Navigating The Rial: Your Guide To Buying Iranian Currency

For anyone considering a trip to Iran, engaging in international trade, or simply a currency enthusiast, understanding how to buy Iranian currency is a crucial first step. The Iranian Rial, often referred to colloquially as Toman, presents a unique set of challenges and considerations for potential buyers, primarily due to complex geopolitical factors and specific regulatory frameworks. This guide aims to demystify the process, providing comprehensive insights into the Iranian currency market, its denominations, and the legal landscape surrounding its acquisition.

Navigating the world of foreign currency exchange can be intricate, and when it comes to the Iranian Rial (IRR), the complexities are amplified. From understanding the difference between Rial and Toman to grappling with international sanctions, a well-informed approach is essential. This article will delve into the nuances of purchasing Iranian currency, ensuring you have the most accurate and up-to-date information to make sound decisions.

Table of Contents

- Understanding the Iranian Rial and Toman

- Denominations and Features of Iranian Banknotes

- The Complex Exchange Rate Dynamic

- Legal Framework and Sanctions: Impact on Buying Iranian Currency

- How to Buy Iranian Currency: Practical Approaches

- Traveling to Iran: Currency Advice

- Considering Currency Collectors and Uncirculated Notes

- Final Considerations Before You Buy Iranian Currency

Understanding the Iranian Rial and Toman

The official currency of Iran is the Iranian Rial, abbreviated as IRR, and its symbol is ﷼. However, for those unfamiliar with Iran's money system, things can get a little confusing due to the widespread use of "Toman" in daily transactions. This dual-currency reality often perplexes tourists and new visitors, making payments and cost accounting a challenge. The key to understanding this lies in a simple conversion: 1 Toman is equivalent to 10 Rials. More precisely, in Iranian daily life, Toman is an omission of three zeros from the Rial denomination. For example, 100,000 Iranian Rials (IRR) is commonly referred to by an Iranian layman as 100 Toman. This reflects a significant difference in value, making it crucial to clarify which unit is being discussed when dealing with prices or exchange rates. While the Central Bank of Iran issues notes in Rial denominations, people almost always quote prices in Toman. This informal system came about due to the Rial's significant devaluation over the years, making larger numbers cumbersome to use in everyday conversation.Denominations and Features of Iranian Banknotes

