Unraveling The Billions: Decoding Iran's Access To Global Funds

The narrative surrounding "billions given to Iran" is often fraught with misinformation, political rhetoric, and a complex web of international finance. For years, headlines and political debates have swirled around vast sums of money allegedly transferred to the Islamic Republic, fueling public concern and shaping foreign policy discussions. Understanding the true nature of these financial flows, their origins, and their intended purposes is crucial for a clear and accurate perspective on a highly sensitive geopolitical issue. This article aims to cut through the noise, providing a comprehensive and factual account based on verified information and official statements.

Far from being direct aid or taxpayer money handed over, the funds Iran has accessed typically represent its own assets, previously frozen by international sanctions. These transactions are often tied to complex diplomatic agreements, such as prisoner swaps or nuclear deals, and are subject to stringent conditions. Delving into the specifics of these arrangements reveals a nuanced picture, challenging many of the simplified, and often misleading, claims that dominate public discourse.

Table of Contents

- Unpacking the Myth: The "$150 Billion" Narrative

- The Joint Comprehensive Plan of Action (JCPOA) and Frozen Assets

- The Mechanics of Sanctions: Why Cash Payments?

- The $6 Billion Controversy: A Closer Look at Recent Funds

- Origins of the $6 Billion: Iranian Money, Not Taxpayer Funds

- The Humanitarian Clause and Strict Oversight

- Geopolitical Fallout: Funds, Hamas, and Regional Stability

- Beyond the Headlines: Other Financial Flows to Iran

- Iran's Military Budget and Proxy Support

- Navigating the Political Divide: Debates and Defenses

- The Evolving Landscape of Iran's Finances and Global Diplomacy

- Conclusion: Clarity Amidst Complexity

Unpacking the Myth: The "$150 Billion" Narrative

One of the most persistent and widely circulated claims is that the Obama administration "gave $150 billion to Iran" in 2015. This assertion has been repeatedly debunked by official sources and fact-checkers, yet it continues to resurface in political discourse. The reality is far more complex and involves Iran's own assets, which had been frozen by international sanctions for years.The Joint Comprehensive Plan of Action (JCPOA) and Frozen Assets

In 2015, the world watched as Iran and a group of world powers – the P5+1 (China, France, Germany, Russia, the United Kingdom, and the United States) – finalized the Joint Comprehensive Plan of Action (JCPOA), commonly known as the Iran nuclear agreement. This landmark deal aimed to prevent Iran from developing nuclear weapons in exchange for sanctions relief. As part of this international agreement, Iran agreed to significantly cut back on its nuclear program. Crucially, the agreement did not involve the U.S. or any other nation *giving* Iran $150 billion. Instead, the deal unfroze a portion of Iran's own assets, which had been held in foreign banks due to years of international sanctions. These were Iranian funds, earned from oil sales and other legitimate economic activities, that had been inaccessible. The total amount of Iran's frozen assets was estimated to be around $100 billion to $150 billion, but only a fraction of this became immediately accessible. Democrats and Obama did not give $150 billion to Iran. This distinction is vital for understanding the financial mechanisms at play.The Mechanics of Sanctions: Why Cash Payments?

Another point of contention has been the use of cash payments in some transactions with Iran. For instance, an initial $400 million cash delivery was sent on January 17, 2016, the same day Tehran agreed to release four American citizens. This specific payment was part of a larger $1.7 billion settlement related to a decades-old arms deal from before the 1979 Iranian revolution, which had been tied up in an international tribunal. The Treasury Department spokeswoman, Dawn Selak, explained that these cash payments were necessary because of the "effectiveness of U.S. and international sanctions," which had largely isolated Iran from the international financial system. When a country is cut off from global banking networks, traditional wire transfers become impossible. To facilitate legitimate transactions, such as settling legal claims or paying for humanitarian goods, cash or non-dollar currencies often become the only viable option. This highlights the double-edged sword of sanctions: while effective in isolating a regime, they can also complicate the very transactions necessary for diplomatic resolutions or humanitarian relief.The $6 Billion Controversy: A Closer Look at Recent Funds

More recently, a different sum, $6 billion, has dominated headlines, particularly after the Hamas attacks on Israel in October 2023. Republicans have sought to link $6 billion in unfrozen Iranian funds to the weekend attacks on Israeli civilians, sparking intense debate.Origins of the $6 Billion: Iranian Money, Not Taxpayer Funds

It is crucial to reiterate that the $6 billion was always Iranian money. This sum represented Iranian oil revenues that had been held in restricted accounts in South Korea due to U.S. sanctions. The Biden administration cleared the way for the release of five American citizens detained in Iran by issuing a waiver for international banks to transfer $6 billion in frozen Iranian money. This was part of a prisoner swap deal. Some critics have described the money as coming from American taxpayers, but this is inaccurate. It was Iran's own money, earned from its oil exports, that had been inaccessible.The Humanitarian Clause and Strict Oversight

