Iran's Oil Exports: Unraveling The Daily Barrel Count

Table of Contents

- Understanding Iran's Oil Export Landscape

- The Impact of Sanctions and Geopolitics on Iranian Oil Exports

- Iran's Production Capacity: Beyond Exports

- Key Drivers Behind Iran's Export Growth

- The Economic Lifeline: Oil's Role in Iran's Budget

- The Broader Global Context of Oil Trade

- Looking Ahead: Projections and Challenges for Iran's Oil Future

Understanding Iran's Oil Export Landscape

Iran's position as a major oil producer and exporter is deeply ingrained in its economic and political identity. The country holds some of the world's largest proven oil reserves, making its export volumes a critical indicator for global energy markets. To truly grasp **how many barrels of oil Iran exports per day**, it's essential to look at both the long-term historical averages and the more recent, often volatile, fluctuations.Historical Trajectories and Averages

Tracing Iran's oil export history reveals a journey marked by significant shifts, often mirroring geopolitical developments. Data on crude oil exports for Iran has been updated yearly, providing a valuable long-term perspective. From December 1980 to 2023, the average export volume stood at approximately 2,122,500 barrels per day (bpd), based on 44 observations. This long-term average highlights Iran's consistent, albeit sometimes constrained, role as a significant global supplier. However, this average masks considerable peaks and troughs. For instance, in December 2022, Iran's exports were reported at 900,632 barrels per day. This figure represents a relatively lower point in its recent history, particularly when compared to periods of fewer international restrictions. Understanding this historical context is crucial for appreciating the current state of **how many barrels of oil Iran exports per day**.Recent Trends: A Surge in Shipments

The narrative of Iran's oil exports has seen a remarkable shift in recent years, particularly from 2020 onwards. The country has demonstrated a significant ability to increase its crude oil and condensate exports, more than tripling them between 2020 and 2023 to more than 1.59 million barrels per day. This substantial increase is a testament to Iran's efforts to circumvent sanctions and find new markets for its oil. Looking at more immediate figures, the trend of increasing exports is clear. In December 2023, exports were reported at 1,322,634 barrels per day, marking a notable increase from the previous year's figure of 900,632 barrels per day in December 2022. This upward trajectory continued into 2024. According to commodity information company Kpler, in the first three months of the current year, Iran’s oil exports reached 1.5 million barrels per day, which is 200,000 barrels more than in 2023. Even more recently, in March 2024, Iranian exports reached 1.82 million barrels per day, marking the highest rate since October 2018, just before the Trump administration reinstated oil sanctions. Some reports even suggest higher figures for specific periods. For instance, data indicates that since June 13, following the start of an Israeli offensive against Iranian nuclear sites and military leadership, Iran has exported on average 2.33 million barrels per day (bpd). While this specific figure might represent a short-term surge or include different types of liquids, it underscores the country's capacity to ramp up exports under certain circumstances. Vortexa, another analytics firm, attributes this growth to an increase in Iran’s crude production, higher demand from China, and a net increase in the size of the Islamic Republic’s "dark fleet," which helps facilitate its oil export growth by operating outside conventional tracking systems. Currently, general estimates suggest Iran exports around 1.7 million barrels per day (mbpd) of crude oil.The Impact of Sanctions and Geopolitics on Iranian Oil Exports

The story of **how many barrels of oil Iran exports per day** cannot be told without a deep dive into the profound impact of international sanctions and the ever-present geopolitical tensions. These external pressures have historically been the primary determinant of Iran's oil export volumes, often leading to dramatic fluctuations.The "Maximum Pressure" Era and Its Aftermath