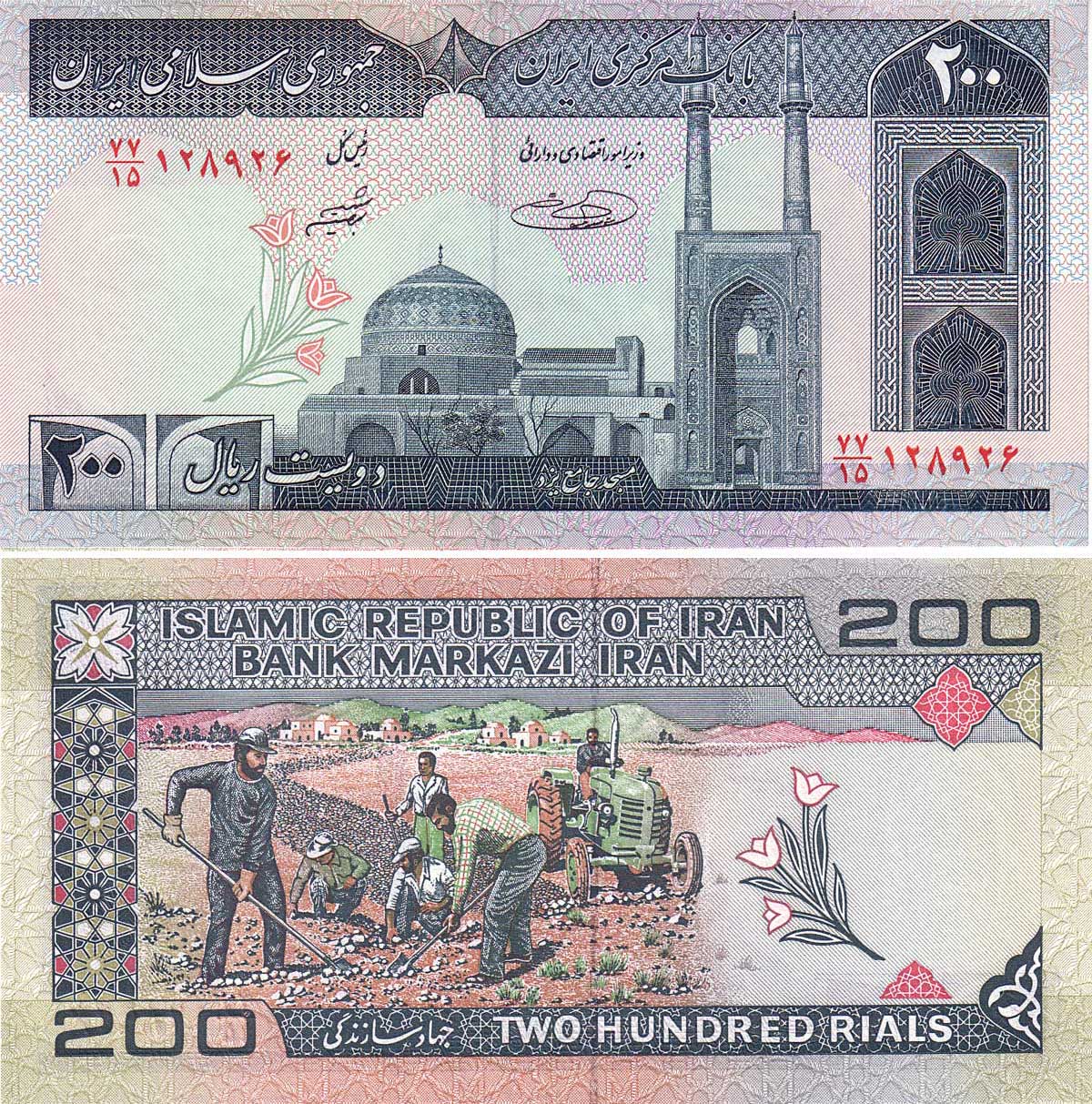

The Central Bank of Iran issues banknotes in various denominations, catering to the country's economic needs. Commonly encountered notes include 10,000, 20,000, 50,000, and 100,000 Rials. For larger transactions, or as a result of sanctions, the government has also introduced higher-value "Iranian cheque currency" notes, which are legal tender and possess the same purchasing power as traditional banknotes. These include denominations of 500,000 IRR, one million IRR, and even two million IRR. These higher denominations, often referred to in Toman (e.g., 500 Toman, 1,000 Toman, 2,000 Toman), are essential for managing transactions in an economy with significant inflation. For collectors or those seeking specific notes, all denominations of IRR are available, including the 500k and 100k, as well as the one million and two million IRR notes, often found in uncirculated consecutive serial numbers. Some vendors cater to this niche, offering worldwide shipping via registered, signed-for mail, ensuring the secure delivery of these valuable items.The Complex Exchange Rate Dynamic

Understanding the exchange rate is the first step for anyone looking to buy Iranian currency. Unlike many stable economies where exchange rates fluctuate minimally, the Iranian rate of exchange is highly volatile, changing day to day and even hourly. This rapid fluctuation is directly influenced by Iran's economic system and its evolving political relations on the global stage. It's crucial to note that the currency rate for major foreign currencies like the US Dollar and Euro in the Iranian currency market is often significantly different from the official rate set by the government. In 2012, for instance, the government launched a foreign exchange center intended to provide importers of some basic goods with foreign exchanges at a rate about 2% cheaper than the open market rate. This dual-rate system adds another layer of complexity for individuals trying to determine the true value of their foreign currency when converting it to Rial. A little information from a trusted local agent or a reliable currency converter can help you find the best way to exchange your currency into Rial, ensuring you get a fair rate. The US Dollar remains the most used currency in international transactions globally, and its strength often impacts the value of the Rial. While several countries use the U.S. Dollar as their official currency, and many others allow it to be used in a de facto capacity, its interaction with the Iranian Rial is particularly sensitive due to geopolitical tensions.Legal Framework and Sanctions: Impact on Buying Iranian Currency

Perhaps the most significant hurdle for individuals and entities looking to buy Iranian currency, especially from outside Iran, is the stringent legal framework imposed by various international bodies, particularly the United States. The US exercises tight control over Iranian currency transactions through multiple regulatory frameworks, making direct purchases extremely difficult and, in many cases, illegal for US persons.US Regulations and OFAC Prohibitions

The Office of Foreign Assets Control (OFAC) of the U.S. Department of the Treasury specifically prohibits U.S. financial institutions from processing transactions involving the Iranian Rial. This means that traditional banking channels, credit cards, and many online payment processors based in or operating under US jurisdiction cannot facilitate the exchange of US Dollars (or other major currencies) for Iranian Rials. This prohibition extends to individuals and entities subject to US law, making it nearly impossible to legally acquire Iranian currency through conventional means while in the United States. The goal of these sanctions is to limit Iran's access to the international financial system and exert economic pressure.Why Some Platforms Don't Sell Iranian Rial

In response to the changing sanctions regarding Iran, many reputable currency exchange platforms have taken a cautious stance. For instance, Safedinar.com, a platform that deals with other currencies, has seen increasing interest from clients looking to buy Iranian Rial. However, their research has indicated that the purchase of Iranian currency or goods remains illegal under current regulations for US persons. Consequently, Safedinar.com is not offering the Rial for sale at this time. This highlights the severe restrictions and the legal risks associated with attempting to purchase Iranian currency from outside Iran, especially if you are subject to US sanctions law. Any platform claiming to offer Iranian Rial for sale globally should be approached with extreme caution, and potential buyers should thoroughly research the legality in their specific jurisdiction.How to Buy Iranian Currency: Practical Approaches

Given the complexities and legal restrictions, the methods for acquiring Iranian currency are often unconventional and primarily geared towards those physically present in Iran or those dealing with specific, legally compliant channels for collectors.Exchanging Currency Within Iran

