted from each ton of gold ore extracted. Such domestic production provides a stable, sanctions-proof source of gold, reducing the country's reliance on international markets for its gold accumulation strategy. The existence of significant proven reserves and active mining operations contributes directly to the question of how much gold does Iran have, adding to its overall national wealth in the precious metal.

Iran's Recent Gold Imports: A Strategic Surge

In addition to its domestic production, recent data points suggest that Iran has significantly ramped up its gold imports, indicating a renewed strategic focus on accumulating the precious metal. By January 2025, Iran had imported a remarkable 81 metric tons of gold, representing a staggering 234% increase compared to the previous year. This rapid acceleration in gold acquisition continued into the following month, with total imports exceeding 100 metric tons by February 2025. This surge in imports is a clear signal of Iran's ongoing efforts to bolster its gold reserves, potentially as a response to evolving geopolitical landscapes and economic pressures.

The timing of these substantial imports is particularly noteworthy. Such aggressive buying behavior often correlates with periods of heightened global uncertainty or increased domestic economic instability. For a nation like Iran, which frequently navigates complex international relations and sanctions, increasing gold holdings can serve as a vital hedge against currency depreciation and as a liquid asset that retains value independent of the dollar or other fiat currencies. The question of how much gold does Iran have is therefore not static; it is influenced by dynamic purchasing patterns that reflect the country's strategic financial decisions in a volatile world. These recent import figures suggest a proactive approach to strengthening its economic resilience through gold accumulation.

The Multifaceted Role of Gold in Iran's Economy and Geopolitics

Gold plays a pivotal and complex role in Iran, serving not just as a financial asset for the central bank but also as a crucial safe haven for its citizens and a strategic tool in its geopolitical maneuvering. The interplay of international sanctions, regional conflicts, and domestic economic policies profoundly influences the demand for and valuation of gold within the country.

Gold as a Safe Haven Amidst Escalating Tensions

Historically, middle-east conflicts have often led to rallies in oil prices, and recent events involving Israel and Iran have been no exception. When tensions escalated, oil prices surged, stocks dropped, and investors globally flocked to safe havens like gold. This pattern was evident when, on a particular Friday, the price of gold was trading about 1 percent higher at $3,426 an ounce, nearing its record high of $3,500 hit in April. This immediate reaction highlights gold's universal appeal as a store of value during times of uncertainty, a principle that holds particularly true for Iran and its populace. The surge in gold's value during such periods directly impacts the perceived and actual worth of how much gold does Iran have, both at the state and individual levels.

Crucially, even when Iran has not directly attacked any US military assets, the mere escalation of tensions can trigger market reactions. The dollar, albeit not by much, also reacted, but the more pronounced movement was seen in commodities like oil and gold. Brent crude, for example, ended one day more than 7% higher than its previous closing price, trading at $74.23 a barrel. This interconnectedness means that Iran's geopolitical standing directly influences the value of its gold holdings and the domestic demand for the precious metal.

Sanctions, Frozen Assets, and the Lure of Gold

For decades, Iran has been grappling with international sanctions, particularly from the US and European Union. Since 1980, Iran has consistently demanded that the US, European Union, and South Korea return all of its frozen assets, but these demands have largely been ignored. Compounding the issue, some of the seized assets have reportedly been resold to third parties, while many others have been given to families of victims of the regime. This history of asset freezing and appropriation provides a strong impetus for Iran to diversify its reserves away from currencies susceptible to such actions and into physical gold.

The strategic shift of converting foreign exchange reserves into gold, as seen in the 2012 report of 15% conversion, is a direct consequence of this vulnerability. Gold, being a tangible asset, is far more difficult to seize or freeze than digital currency holdings in foreign banks. This makes gold an attractive, albeit challenging, asset for Iran to accumulate and hold, reinforcing its importance in the context of how much gold does Iran have as a strategic reserve.

The Domestic Gold Market Dynamics in Tehran

Beyond the central bank's reserves, the domestic gold market in Iran, particularly in Tehran, is a vibrant and often volatile indicator of public sentiment and economic health. The surge in demand for gold has driven up coin prices to as much as 30% above their intrinsic value, creating a significant gold coin price bubble within Tehran. A number of factors contribute to this inflated market, including high inflation, currency depreciation, lack of alternative investment opportunities, and the ingrained cultural preference for gold as a store of wealth.