The period of "maximum pressure" sanctions, particularly under the former U.S. President Donald Trump's administration, aimed to reduce Iran’s oil exports to zero. This policy had a severe impact, causing Iran’s oil exports to decline significantly. For context, during this time, Iran’s oil exports declined to just $16 billion in 2020, a sharp contrast to previous periods. The goal was to cripple Iran's economy and force it to renegotiate its nuclear program and regional activities. However, despite these stringent measures, Iran has shown remarkable resilience and adaptability. The trend of increasing exports from 2020 to 2023, where crude oil and condensate exports more than tripled, demonstrates a strategic shift. This rebound indicates that Iran found ways to navigate the sanctions regime, often through unofficial channels and by leveraging its existing infrastructure and relationships, particularly with key buyers like China. For instance, Iran raised its crude oil output by about 1 million barrels per day (b/d) from 2020 to 2023, and its exports to China grew by almost 870,000 b/d during this time. This significant increase highlights the effectiveness of Iran's strategies in mitigating the impact of sanctions.Navigating Renewed Sanctions and Global Dynamics

The geopolitical landscape remains highly volatile, directly influencing **how many barrels of oil Iran exports per day**. In response to Iran's continued oil sales, the United States expanded sanctions in April 2024 to cover ports, vessels, and refineries involved in the purchase of Iran’s oil. These measures aim to tighten the noose on Iran's illicit oil trade and further limit its access to international markets. However, the effectiveness of these expanded sanctions is a subject of ongoing debate. While sanctions are designed to restrict oil flows, Iran has historically demonstrated its ability to adapt, often by using a "dark fleet" of tankers that obscure their origins and destinations, as well as by offering discounted prices to buyers willing to take on the risk. The global demand for oil, particularly from energy-hungry nations like China, also plays a crucial role in Iran's ability to maintain its export volumes. The reality is that other producers would need significant spare capacity to fully offset a rise in Iranian exports if sanctions were rigorously enforced, and OPEC’s effective spare capacity — excluding Iran, Russia, and Libya — is currently above 5 mbpd, suggesting there is indeed some room for other producers to fill potential gaps if Iran's exports were to face a drastic reduction. This complex interplay of sanctions, evasion tactics, and global market dynamics makes the exact daily export figure a constantly moving target.Iran's Production Capacity: Beyond Exports

While the focus is often on **how many barrels of oil Iran exports per day**, it's equally important to understand the nation's overall crude oil production capacity. Exports are a function of production, and Iran's ability to extract oil from its vast reserves directly impacts its potential to supply the global market.Crude Oil and Condensate Output

Iran is a significant global producer, ranking as the third largest producer in the Organization of the Petroleum Exporting Countries (OPEC). The country produces about 3 million barrels of oil per day (bpd), which accounts for approximately 3% of total world output. This figure encompasses not just crude oil but also other liquids. For instance, Iran also produces 1.3 million barrels of condensate per day and other liquids, which are valuable byproducts of natural gas production. Recent data indicates a strong rebound in Iran's production levels. Oil production in Iran has increased around 75 percent to about 3.4 million barrels a day from depressed 2020 levels, according to estimates. This surge in production directly correlates with the increase in exports. Iran's average crude output stood at 3.257 million bpd in 2024, a significant rise from 2.884 million bpd in 2023. This increase in output is a critical factor enabling the higher export volumes observed recently. While some estimates suggest crude oil production was about 3.1 mb/d in October, in line with OPEC and IEA’s estimates, it's clear that Iran has successfully ramped up its production capabilities. This higher production means more crude oil and gas condensate available for export. In October, for instance, Iran had about 1.5 mb/d of surplus crude oil and gas condensate for export, including about 322,000 barrels of floating crude oil sale.Iran's Role in Global Oil Supply

Given its production capacity, Iran plays a non-negligible role in the global oil supply chain. The total output, including crude oil, condensate, and other liquids, amounts to about 4.5% of the global supply. While this percentage might seem modest compared to giants like Saudi Arabia or Russia, Iran's contribution is significant, especially considering the geopolitical constraints it operates under. The consistent increase in Iran's oil production and exports has implications for global energy security and pricing. When Iran's oil flows more freely into the market, it can contribute to a more balanced supply-demand equation, potentially influencing global oil prices. The price of Iranian heavy crude in February 2025 was $77.41 per barrel, marking a decline of $2, which is part of the broader market dynamics but also reflects the availability of Iranian crude. The ability of Iran to increase its supply, even under sanctions, means that its output cannot be easily ignored by global energy analysts and policymakers. The ongoing monitoring of crude oil production for Iran, Islamic Republic of (IRNNGDPOMB) from 2000 to 2025 highlights the continuous interest in Iran's capacity to influence global supply.Key Drivers Behind Iran's Export Growth