A key aspect of the $6 billion agreement is that Iran is not at liberty to do whatever it pleases with the funds. The money was transferred to an account in Qatar, where it is strictly monitored and can only be used for humanitarian purposes, such as purchasing food, medicine, and agricultural products. The U.S. Treasury Department confirmed this, emphasizing that the funds would be held in a restricted account and accessible only through a "treasury-licensed vendor for humanitarian transactions." For now, the $6 billion released in August has not made it to Iran. Following the Hamas attacks, there was immense pressure to ensure the funds could not be diverted. Reuters reported on the "Iran prisoner swap for $6 billion in spotlight after Hamas attacks Israel," and The Hill noted, "$6B in frozen Iranian funds remain unspent in wake of Hamas attack." This demonstrates the immediate halt and scrutiny applied to the funds in light of regional events, underscoring the mechanisms in place to prevent misuse. The Biden administration has been actively defending the $6 billion deal with Iran, emphasizing its humanitarian nature and the strict oversight.Geopolitical Fallout: Funds, Hamas, and Regional Stability

The perception of "billions given to Iran" inevitably ties into broader geopolitical concerns, particularly regarding Iran's role as a state sponsor of terrorism. Critics argue that any release of funds, even if designated for humanitarian purposes, frees up other Iranian resources that can then be diverted to its military or proxy groups. One of the reasons Israel was attacked by Hamas, some argue, was that Biden gave $6 billion in ransom money to Iran. This perspective suggests fungibility, where money released for one purpose indirectly enables spending on another. Indeed, the Foundation for Defense of Democracies (FDD) highlights that "those billions of dollars would go a long way for the leading state sponsor of terrorism." They point to Iran's historical financial support for its allies, such as sending $700 million a year to Hezbollah, and more than $16 billion supporting allies in Syria, Iraq, and Yemen since 2012. The concern is that even if the $6 billion is strictly controlled, the psychological and economic relief it provides could embolden Iran's regional ambitions. The fear among some is that Iran will be shooting at our soldiers with bullets, etc., purchased with funds indirectly enabled by these releases.Beyond the Headlines: Other Financial Flows to Iran

While the $6 billion and the 2015 JCPOA funds capture significant attention, other financial avenues have also allowed Iran to access its assets or generate revenue.Iran's Military Budget and Proxy Support

Despite sanctions, Iran has managed to sustain its military and its network of regional proxies. The Iranian surge in oil exports since President Biden took over has brought Iran an additional $32 billion to $35 billion, according to the Foundation for Defense of Democracies. This increased revenue from oil sales, often circumventing sanctions through various means, provides a significant boost to Iran's treasury, far exceeding the amounts discussed in prisoner swaps or frozen asset releases. Furthermore, two separate agreements in the fall allowed Iran to access up to $16 billion of its previously frozen assets, including a reported $10 billion as the result of an extension of a Trump-era waiver. This move allowed Iraq to transfer approximately $10 billion in frozen payments to Iran for electricity imports. These examples illustrate that Iran's access to funds is not limited to a single large transfer but is an ongoing process involving various mechanisms, waivers, and the leveraging of its own resources. While Iran's entire military budget has been reduced to less than $20 billion a year, the ability to access these funds, coupled with oil revenues, remains a critical factor in its regional influence.Navigating the Political Divide: Debates and Defenses

The issue of "billions given to Iran" is deeply politicized in the United States. Republicans consistently criticize administrations for any actions that appear to provide financial relief to Iran, viewing it as enabling a hostile regime. They often highlight the potential for funds to be diverted to terrorism and point to Iran's malign activities in the region. Democrats and the Biden administration, on the other hand, defend these actions as necessary diplomatic tools. They argue that prisoner swaps are vital for bringing American citizens home and that humanitarian waivers are essential to prevent a humanitarian crisis in Iran, which could further destabilize the region. They emphasize the strict controls placed on funds and the fact that these are Iran's own assets, not U.S. taxpayer money. The 2015 Iran nuclear deal involved multiple nations, not just the U.S., highlighting the multilateral nature of these complex diplomatic efforts. Schumer and Pelosi, for instance, were involved in responding to such debates, indicating the high-level political engagement on these matters.The Evolving Landscape of Iran's Finances and Global Diplomacy