An Iranian gold merchant checking the price of gold coins for a customer in Tehran, Iran, as depicted in an April 19, 2006, image, illustrates the everyday reality of this market. Today, gold prices in Iran (Tehran) are quoted in Iranian Rial per ounce, gram, and tola, across different karats (24, 22, 21, 18, 14, 12, 10), based on live spot gold prices. This active domestic market, driven by both investor and public demand, means that a significant amount of gold is also held by private citizens, further complicating the comprehensive answer to how much gold does Iran have in total, beyond just official reserves.

Comparing Iran's Gold Holdings: A Global Perspective

To truly understand the significance of how much gold does Iran have, it's helpful to place its known and estimated holdings within a broader global context. While direct comparisons are challenging due to Iran's opacity, looking at other nations can provide a valuable frame of reference. For instance, based on Italy's official data for the end of 2024, its gold holdings stand firm at 2,451.9 tonnes, unchanged from five years earlier. With a population nearing 58.9 million, the country enjoys a strong 41.6 grams of gold per capita, one of the highest ratios in Europe. This illustrates the scale of gold reserves held by established economies and their per capita distribution.

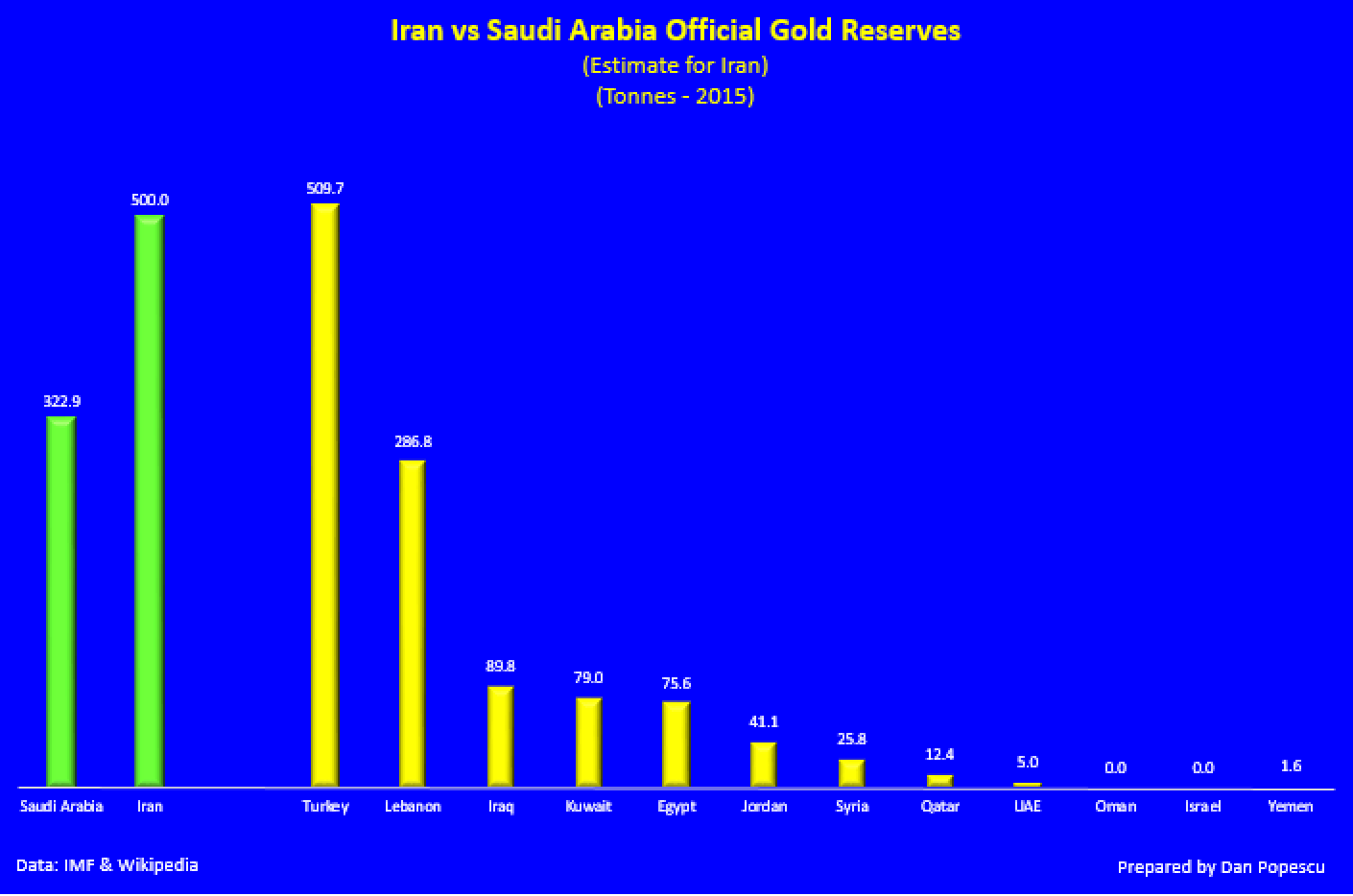

In the Middle East and North Africa region, other countries also possess significant historical production or reserves. For example, Algeria, an African nation, had reported reserves of 19,500 tonnes as of 2019, with historical production to 2014. While these figures represent different categories (reserves vs. production), they provide a regional context. When considering Iran's reported 907 tons in 2012 and its recent import surge, it suggests a significant, albeit not top-tier globally, holding. However, given the strategic importance of gold for Iran, its actual holdings, including undeclared or privately held gold, could be substantially higher, making a definitive comparison difficult but underscoring the country's strategic emphasis on the metal.

Challenges in Ascertaining Iran's True Gold Reserves

The persistent question of how much gold does Iran have remains largely unanswered with definitive public data, primarily due to a confluence of strategic and political factors. Unlike many nations that adhere to international reporting standards for transparency and to foster investor confidence, Iran operates under a different set of imperatives. The pervasive international sanctions regime means that openly declaring the full extent of its gold reserves could potentially expose these assets to further scrutiny, and in some cases, attempts at freezing or seizure. This strategic opacity is a defense mechanism, allowing Iran to maintain a degree of financial flexibility and resilience outside the conventional global financial system.