Understanding **how many barrels of oil Iran exports per day** requires an examination of the factors that have propelled its recent export growth, particularly in the face of persistent international sanctions. Several key drivers have contributed to Iran's ability to increase its oil shipments. One primary factor is the strategic adaptation of its export mechanisms. Iran has become adept at circumventing sanctions, often by utilizing a vast "dark fleet" of tankers that turn off their transponders or engage in ship-to-ship transfers to obscure the origin and destination of their cargo. This clandestine network allows Iran to move its oil without being easily detected by international monitoring agencies. Vortexa, an energy analytics firm, specifically points to a net increase in the size of the Islamic Republic’s dark fleet as a facilitator of its oil export growth. Another significant driver is the sustained demand from key buyers, most notably China. China has remained a crucial market for Iranian oil, often purchasing it at discounted rates. The relationship between Iran and China has allowed for a consistent outlet for Iranian crude, even when other traditional markets were closed off due to sanctions. As noted, Iran's exports to China grew by almost 870,000 barrels per day from 2020 to 2023, underscoring the vital role of this bilateral trade. This robust demand from China provides Iran with the necessary incentive and market access to maintain high production and export levels. Furthermore, Iran's internal efforts to boost crude production have been instrumental. As highlighted earlier, oil production in Iran has increased by around 75 percent from 2020 levels, reaching approximately 3.4 million barrels a day. This increase in crude output directly translates into a larger surplus available for export. The country has invested in maintaining and, where possible, expanding its production capabilities, ensuring a steady supply of oil for its clandestine export operations. The increase in Iran’s crude production, coupled with higher demand from China and the operational efficiency of its dark fleet, collectively explains the recent surge in **how many barrels of oil Iran exports per day**.The Economic Lifeline: Oil's Role in Iran's Budget

The daily count of **how many barrels of oil Iran exports per day** is not just an energy statistic; it's a critical measure of the Iranian economy's health and the government's fiscal stability. Oil exports represent the lifeblood of Iran's budget, providing a substantial portion of its revenue. Export growth substantially impacts Tehran’s budget because oil exports accounted for more than 40 percent of Iran’s total export revenue in 2023. This significant reliance on oil revenue means that fluctuations in export volumes and global oil prices directly affect the government's ability to fund public services, infrastructure projects, and military expenditures. When sanctions successfully reduce oil exports, the Iranian government faces severe budgetary constraints, leading to economic hardship and sometimes social unrest. Conversely, when Iran manages to increase its oil exports, it gains greater financial flexibility, which can be used to bolster its economy and pursue its strategic objectives. The "maximum pressure" period, during which Iran’s oil exports declined dramatically, served as a stark reminder of this dependency. The sharp drop in oil revenue during that time created immense economic pressure on the country. However, the subsequent rebound in exports, as observed in recent years, has provided a much-needed boost to the Iranian treasury. The ability to export 1.82 million barrels per day in March 2024, the highest rate since October 2018, translates directly into billions of dollars in revenue, significantly easing the financial strain on the government. This deep reliance on oil exports also highlights the vulnerability of the Iranian economy to external pressures. While Iran strives to diversify its economy, oil remains its primary source of foreign exchange. Therefore, monitoring **how many barrels of oil Iran exports per day** is not just about tracking energy flows; it's about understanding the financial resilience and strategic maneuvering of a nation under considerable international scrutiny.The Broader Global Context of Oil Trade