For travelers, the most practical and common way to acquire Iranian Rial is to exchange foreign currency upon arrival in Iran. Major foreign currencies like the US Dollar, Euro, and British Pound are generally accepted for exchange at official exchange bureaus (Sarrafi) or banks within the country. It's advisable to carry some local currency when traveling within Iran, as not all establishments accept foreign currencies or credit cards due to the sanctions limiting their access to international banking systems. When exchanging money in Iran, understanding the exchange rate is paramount. As mentioned, the rate determines how much Rial you'll get for your foreign currency, and this rate can vary significantly between the official and open markets. It's wise to consult a live Iranian Rial (IRR) exchange rate converter (e.g., USD = IRR/IRT) before or upon arrival to get an idea of the current market value. Always compare rates from different reputable exchange offices to ensure you're getting the best deal.Online Platforms and Their Limitations

While some online platforms might claim to facilitate the purchase of Iranian currency, extreme caution is advised, especially for individuals in jurisdictions with strict sanctions. The data provided mentions a recommendation for "Revolut's prepaid travel debit card to buy Iranian Rial in the USA cheaply." However, this statement must be interpreted carefully within the context of OFAC prohibitions. While Revolut is a versatile platform, its ability to directly facilitate the purchase of IRR for US persons, bypassing OFAC regulations, is highly questionable. It's more likely that such a recommendation refers to its general utility for international transactions or for converting other currencies, rather than a direct, legal pathway to buy Iranian currency from a sanctioned entity. Always verify the legality and compliance of any online service with relevant authorities before proceeding. Some general currency exchange services, like those mentioned by customers of "Currency Liquidator" (e.g., James Brunswick, first-time currency buyer), highlight the benefits of layaway programs for acquiring more currency than one could buy at one time. While these testimonials are for general currency acquisition (like IQD), they illustrate the concept of using specialized services. However, it is critical to reiterate that such services generally do not apply to Iranian Rial due to the unique sanction regime. The challenges in finding a legitimate and legal way to buy Iranian currency outside of Iran remain substantial.Traveling to Iran: Currency Advice

For those planning a trip to Iran, gaining some information about Iranian currency beforehand will make your journey significantly easier. Here are some key pieces of advice:- **Carry Cash:** Due to sanctions, international credit and debit cards generally do not work in Iran. You will need to carry sufficient cash (US Dollars or Euros are widely preferred) to exchange upon arrival.

- **Understand Rial vs. Toman:** Always clarify whether a price is quoted in Rial or Toman. This is the most common source of confusion for foreigners. Remember, 1 Toman = 10 Rials.

- **Exchange at Reputable Bureaus:** Exchange your foreign currency at licensed exchange offices (Sarrafi) or major banks. Avoid unofficial street exchangers, as you risk being scammed or receiving counterfeit notes.

- **Keep Smaller Denominations:** Once you have Rials, try to break down larger notes into smaller denominations. While 500,000, 1 million, and 2 million Rial notes (or their Toman equivalents) are legal tender, smaller shops or taxis might not have change for very large bills.

- **Monitor Exchange Rates:** Keep an eye on the local exchange rate, as it can fluctuate daily.

Considering Currency Collectors and Uncirculated Notes

For numismatists or those interested in collecting foreign currency, the availability of Iranian Rial banknotes, particularly in uncirculated condition with consecutive serial numbers, can be appealing. Some specialized dealers offer these notes, including the higher denominations like 500,000, 1 million, and 2 million IRR. These are often marketed with "free shipping on your Iranian currency order" or "worldwide shipping via registered signed for mail." When considering such purchases, it's important to distinguish between buying currency for collection purposes and buying it for actual use or investment. While collecting banknotes is a hobby, individuals subject to sanctions should still exercise caution. The legality of importing or possessing Iranian currency, even for collection, may vary by jurisdiction. Always ensure that any purchase adheres to both the seller's and your own country's laws regarding the import and possession of foreign currency, especially from sanctioned nations.Final Considerations Before You Buy Iranian Currency

The decision to buy Iranian currency, whether for travel, trade, or collection, requires careful consideration of the unique economic and political landscape surrounding the Rial. The Iranian Rial is the official currency of Iran, but its value and accessibility are heavily influenced by international sanctions and domestic economic policies. The most popular Iranian Rial exchange rate is typically the IRR to USD rate, reflecting the dollar's global prominence. However, the official rate often differs from the open market rate, which is subject to daily and even hourly changes. For anyone outside Iran, especially those in the US, the current legal framework for Iranian currency, particularly the prohibitions by OFAC, makes it virtually impossible to legally purchase Iranian Rial through conventional financial channels. Therefore, for most individuals, the practical approach to acquiring Iranian currency involves exchanging major foreign currencies like USD or EUR upon arrival in Iran. For collectors, while some online avenues exist, due diligence regarding legal compliance is paramount. Always prioritize your safety and adhere to the laws of your country and the country you are visiting. We hope this comprehensive guide has educated you about the processes and challenges involved in acquiring Iranian currency. If you have further questions or experiences to share, please leave a comment below. We encourage you to share this article with anyone who might find this information useful, and explore our other articles for more insights into international finance and travel.

clay@panix.com

clay@panix.com

Iran Currency