The financial relationship between Iran and the rest of the world is a constantly evolving landscape, shaped by sanctions, diplomatic negotiations, and geopolitical events. The discussions around "billions given to Iran" underscore the delicate balance between exerting pressure on a regime through sanctions and maintaining channels for humanitarian aid, prisoner exchanges, or even future diplomatic breakthroughs. The effectiveness of sanctions is often measured by their ability to isolate a country from the global financial system, as highlighted by the Treasury Department. However, this isolation also creates challenges for legitimate transactions. The ongoing debate reflects fundamental disagreements on how best to manage Iran's nuclear ambitions and its regional behavior. Whether through the JCPOA, prisoner swaps, or the complex web of oil exports and frozen asset releases, Iran's access to funds remains a central, highly scrutinized aspect of international relations.Conclusion: Clarity Amidst Complexity

The narrative of "billions given to Iran" is often oversimplified, leading to misunderstandings and heightened political tensions. A closer examination reveals that the vast majority of funds Iran has accessed are its own assets, previously frozen by international sanctions. These releases are typically tied to specific, often humanitarian, purposes or diplomatic agreements like prisoner swaps, and are frequently subject to strict oversight. While legitimate concerns exist about the fungibility of money and Iran's support for malign actors, it is crucial to distinguish between direct aid and the unfreezing of a nation's own funds. Understanding the intricacies of these financial mechanisms, the reasons behind cash payments, and the conditions attached to fund releases is essential for an informed public discourse. As geopolitical dynamics continue to shift, the way the world engages with Iran financially will remain a critical component of global stability.We hope this detailed breakdown has provided clarity on a complex issue. What are your thoughts on the balance between sanctions and diplomatic engagement with Iran? Share your perspectives in the comments below, or explore our other articles on international relations and economic policy to deepen your understanding of global affairs.

Fact-checking Trump’s address on the Iran missile attacks - The

Was Obama’s $1.7 billion cash deal with Iran prohibited by U.S. law

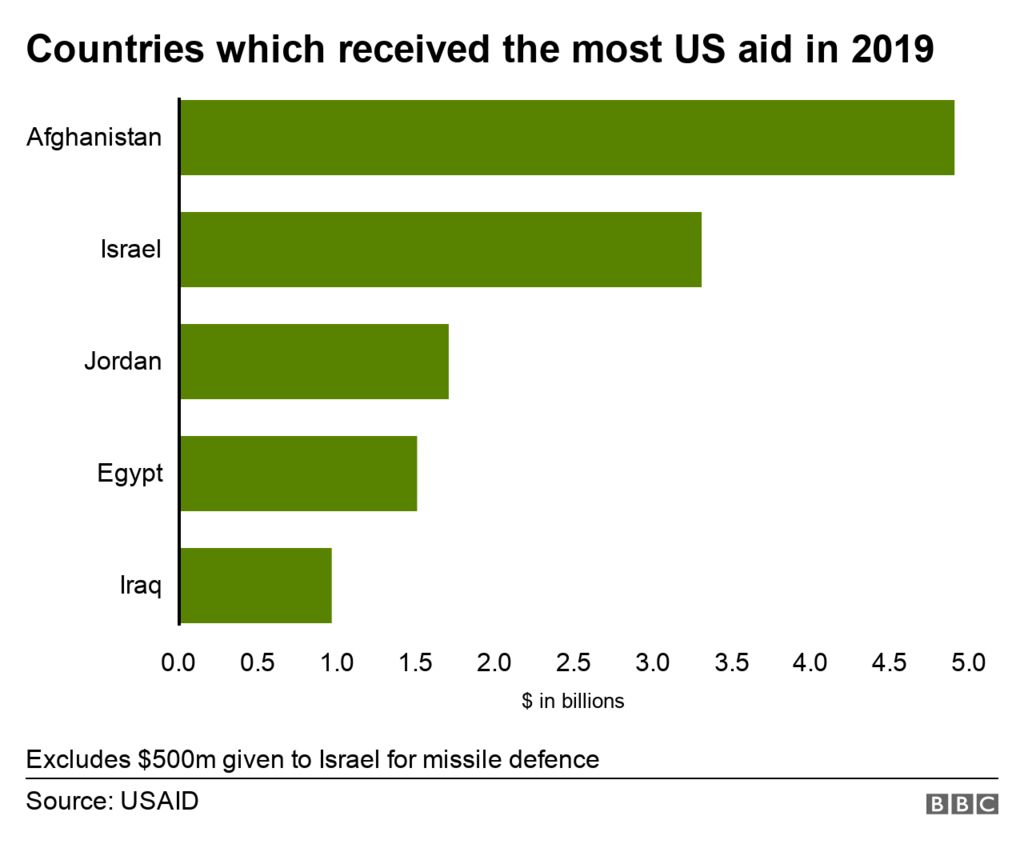

Israel-Gaza: How much money does Israel get from the US? - BBC News