While our primary focus is on **how many barrels of oil Iran exports per day**, it's beneficial to briefly place this within the broader context of global oil trade. Iran is a significant, but not isolated, player in a vast and interconnected market. Understanding this larger picture helps to contextualize Iran's specific figures and their global implications. The global petroleum market is immense and complex. For example, in 2023, the United States imported about 8.51 million barrels per day (b/d) of petroleum from 86 countries. This figure includes crude oil, hydrocarbon gas liquids (HGLs), refined petroleum products such as gasoline and diesel fuel, and biofuels. Of this, crude oil imports accounted for about 6.48 million b/d. These numbers illustrate the sheer scale of international oil trade and the diverse sources from which major economies procure their energy. Iran's oil, when it reaches the market, contributes to this global supply. Although its exports are often constrained by sanctions, any increase or decrease in Iran's daily barrel count can have ripple effects, albeit often localized, on regional supply dynamics and, to a lesser extent, global prices. The market continuously monitors production and export data from all major players, including Iran, to assess supply-demand balances. Moreover, the process of refining crude oil into usable products is a key part of this chain. One barrel of crude oil, which is 42 U.S. gallons, yields approximately 19 to 20 gallons of gasoline and 10 to 11 gallons of diesel fuel, along with other petroleum products. This transformation process underscores the value chain of crude oil, from extraction and export to refining and consumption. The constant monitoring of crude oil exports for Iran, Islamic Republic of (IRNNXGOCMBD) from 2000 to 2025, alongside production data, is part of a larger effort by energy analysts and policymakers to understand global energy flows. While Iran's direct contribution to global supply might be overshadowed by other major producers when under sanctions, its strategic importance and potential to quickly increase supply mean that its export figures are always closely watched by the international community.Looking Ahead: Projections and Challenges for Iran's Oil Future

Forecasting **how many barrels of oil Iran exports per day** in the future involves navigating a landscape fraught with political uncertainties, technological challenges, and evolving market dynamics. While Iran has demonstrated remarkable resilience in boosting its exports recently, several factors will shape its trajectory moving forward. One of the most significant challenges remains the international sanctions regime. Despite Iran's success in circumventing existing sanctions, the United States continues to expand its measures, targeting more entities involved in Iran's oil trade. The effectiveness of these expanded sanctions in truly curtailing Iran's exports will be a key determinant. If enforcement becomes stricter and the "dark fleet" operations face greater obstacles, Iran's ability to maintain its current export levels could be jeopardized. Another factor is the global demand for oil, particularly from China, which has been Iran's primary customer. While China's demand remains robust, any shifts in its energy policy or economic growth could impact its appetite for Iranian crude. Furthermore, the global transition towards cleaner energy sources, though gradual, poses a long-term challenge for all oil-dependent economies, including Iran. Internally, Iran faces the challenge of maintaining and upgrading its oil infrastructure. Decades of sanctions have limited investment in its energy sector, potentially affecting its long-term production capacity. While oil production has increased significantly from 2020 levels, sustaining this growth requires continuous investment in exploration, extraction, and maintenance. Despite these challenges, Iran's strategic importance as an OPEC member and a major reserve holder means its oil will always be a factor in global energy calculations. The country's proven ability to adapt and find new markets, coupled with the ongoing global demand for hydrocarbons, suggests that Iran will continue to be a significant oil exporter. The graph and download economic data for crude oil exports for Iran, Islamic Republic of (IRNNXGOCMBD) from 2000 to 2025, along with crude oil production data, indicates that analysts will continue to closely monitor Iran's capacity to influence global oil markets. The future of **how many barrels of oil Iran exports per day** will largely depend on the delicate balance between geopolitical pressures, Iran's adaptive strategies, and the evolving dynamics of global energy demand.Conclusion

Understanding **how many barrels of oil Iran exports per day** is a journey through a complex web of economic data, geopolitical tensions, and strategic adaptations. We've seen that while historical averages suggest a consistent role for Iran in global oil supply, recent years have witnessed a remarkable surge in exports, largely driven by increased production, robust demand from China, and sophisticated methods of sanctions circumvention. From a low of 900,632 barrels per day in December 2022, exports climbed to 1,322,634 barrels per day in December 2023, and even reached 1.82 million barrels per day in March 2024, the highest in years. This rebound underscores Iran's resilience and the critical importance of oil revenue, which accounted for over 40% of its total export revenue in 2023, to its national budget. Despite ongoing and expanding international sanctions, Iran has leveraged its substantial production capacity—currently around 3 million barrels per day of crude and 1.3 million barrels per day of condensate—to maintain its position as a significant global supplier. The future trajectory of Iran's oil exports will undoubtedly be shaped by the interplay of persistent geopolitical pressures, the effectiveness of sanctions enforcement, and the ever-evolving dynamics of global energy demand. We hope this detailed exploration has provided you with a clearer and more comprehensive understanding of Iran's oil export landscape. What are your thoughts on the future of Iran's oil exports given these complex dynamics? Share your insights in the comments below! If you found this article informative, please consider sharing it with others who might be interested in global energy markets. Explore our other articles for more in-depth analyses of critical geopolitical and economic topics.- Kalender Iran