Furthermore, the nature of gold as a tangible, physical asset makes it inherently easier to hold and transfer discreetly compared to digital currency reserves. This characteristic is highly valued by countries seeking to circumvent financial blockades. The lack of detailed, up-to-date reports from the Central Bank of Iran to international bodies like the IMF further compounds the challenge. Therefore, any attempt to quantify Iran's total gold holdings must rely on historical statements, reported import/export data, domestic production figures, and an understanding of the country's economic and geopolitical strategies. This patchwork of information, while insightful, ultimately leaves the precise answer to "how much gold does Iran have" as an estimate rather than a definitive figure.

The Future Trajectory of Iran's Gold Strategy

Looking ahead, Iran's relationship with gold is likely to remain central to its economic and geopolitical strategy. The recent surge in gold imports, coupled with consistent domestic production, signals a continued commitment to accumulating and safeguarding this precious metal. As long as international sanctions persist and geopolitical tensions remain elevated, gold will serve as a crucial hedge against currency volatility, inflation, and external financial pressures. Iran's decision to pull out of the sixth round of talks with the U.S., which were scheduled for Sunday in Oman, further underscores the ongoing diplomatic stalemates that could reinforce the country's reliance on hard assets like gold.

The domestic gold market, with its unique dynamics and inflated coin prices, also reflects a deep-seated public trust in gold as a reliable store of wealth. This internal demand, combined with the state's strategic accumulation, ensures that gold will continue to play a vital role in Iran's economic resilience. While the exact figure of how much gold does Iran have may remain elusive, the trend points towards a nation that strategically values and actively acquires gold as a cornerstone of its financial sovereignty in a challenging global environment.

Conclusion

In conclusion, while a precise, up-to-the-minute figure for how much gold does Iran have remains largely undisclosed due to strategic opacity and international sanctions, available data points offer significant insights. From a reported 907 tons in 2012 and a strategic conversion of 15% of foreign exchange reserves into gold, to consistent domestic production of around 7,000 kg annually and a recent surge in imports exceeding 100 metric tons by February 2025, Iran clearly prioritizes gold as a key component of its national wealth and economic defense.

Gold serves as a critical safe haven amidst regional conflicts and a tangible asset immune to the freezing of foreign reserves. The vibrant, albeit sometimes inflated, domestic gold market further underscores its importance to the Iranian populace. As geopolitical landscapes continue to shift, Iran's strategic accumulation and reliance on gold are likely to persist, making it a fascinating case study in national economic resilience. We hope this comprehensive analysis has shed light on this complex topic. What are your thoughts on Iran's gold strategy? Share your insights in the comments below, and explore more of our articles on global economic trends and precious metals.

- Sanctions With Iran

- Iran Is Shia Or Sunni

- Irans 1979 Islamic Revolution

- Saudi Arabia Iran Relations

- Iran Air Airlines

Iran Pahlavi Gold Coin | GoldStandardX

How much gold does average person have?

Iran, Saudi Arabia and Gold | GoldBroker.com