- Is The Us Going To War With Iran

- How Many People Live In Iran

- Iran Flag Lion

- Dance Of Iran

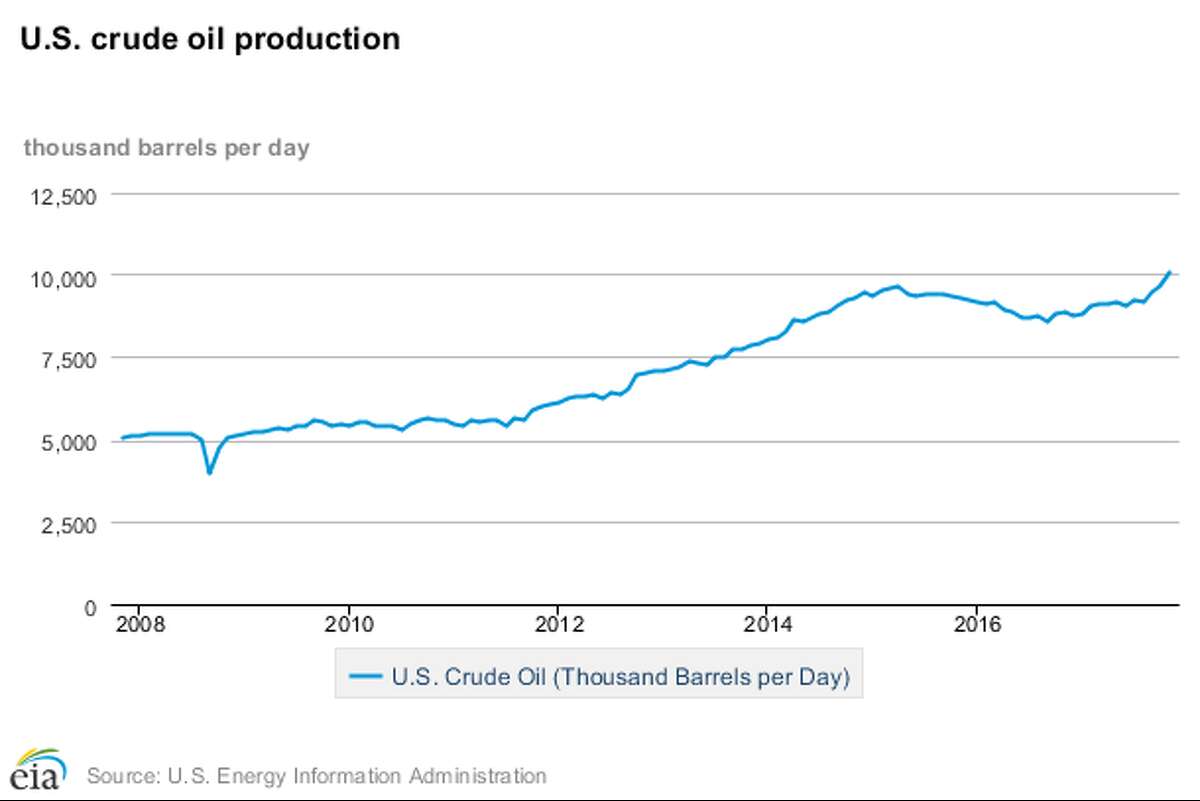

Oil production hits 10 million barrels per day

Iran’s oil output to hit 3.5 million barrels per day by late September

Iran Orders Oil Production Boost of 500,000 Barrels Per Day After